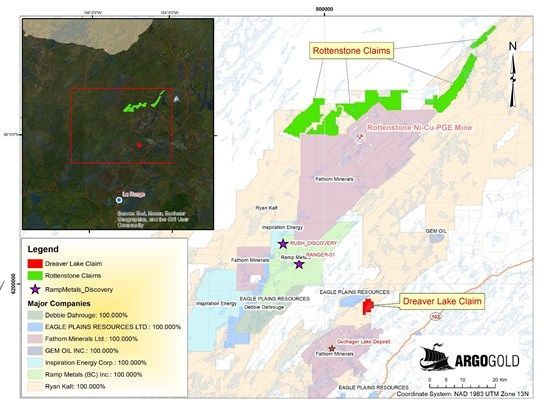

Argo Gold Inc. (CSE: ARQ) (OTC Pink: ARBTF) (XFRA: A2ASDS) (XSTU: A2ASDS) (XBER: A2ASDS) ("Argo" or the "Company") has obtained its mineral exploration permits from the Saskatchewan Ministry of Environment for Argo Gold's projects in the Rottenstone Belt in Saskatchewan. The permits cover 26,661 hectares of mineral claims in the emerging Rottenstone Belt and 1,155 hectares at the Dreaver Lake Gold Project.

Under the permits, Argo Gold is authorized to conduct prospecting, geological mapping and surface sampling. Airborne surveys can also be conducted upon notifying the Saskatchewan Ministry of Environment.

Dreaver Lake Gold Project

The Dreaver Lake Gold Project has weakly anomalous gold and silver in lake sediments, as well as a highly anomalous halo of coincident gold and silver in lake sediments for 10 kilometres in the down-ice direction. (GSC). In 1968, prospecting at Dreaver Lake identified outcrops of quartz diorite rock consistent with rock hosting the gold mineralization in the Ramp Metals discovery hole Ranger 1 which intersected 73.55 grams/tonne Au over 7.5 metres from 227 to 234.5 metres. (Ramp Metals, June 17, 2024). Exploration work in the 1960's was focused on nickel and copper, not gold. An airborne survey conducted for Noranda Exploration in 1966 at Dreaver Lake delineated 3 conductors, all with associated magnetic highs, in the metasediments flanking the intrusive granites. The highest priority target is a strong, wide EM conductor that is approximately 1.5 km in length with associated magnetic highs on both sides. All 3 conductors remain undrilled. The Dreaver Lake mineral claims are located approximately 12 km southeast of the Ramp Metals Property.

The Dreaver Lake Gold Project is contiguous to that of Eagle Plains Resources where trench sampling on the Cook Showing returned 79.96 g/t Au over 1.0 metre, and a grab sample returned up to 78.84 g/t Au, 2.7 g/t Ag, 0.146% Pb and 0.019% Cu (Eagle Plains website, 2025). Approximately 5 kilometres southwest of the Dreaver Lake Property, Fathom Nickel is currently exploring at Gochager Lake where recent drilling intersected 18.1 metres @ 2.43% Ni, 0.51% Cu and 0.18% Co. (Fathom Nickel, April 12, 2023). Rock chip and soil geochemical sampling has extended the Gochager footprint by 2 kilometres to the southwest and 2 kilometres to the Northeast. (Fathom Nickel, August 26, 2024). Underground exploration drilling at the past-producing Roy Lloyd mine located 20 kilometres south of Dreaver Lake intersected 8.17 metres (5.32 metres true width) of 66.85 g/t Au, 6.79 metres (4.42 metres true width) of 80.12 g/t Au and 2.23 metres (1.73 metres true width) of 128.37 g/t Au at a depth of approximately 240 metres. (Matrixset Investment Corp. website).

Rottenstone Project

Argo has completed a compilation of all historic data for the Rottenstone Project where Argo owns 100% of 26,661 hectares of mineral claims in the emerging Rottenstone Belt. (Argo Gold, August 7, 2024, and Argo Gold, January 20, 2025). The compilation of historic data has identified additional prospective mineral exploration ground where anomalous gold, silver and copper in lake sediments (GSC) coincide with an interpreted fold axis from historic geophysical data. Argo's mineral claim position in the Rottenstone Belt covers areas of interest including: anomalous copper in soils, electromagnetic conductors identified by historic geophysical surveys, ultramafic rocks, the Gow Lake meteor crater area, and the geological strike extension of the Rottenstone Mine.

The Fraser Institutes Annual Survey of Mining Companies ranked Saskatchewan as third in the world for mineral exploration and mining investment attractiveness Argo is well positioned to advance mineral exploration with high-quality assets in a mining friendly jurisdiction.

National Instrument 43-101 Disclosure

The technical information in this news release has been reviewed and approved by Michael Guo PhD, PGeo, MG Geological Consulting Ltd, who is a Qualified Person in accordance with the Canadian regulatory requirements set out in National Instrument 43-101. Historical geochemical, drilling results and geological descriptions quoted in this news release were taken directly from news releases by other mineral explorers and from information provided by the Government of Saskatchewan. Management cautions that results reported by other parties on adjacent properties have not been verified nor confirmed by its Qualified Person, but Argo believes they create a scientific foundation for the exploration in the district. Management further cautions that historical results or discoveries on adjacent or nearby mineral properties are not necessarily indicative of the results that may be achieved on Argo's mineral properties.

About Argo Gold

Argo Gold is a Canadian mineral exploration and development company, and an oil producer. Information on Argo Gold can be obtained from SEDAR at www.sedarplus.ca and on Argo Gold's website at www.argogold.com. Argo Gold is listed on the Canadian Securities Exchange (www.thecse.com) CSE: ARQ as well as OTC: ARBTF and XFRA, XSTU, XBER: A2ASDS.

Judy Baker, CEO

(416) 786-7860

jbaker@argogold.ca

www.argogold.com

NEITHER THE CANADIAN SECURITIES EXCHANGE NOR ITS REGULATIONS SERVICES PROVIDER HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Forward-Looking Information Cautionary Statement

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to the financing not being completed in its entirety, or at all, delays or uncertainties with drilling and surface preparation work, and not achieving hoped for exploration success. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available.

Map 1: Location of Argo Gold Rottenstone Belt Mineral Claims

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3921/267330_6cf1d94f24d9c8f9_001full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/267330