September 25, 2024

Athena Gold Corporation (CSE:ATHA)(OTCQB:AHNR) ("Athena" or the "Company") is pleased to report high-grade gold and silver samples from its first-ever underground mapping and sampling program at its flagship Excelsior Springs project in Nevada's prolific Walker Lane Trend. Five samples were collected underground from the past-producing Buster Mine, which historically produced an estimated 19,200 oz Au at an average grade of 41.1 g/t Au. Two of these samples returned high-grade Au, including:

- 50.6 g/t Au and 33.7 g/t Ag over 0.3 m, from the 75' level; and,

- 28.1 g/t Au and 29.6 g/t Ag over 1.0 m, from the 125' level.

The reconnaissance program conducted in August 2024 represents Athena's first-time underground at the Buster Mine, providing an opportunity for the team to have a close-up look at the mineralized orebody and gain a better understanding of structural controls at Excelsior. Historical sampling included four samples which exceeded the upper detection limit of 10 g/t Au; however, these were never analyzed to completion. The geologist who collected the surface and underground samples at the Buster Mine in 1986 estimated a mineralized zone containing a historical mineral inventory of up to 200,000 oz Au within a shallow depth of 61 m. This estimate is historical in nature and should not be relied upon as a current mineral resource. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves.

"We are pleased to see sampling results confirm the high-grade nature of the epithermal veins at the historic Buster Mine. In addition, we now have a much better understanding of structural controls on mineralization at Excelsior, which should bode well for planning our upcoming drill program" stated John Power, President & CEO of Athena Gold. "Due to small stoping dimensions and uncertain ground conditions, we were unable to sample over broader zones - however, we have reason to believe that high-grade, vein-hosted mineralization ‘bleeds' into the host rock as evidenced by previous drilling at Excelsior. The Buster Mine area is located 400 meters from the Western Slope Zone where our recent RC drill campaigns returned several impressive intercepts including up to 5.2 g/t Au over 33 m. Importantly, the geochemistry at Buster and the Western Slope Zone appear very similar, providing evidence that both mineralized zones may be part of the same system, and opens up the possibility of a larger, mineralized system connecting these two zones."

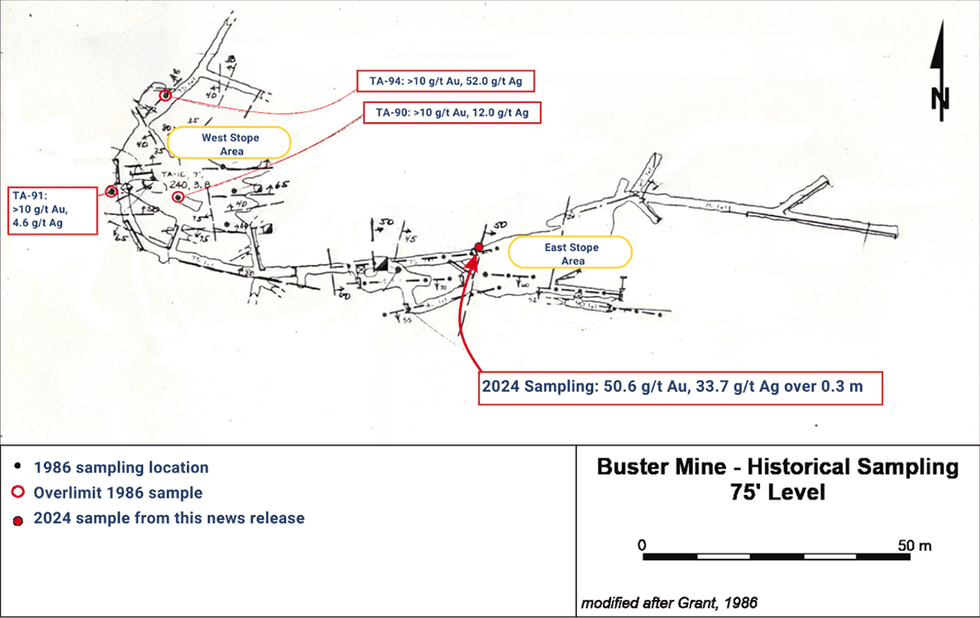

Two distinct structural orientations were observed and believed to be controlling mineralization, both east-west striking. The first is very steeply north dipping and yielded 50.6 g/t Au over 0.3 m (Figure 1). This sample was collected near the eastern stope on the 75' level, where historical sampling returned 5.8 g/t Au over 1.07 m. Historically, the higher-grade samples which exceeded the 10 g/t Au detection limit were collected from the western stope on the 75' level. Most of the past production occurred within the western stope, which extends from near surface to the 125' level.

