Almadex Minerals Ltd. ("Almadex" or the "Company") (TSX-V: DEX) is pleased to provide an overview of its wholly owned Nicoamen and Merit Projects, located within the Spences Bridge Gold Belt in southern British Columbia.

The Spences Bridge Gold Belt ("SBGB") is a 110 km northwest-trending belt in southern British Columbia, underlain by Cretaceous-aged volcanic rocks of the Spences Bridge Group. These rocks are highly prospective for low-sulphidation epithermal gold-silver mineralization. Although historically underexplored, the belt has gained attention following recent high-grade gold discoveries like Westhaven Gold's Shovelnose Project, making it a focus for renewed exploration activity. To date, approximately CA$55 million has been invested in exploration at the Shovelnose Property. In a news release dated March 3, 2025, Westhaven announced an updated Preliminary Economic Assessment (PEA) outlining a robust, low-cost, high-margin underground gold mining operation with a rapid payback period and an estimated mine life of 11.1 years.

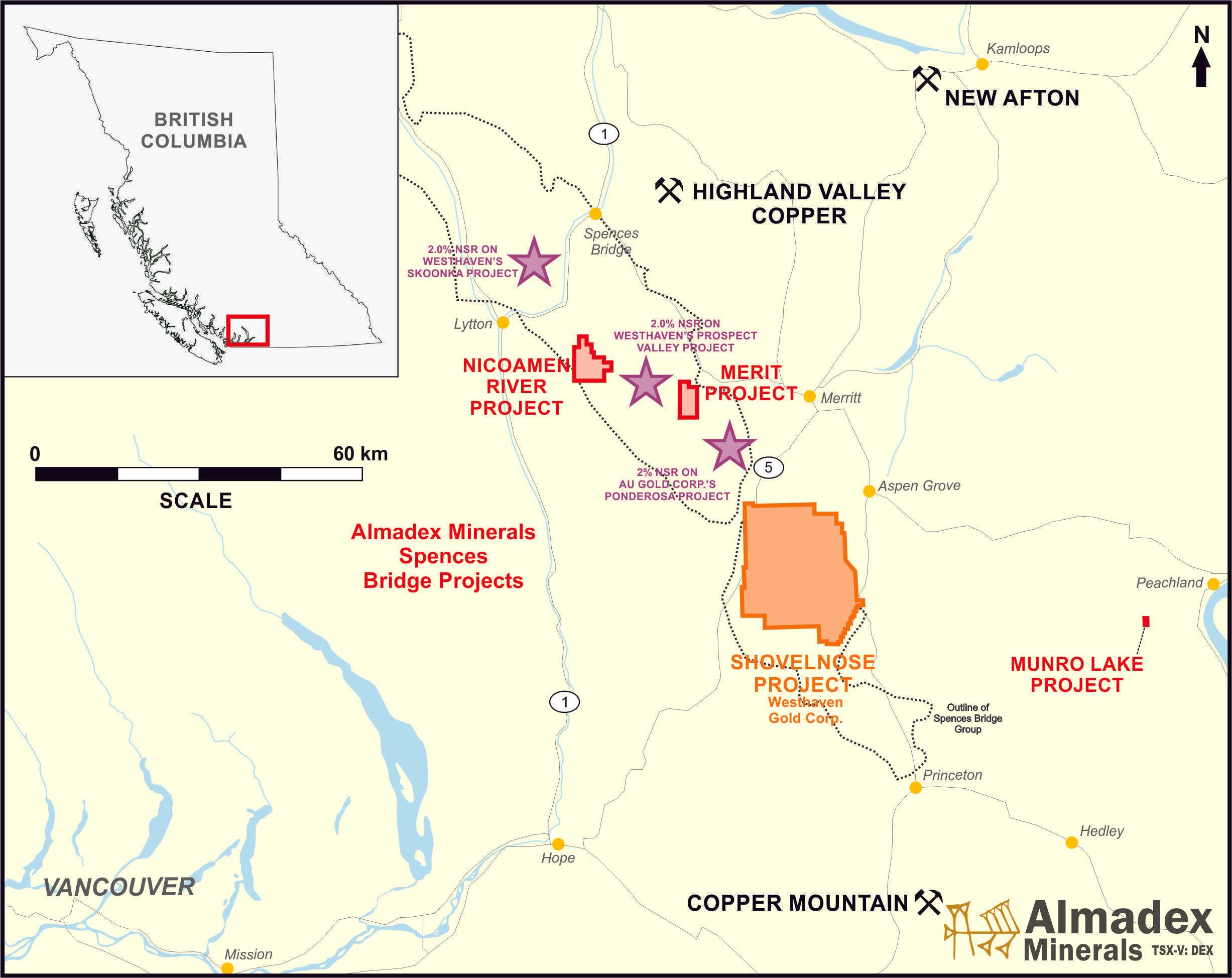

Figure 1: Location of the Nicoamen and Merit Projects within the Spences Bridge Gold Belt, southern British Columbia.

Nicoamen Project Highlights

Almadex's wholly owned Nicoamen Project consists of 9 claims totalling 3,332 hectares. The Property is located approximately 17 km southeast of Lytton, 34 km northeast of Boston Bar and 40 km northwest of Westhaven Gold's Shovelnose Project. Initially staked by Almadex in 2004, the property has since been explored through a combination of stream sediment, rock, and soil sampling, trenching, and geophysical surveys including induced polarization and ground magnetics.

