April 12, 2023

Critical metals exploration and development company MetalsGrove Mining Limited (ASX: MGA), (“MetalsGrove” “MGA” or the “Company”), is pleased to report a recently completed aeromagnetic and surface geochemistry program has highlighted a 1,000m X 600m intrusive system (Refer Figures 1 and 2) considered highly prospective for rare earth element (REE) mineralisation at the Bruce Prospect.

Highlights:

- Recently completed aeromagnetic and surface geochemistry work has identified a 1,000m X 600m intrusive system considered highly prospective for rare earth element (REE) mineralisation.

- Sampling has shown a significantly high proportion of yttrium (258ppm, 45% of total REO).

- High proportion of NdPr (21% of total REO), similar to the other NdPr projects including Mount Weld (Lynas ASX: LYC), Ngualla (Peak ASX: PEK) and Nolan’s Bore (Arafura ASX: AUR).

- Sampling comparisons of the rare earth distributions with other key projects in the Arunta region - namely Brown’s Range and Nolan’s Bore.

- Maiden RC drilling programme will commence this quarter to test the broad conductor and large intrusive system within the Bruce prospect.

The Bruce Prospect is located within the Company’s Arunta Project, north of Alice Springs in the Northern Territory.

Previous work completed within the Arunta Project has confirmed the presence of REE anomalism associated with Cu-Au and base metal mineralisation.

As previously reported (see ASX release dated 20th July 2022), MetalsGrove has identified a broad conductor along strike from the Plenty River mine which has not been tested to date. The recently completed aeromagnetic, radiometric and geochemical data has been processed and overlaid by Intrepid Geophysics to identify and refine new drilling targets for testing in Q2 CY 2023.

Commenting on the large-scale anomaly at the Bruce Prospect, MetalsGrove’s Managing Director, Sean Sivasamy said:

“We are very encouraged by the outcomes from our pre-drilling exploration work at the Bruce Prospect which has provided a much clearer insight into the mineralised system we are targeting.

The comparisons of the rare earth distributions with other projects in the Arunta region - namely Brown’s Range and Nolan’s Bore - are very encouraging and follow up drilling is planned to commence later this quarter. Our Phase 1 drilling will commence at these priority targets within Bruce and this will be followed by drilling at the Box Hole and Edwards Creek Prospects.

I would also like to thank the station owners within our Arunta Project, along with the traditional owners Huckitta Aboriginal Corporation and Ingkekure Aboriginal Corporation of the project area for assisting with getting this programme completed on time. I look forward to providing further updates as we near the commencement of drilling at Arunta.”

Surface Rock Chip Sampling Review at Bruce

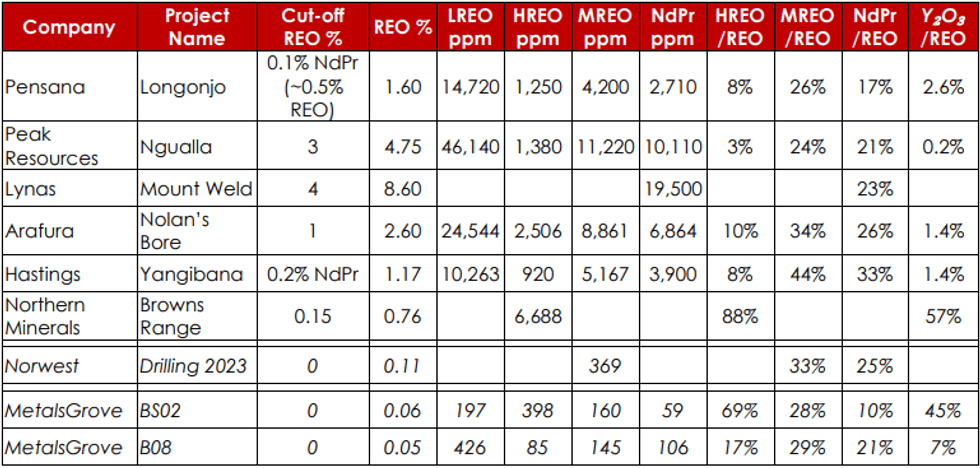

Rare earth projects can typically be divided up into various categories, depending on the quantity and ratio of rare earths that they contain. Table 1 shows a select few rare earth projects. Rare earth projects tend to be defined according to the REE they contain that will give the most value to the project. For example, Ngualla and Nolan’s Bore are NdPr projects as it will be the neodymium and praseodymium that give the most value. Browns Range contains significant dysprosium (640ppm) and yttrium (4,330ppm, 57% of total REO) and is considered a heavy rare earth project (the HREO is 88% of total REO). Mount Weld is a high grade rare earth deposit (8.6% REO in the Ore Reserve); much of the grade is driven by the low-value lanthanum and cerium, however, it is the NdPr (19,500ppm) and dysprosium (338ppm) that will be key value drivers.

The two highest grade rock chip assays have been added to the base of Table 1 as a comparison with the other project types. Sample BS02 has a significantly high proportion of yttrium (258ppm, 45% of total REO) and dysprosium is also elevated (44ppm). These proportions are comparable to Brown’s Range. Sample BS04 showed similar ratios but had a low overall grade (114ppm, Table 2).

Sample B08 has a relatively high proportion of NdPr (21% of total REO), similar to the NdPr projects Mount Weld, Ngualla and Nolan’s Bore. The ratios of all the rock chips above 100ppm TREO are shown in Table 2 and a high proportion of MREO to TREO is consistent throughout the rock chips.

The rare earth elements composition for the two highest grade rock chips are compared to the average abundance of rare earths for granite in Table 3. The heavy rare earths in Sample BS02 are several times the expected background.

The comparison of the rare earth distributions with other projects in the Arunta region (namely Brown’s Range and Nolan’s Bore) are encouraging and follow up drilling will commence Q2 CY2023.

Click here for the full ASX Release

This article includes content from MetalsGrove Mining Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00