July 02, 2023

Australian Critical Minerals (ASX: ACM, “Australian Critical Minerals” or “the Company”) a mineral exploration company focused on the exploration and development of critical mineral projects in Western Australia, is pleased to advise it will commence trading today on the Australian Securities Exchange (“ASX”).

Highlights

- Australian Critical Minerals commences trading on the ASX today at 11am AEST under the code “ACM”, following a successful, fully subscribed IPO, having received demand well over the maximum subscription amount

- ACM is an emerging critical mineral exploration company focused on projects to support the global transition away from fossil fuels

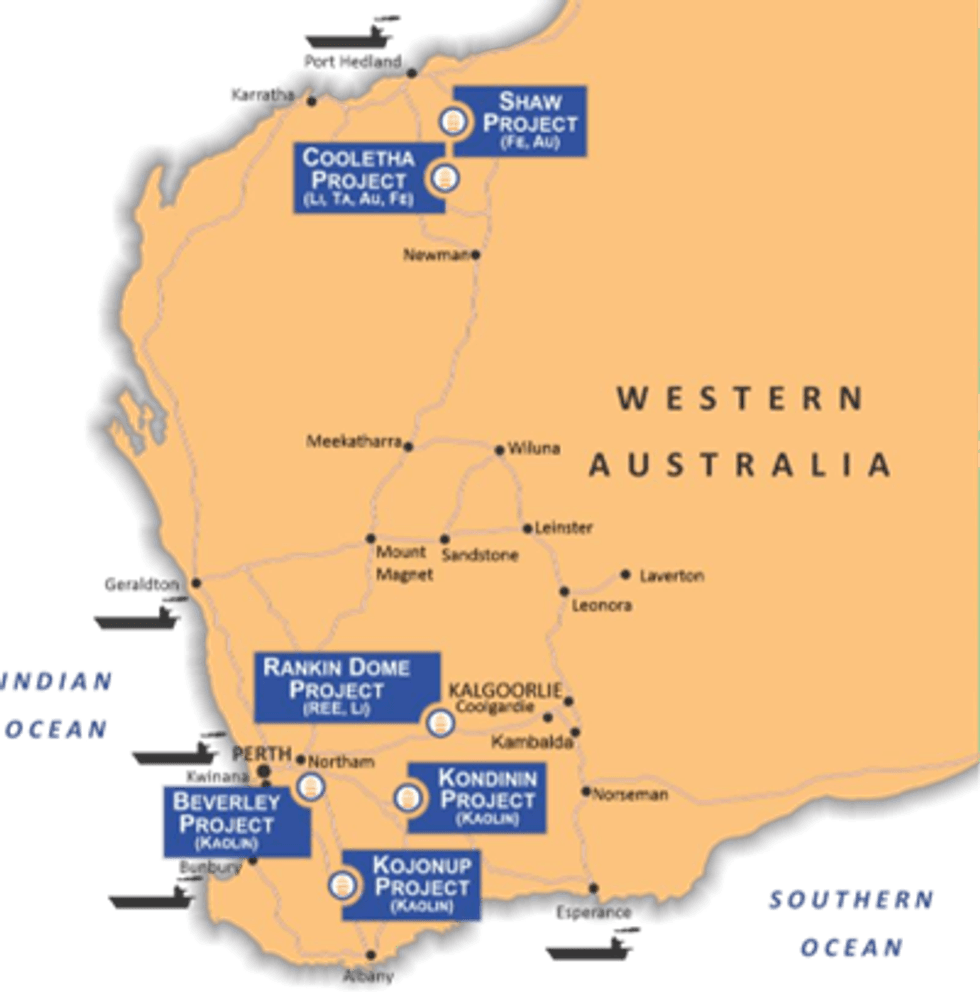

- ACM’s portfolio comprises 6 projects spanning 1,861km2 across the Pilbara and Southwest Goldfields regions in the Tier-1 jurisdiction of Western Australia

- Funds raised through the IPO are to be used initially to commence exploration at the Company’s key projects:

- Cooletha Lithium Project, Pilbara, WA

- Rankin Dome Rare Earth Project, near Southern Cross, Yilgarn, WA

- ACM will commence a mapping and sampling program on the Cooletha Lithium Project immediately which will be followed by a drill program targeting the REE anomalies at Rankin Dome during the September quarter.

- Loyalty Option of one option per two shares held expected in next 3-6 months

ACM has successfully completed an Initial Public Offer (IPO), which raised the maximum subscription of $5 million, through the issue of 25,000,000 shares at an issue price of $0.20 per share, giving the Company a market capitalisation of approximately $8.7 million at the IPO price.

The offer was strongly supported by institutions and sophisticated investors and the Company received demand well over the maximum subscription amount. State One Equities was the Lead Manager for the IPO.

Funds raised through the IPO will be used to commence exploration at the Company’s two key projects, Cooletha Lithium Project, where the team is in the process of mobilizing field personnel to commence mapping and sampling, and the Rankin Dome Rare Earth Project, where drilling is expected to commence later this quarter.