The most recent work on the property was carried out by Independence Gold Corp. ("IGO") under an option agreement that granted them the right to earn a 60% interest in the Nicoamen Property. Prior to the termination of the agreement in early 2022, IGO carried out an exploration program that included 41 rock samples, 245 soil samples, and a ground magnetic survey covering half of the property. The magnetic data outlined a "magnetic low" structural corridor associated with mineralized low sulphidation epithermal style chalcedonic quartz veins, yielding gold values of up to 4.46 g/t. More specifically, they delineated a zone over 100 metres wide containing five vertical chalcedonic veins characterized by ginguro-style banding, with each vein returning consistent gold grades between 1.05 g/t and 3.91 g/t. This newly identified vein zone is a compelling target for future drilling programs. No additional exploration has been conducted on the Property since that time.

Merit Project Highlights

Almadex's 100%-owned Merit Project comprises four mineral claims covering roughly 1,900 hectares. The Property is located approximately 22 km west of the city of Merritt and 20 km northwest of Westhaven's Shovelnose Project. Previous work on the property is documented in a British Columbia Assessment Report filed by Almaden Minerals Ltd., titled "2014 Exploration Drilling Program, Merit Gold Property, British Columbia, Canada", dated May 27, 2015. Key highlights are summarized below. The Merit Property was staked in late 2004 following encouraging results from prospecting and reconnaissance stream sediment, soil, and rock sampling, which led to the discovery of multiple zones of alteration and mineralization, the most prominent being Sullivan Ridge. Sullivan Ridge is characterized by strong silica and carbonate (ankerite) alteration of andesitic breccias and is host to a 1‐2 metre wide, north trending, gold‐bearing quartz vein zone. A 2005 trenching program across this quartz zone returned anomalous gold values such as 7.24 g/t gold over 1.8 metres, including 15 g/t gold over 0.6 metres. Subsequent work on the property included a 2010 Induced Polarization geophysical survey which identified a number of high contrast resistivity anomalies, including one below Sullivan Ridge, and a 2014 two-hole diamond drill program targeting mineralization below Sullivan Ridge. The drilling program returned narrow intercepts of gold mineralization, including 0.5 metres grading 0.439 g/t Au and 0.49 metres grading 0.246 g/t Au, which provide valuable geological information to guide future exploration.

The most recent work on the Property was carried out by Independence Gold Corp. ("IGO") under an option agreement that granted them the right to earn a 60% interest in the Merit Property. Before the agreement was terminated in early 2022, IGO conducted a ground magnetic survey across the entire property, along with geological mapping and rock geochemical sampling. According to IGO's October 8, 2020 news release, sampling of low-sulphidation quartz veins at Sullivan Ridge returned assays of up to 9.5 g/t gold and 341 g/t silver. Follow-up work defined a 200 by 100 metre zone of chalcedonic quartz veins branching from the main vein, with samples returning grades of up to 4.35 g/t gold and 50 g/t silver. At the Central Zone, a newly identified area situated 3 kilometres southwest of Sullivan Ridge, sampling returned assay values of 7.69 g/t gold and 447 g/t silver. Mapping and structural interpretation suggest that the Central Zone belongs to the same structural corridor as the Sullivan Ridge veins but has been offset by a northwest–southeast trending fault.

Morgan Poliquin, CEO of Almadex stated: "The Merit and Nicoamen projects represent compelling exploration opportunities within the highly prospective Spences Bridge Gold Belt, located in a mining-friendly jurisdiction. While our current focus remains on advancing its U.S. based exploration projects, we intend to seek a qualified partner to further develop these promising assets."

Spences Bridge Gold Belt Royalties

Almadex holds three royalties within the Spences Bridge Gold Belt, including a 2% NSR on Westhaven Gold's Prospect Valley and Skoonka projects, as well as a 2% NSR on Au Gold Corp's Ponderosa Property.

Qualified Person

Morgan J Poliquin, PhD, PEng, the President and CEO of Almadex and a Qualified Person as defined by National Instrument 43-101 ("NI 43-101"), has reviewed and approved the scientific and technical contents of this news release.

About Almadex

Almadex Minerals Ltd. is an exploration company that holds a large mineral portfolio consisting of projects and NSR royalties in Canada, the U.S., and Mexico. This portfolio is the direct result of many years of prospecting and deal-making by Almadex's management team. The Company has several portable diamond drill rigs, enabling it to conduct cost effective first pass exploration drilling in-house. The Almadex team have significant porphyry lithocap exploration experience and have made three discoveries of mineral deposits under advanced argillic alteration. Our success comes from our audacity, in house exploration capacity and most importantly our ability to drill with our company owned drilling unit. We have assembled a portfolio of lithocap targets that have the potential to be concealing large porphyry systems at depth in the best jurisdiction we know: the United States of America. We have the cash and drills to advance and test these targets and will continue doing so in 2025.

For more information, please visit: www.almadexminerals.com

On behalf of the Board of Directors,

"Morgan J. Poliquin"

Morgan J. Poliquin, President and CEO

Almadex Minerals Ltd.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes forward-looking statements that are subject to risks and uncertainties. All statements within it, other than statements of historical fact, are to be considered forward looking. Forward-looking statements in this news release include, among other things, any further work to advance exploration targets at the Nicoamen and Merit projects. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration successes, permitting, continued availability of capital and financing, equipment availability and general economic, market or business conditions. The foregoing list of assumptions is not exhaustive. There can be no assurances that forward-looking statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. The Company does not assume any obligation to update any forward-looking statements, other than as required pursuant to applicable securities laws.

Contact Information:

Almadex Minerals Ltd.

Tel. 604.689.7644

Email: info@almadexminerals.com

http://www.almadexminerals.com/

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/1ffc6777-bc2d-421a-beef-71679aef1e09