June 05, 2024

Frontier Energy Limited (ASX: FHE; OTCQB: FRHYF) (Frontier or the Company) is pleased to provide an update on the battery procurement process for the Stage One development of its Waroona Renewable Energy Project (Project), which comprises a 120MW solar facility and integrated four-hour 80MW battery.

HIGHLIGHTS

- Final battery technology selection has resulted in a 12% increase in the battery duration to approximately 4.5 hours, compared to 4 hours in the Definitive Feasibility Study1 (DFS)

- The improved battery duration will increase Project revenue compared to the DFS, as more energy can be sold during peak electricity price periods, whilst Reserve Capacity Payments (RCP) will also be higher than previously forecast

- Despite this significant improvement, the capital cost for the battery has fallen by approximately 5% compared to the DFS (DFS estimate – $118.5 million)

- Frontier has narrowed its selection of preferred battery partners to two, both Tier 1 rated manufacturers

- The Company’s funding strategy continues to progress strongly with both debt financing and strategic partnering well advanced

CEO Adam Kiley commented: “The Company is in the fortunate position that the cost of the two largest capital items, solar panels and battery, have fallen significantly since the release of the DFS in February.

Battery prices have fallen due to a combination of factors, including falling raw materials prices, improvement in supply chain, and reportedly weaker than anticipated demand, resulting in an ample supply of batteries in the current market.

This unique situation is to Frontier’s advantage, with improved battery capacity resulting in increased duration (approximately 4.5 hours compared to 4 hours in the DFS), increasing Project revenue while at the same time achieving a lower capital cost.

The Company continues to progress its funding strategy, with both debt financing and strategic partnering processes well advanced.”

Final battery selection confirms longer battery duration at a lower capital cost, enhancing Project economics

As part of the Stage One development of the Project, Frontier concluded that the optimal strategy for Project development consists of a 120MW solar facility and an 80MW/320 MWh battery, i.e. the battery is capable of storing and discharging 80MW for 4 hours.

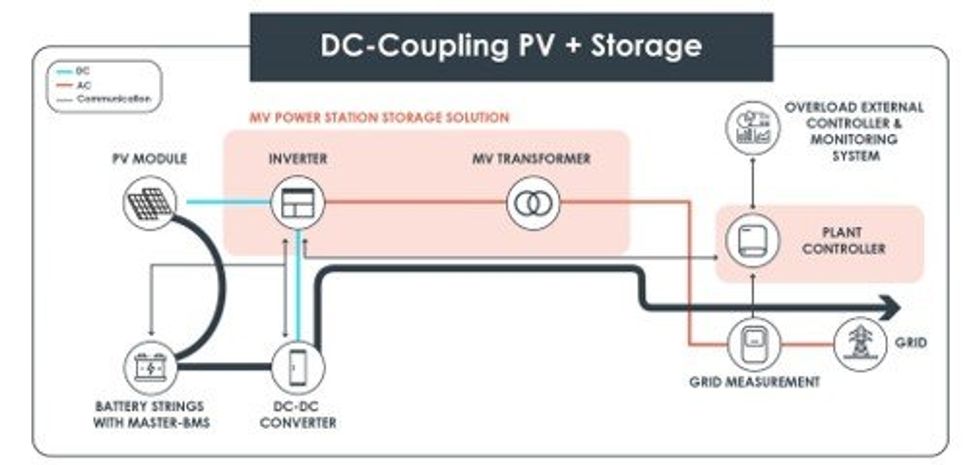

Frontier selected a DC coupled system, the lowest capex and most efficient way of integrating battery storage into new renewable energy installations such as the Waroona solar facility. In a DC coupled system, the battery is connected directly to the DC side of the renewable energy source, the solar panels. DC coupling eliminates the need for an additional inverter to convert DC to AC since the battery system operates directly with the DC electricity generated by the renewable source. See Image 1.

Lithium Iron (Fe) Phosphate (LFP) batteries have been selected for the Project as they are proven technology with superior safety, longer cycle life, higher energy density, faster charging capabilities, wider operating temperature range, and more favourable to the environment than other battery technologies.

Utility-scale LFP batteries experience capacity degradation over time due to factors like calendar aging, cycle aging, temperature, state of charge management, manufacturing quality, and usage patterns. These factors contribute to a gradual reduction in the battery's capacity and performance over its lifespan. The DFS assumed a degradation curve which was based on offers received at the time, that had a degradation of ~16% over the initial 10 years and ~26% over the first 20 years of battery life. See Image 2.

The Company’s competitive tender process has delivered significant improvements compared to the DFS. Frontier has narrowed its selection of the preferred battery partners to two, both of which are rated as Tier 1 battery manufacturers.

Click here for the full ASX Release

This article includes content from Frontier Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FHE:AU

The Conversation (0)

06 February 2024

Frontier Energy

Clean energy to help fill WA’s growing power supply gap

Clean energy to help fill WA’s growing power supply gap Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00