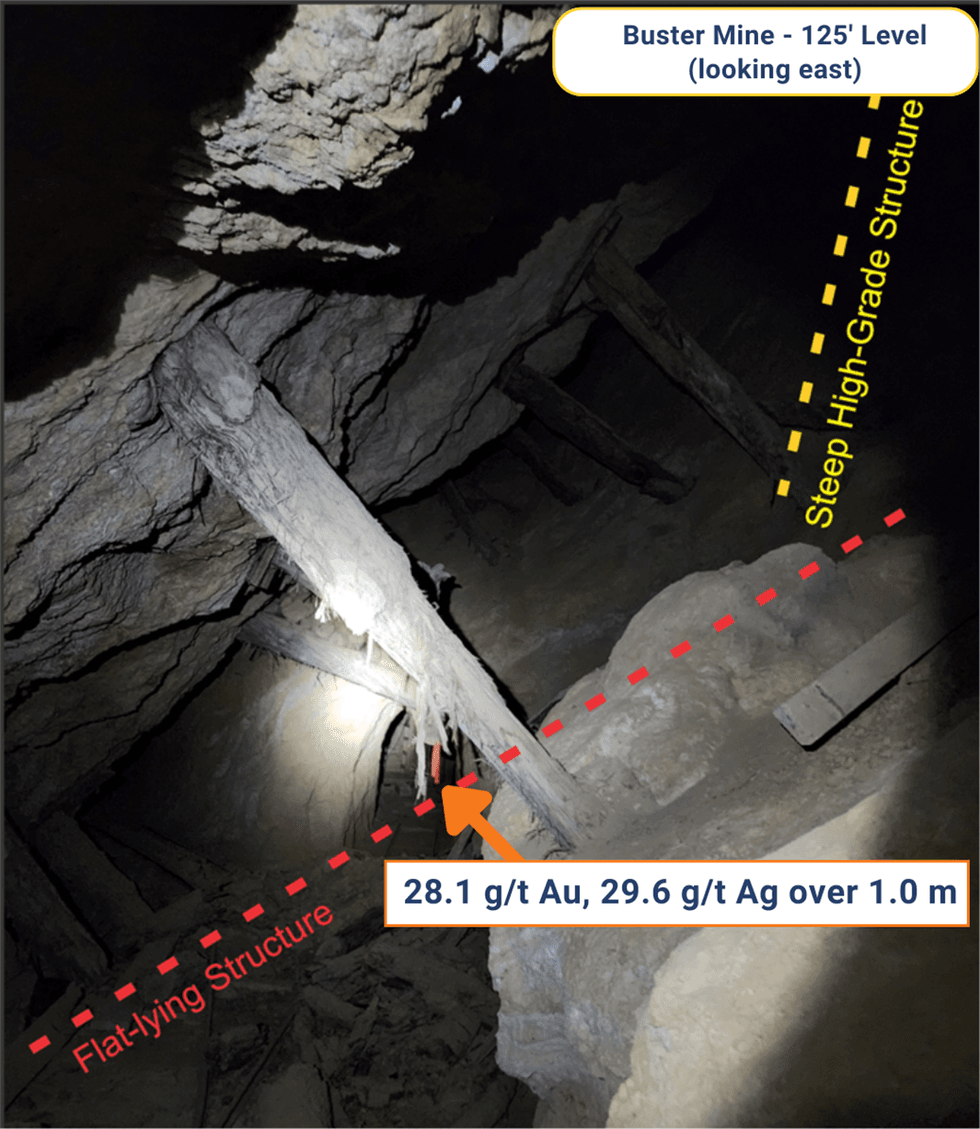

On the 125' level, a shallow 35° north dipping fault zone yielded 28.1 g/t Au over 1.0 m (Figure 2). The steeper structures identified on the 75' level appear to be cut by this younger, shallow structure.

This work program demonstrated the important role these shallow structures, which can be traced on surface, play in the control of mineralization at Excelsior Springs. Additional surface and underground mapping will be conducted to better understand the distribution and extent of mineralization along these structures to better target future drilling.

Figure 1: Plan map of the historic Buster Mine, 75' level.

Figure 2: Photograph of 125' Level at Buster Mine, showing sample location and identified structures, looking east.

About the Buster Mine

The Buster Mine is located on the Fortunatus patented claim owned by Athena and is an integral part of our flagship Excelsior Springs Project.

Mineralization at the Buster Mine was discovered in 1872 and has been through several periods of small-scale mining and exploration efforts. During the late 1800s and perhaps the early 1900s there was unconfirmed reported production from the Buster Mine of an estimated 19,200 oz Au at an average grade of 41.1 g/t Au.

The Buster Shaft is 235' deep, with workings on the 75', 125', and 175' levels. It is estimated there is approximately 1,540' of accessible workings, most of which are on the 75' and 125' levels.