Managing Director, Dean de Largie said,

“On behalf of the Board, I would like to welcome our new shareholders to the ACM register and look forward to their long-term support. I welcome both Mr Michael Wright and Mr Gary Brabham to the ACM Board. With Michael Wright as our Chairman, I look forward to benefiting from his decades of corporate management experience. Gary Brabham has extensive experience in exploration, resource modelling and mine development combined with a deep geological acumen and we welcome his insights and advice as the ACM projects develop and ACM grows to fulfil its potential.

ACM lists on the ASX today with impeccable timing as end users and governments globally are scrambling to secure sources of energy related commodities to support the drive to a green energy future. ACM's projects are in ideal geological settings and have the size and logistical attributes to permit large scale resource development.

We thank our shareholders that have supported us in the IPO and we are pleased to advise that ACM intends to issue a loyalty option post-listing, whereby each Shareholder at the record date of the offer, anticipated to be in the next 3-6 months, will be given the opportunity to subscribe for one Option for every two Shares held.”

I would also like to take this opportunity to thank our Lead Manager State One Stockbroking for their support and input throughout the IPO process and also to express our gratitude to Steinepreis Paganin for their legal counsel, diligence and guidance.

The Company holds interests in six projects located in the Pilbara and Southwest Goldfields Regions of Western Australia covering 1,861km2, considered to be prospective for lithium, tantalum, gold, iron ore, rare earth oxides and kaolin:

- Cooletha Lithium Project

- Rankin Dome Rare Earths Project

- Shaw Iron Ore and Gold Project

- Beverley, Kondinin and Kojonup Kaolin Projects

Australian Critical Minerals is targeting pegmatite-hosted lithium in the Tier-1 mining jurisdiction of the Pilbara, Western Australia, which hosts significant discoveries and operating lithium mines such as Mineral Resources’ Wodgina and Pilbara Minerals’ Pilgangoora.

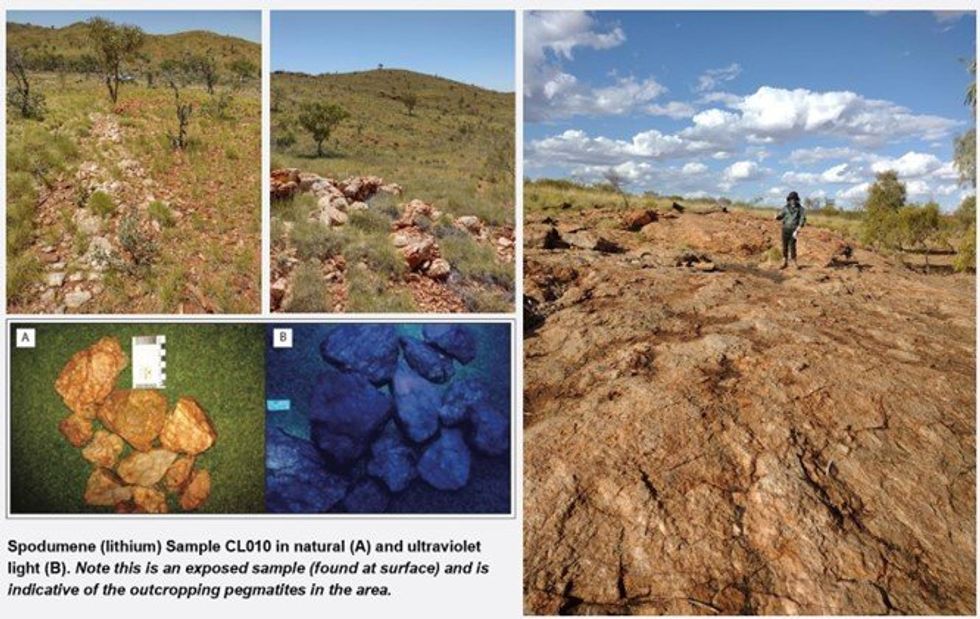

The Cooletha Project, ACM’s flagship lithium project in the Pilbara, has over 100km2 of prospective ground with outcropping pegmatite swarms. Observed pegmatites vary in width from several metres to a hundred metres and outcrop over several hundred metres in length. Spodumene is evident in surface samples and ACM has already identified high-value targets areas which will immediately be mapped and sampled upon listing.

The Rankin Dome Rare Earths Project has produced shallow auger samples highly anomalous in REE. Located close to Southern Cross, an established mining centre, a drill campaign is set to commence shortly after listing. Rankin Dome is held in JV with Kula Gold (ASX: KGD) with ACM to earn up to 51% interest in the Project. Full details with respect to material results from Rankin Dome are set out in the Company’s prospectus.

ACM also holds tenements prospective for iron ore in the Pilbara, located amongst mines operated by Fortescue Metals Group and Hancock Prospecting. Exploration is expected to commence in the second half of 2023 to follow up over 25km of Channel Iron Ridges and Banded Iron Formations identified at the Cooletha and Shaw Projects.

Click here for the full ASX Release

This article includes content from Australian Critical Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00