Technical Information

The data disclosed in this news release includes historical exploration sampling results. The reader is cautioned that the historical results are based on prior data and reports prepared by previous property owners and other sources. Athena has not independently analyzed the results of the historical exploration work to verify the results. The reader is cautioned not to treat them, or any part of them, as current and that a qualified person has not done sufficient work to verify the results and that they may not form a reliable guide to future results. No independent QA/QC protocols are known for these samples and as such analytical results may be unreliable. Athena's current and future exploration work includes verification of the historical data through further exploration.

QA/QC

Sample preparation and gold analysis was performed by ALS Global in Reno, Nevada. Rock samples were analyzed for gold and 50 other elements by inductively coupled plasma followed by mass spectrometry (ME-MS41) and gold by 30-gram fire assay followed by atomic absorption (Au-AA23). Gold over limits were determined by a gravimetric method (Au-GRA21).

Qualified Person

Technical information in this news release has been reviewed and approved by Matthew R. Dumala, P.Eng., a geological engineer with Archer, Cathro & Associates (1981) Limited and a qualified person for the purposes of National Instrument 43-101.

About Our Flagship Excelsior Springs Project

The Excelsior Springs Project (the "Project") lies within the prolific Walker Lane tectonic trend, a large region of northwest-trending, strike-slip fault zones that host a significant number of precious metal deposits having very strong structural control for mineralization. The Walker Lane trend is experiencing a major resurgence of intense and successful exploration and development.

The Project contains numerous prospect pits, trenches, roads, surface sampling sites and 113 drill holes to date within a 300m X 3,000m wide (1,000 foot-wide and 10,000-foot-long east-west trending zone of shearing and alteration. Underground workings on the two patented claims within the Project had unverified, historical production of 19,200 oz at 41.1 g/t Au.

Gold mineralization discovered at the Project to date occurs in quartz veins, stock-works, and silicified zones in hornfels and calc-silicate altered country rock and is generally close to porphyry dykes. The best grades and thicknesses discovered recently were found in oxidized and altered sedimentary rock immediately above porphyry dykes intruded along preexisting east- and east-northeast trending faults. The mineralized stock-work vein zones are shallow and have a relatively flat plunge, making them potentially amenable to open pit mining methods.

Based on the results of previous drilling programs, the Project has the potential to host one or more shallow gold deposits amenable to open pit mining, along with deeper, higher grade feeder zones that may be found and could be mined by underground methods. In the opinion of management and its consultants, the Project is very promising and further exploration has the potential to expand the known mineralization and establish additional mineralized zones.

About Athena Gold Corporation

Athena is engaged in the business of mineral exploration and the acquisition of mineral property assets. Its objective is to locate and develop economic precious and base metal properties of merit and to conduct additional exploration drilling and studies on the Project.

For further information about Athena Gold Corporation and our Excelsior Springs Gold project, please visit www.athenagoldcorp.com.

On Behalf of the Board of Directors

John C. Power

Chief Executive Officer and President

For further information, please contact:

John C. Power

Email: johnpower@athenagoldcorp.com

Jason Libenson

President and CCO

Castlewood Capital Corporation

Phone: (647)-534-9884

Email: jason@castlewoodcapital.ca

Forward Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and U.S. securities laws. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding future exploration plans and the completion of a phase 2 drill program at the Project, future results from exploration, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: "believes", "will", "expects", "anticipates", "intends", "estimates", "plans", "may", "should", "potential", "scheduled", or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this press release, the Company has applied several material assumptions, including without limitation, that there will be investor interest in future financings, market fundamentals will result in sustained precious metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future exploration and development of the Company's projects in a timely manner, QAQC procedures at the Project were followed, the availability of financing on suitable terms for the exploration and development of the Company's projects and the Company's ability to comply with environmental, health and safety laws.

The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, operating and technical difficulties in connection with mineral exploration and development activities, actual results of exploration activities, the estimation or realization of mineral reserves and mineral resources, the inability of the Company to obtain the necessary financing required to conduct its business and affairs, as currently contemplated, the timing and amount of estimated future production, the costs of production, capital expenditures, the costs and timing of the development of new deposits, requirements for additional capital, future prices of precious metals, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, lack of investor interest in future financings, accidents, labor disputes and other risks of the mining industry, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities, risks relating to epidemics or pandemics such as COVID-19, including the impact of COVID-19 on the Company's business, financial condition and results of operations, changes in laws, regulations and policies affecting mining operations, title disputes, the inability of the Company to obtain any necessary permits, consents, approvals or authorizations, including of the Canadian Securities Exchange, the timing and possible outcome of any pending litigation, environmental issues and liabilities, and other factors and risks that are discussed in the Company's periodic filings with the SEC and disclosed in the final long form prospectus of the Company dated August 31, 2021.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements in this press release or incorporated by reference herein, except as otherwise.

ATHA:CNX

The Conversation (0)

09 January 2025

Athena Gold

High-grade gold exploration in Ontario and Nevada

High-grade gold exploration in Ontario and Nevada Keep Reading...

5h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

17h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

18h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

18h

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

19h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

19h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00