April 20, 2022

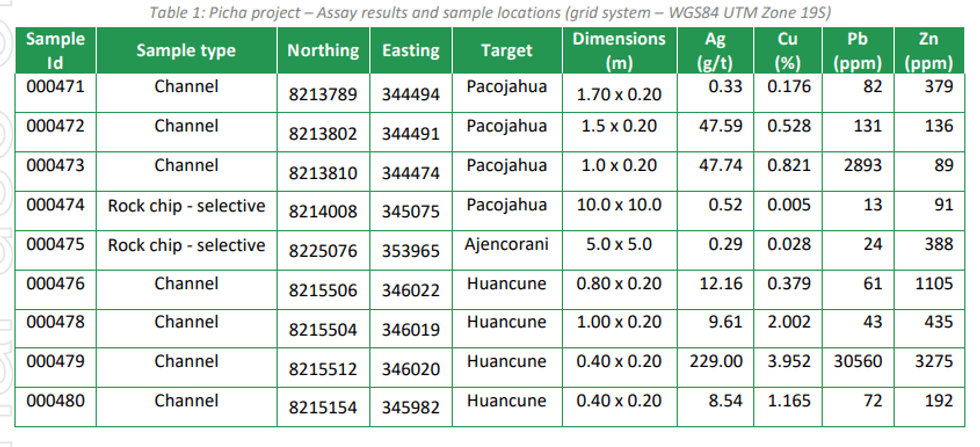

Valor Resources Limited (“Valor” or the “Company”) is pleased to announce the results of rock chip samples taken from recently identified copper targets at the Company’s Picha Project in southern Peru. Samples were taken from two new targets which were first highlighted in the Company’s ASX announcement dated 31st March 2022 titled “Spectral study supports the porphyry potential at Picha Copper project”. Samples were also taken from the Huancune target where Valor intends to commence systematic on-ground exploration in 2022. The sample details and assay results are shown in Table 1 below.

HIGHLIGHTS

- Multiple new targets confirmed with rock chip assay results:

- 3.95% Cu, 229g/t Ag and 3.06% Pb in channel sample at Huancune target

- Three of four channel samples at Huancune return >1% Cu

- 0.82% Cu, 47.7 Ag g/t in channel sample at new target (Pacojahua) 2km southwest of Huancune

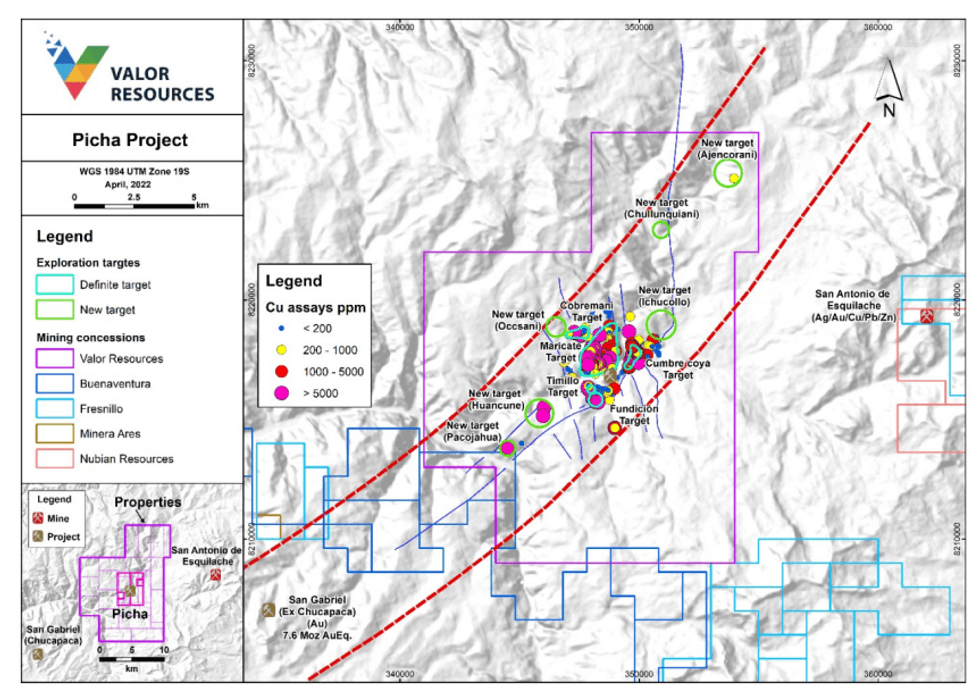

Figure 1: Picha Project – Exploration Targets and Copper geochemical anomalies (potential mineralised corridor shown as red outline)

Executive Chairman Mr George Bauk commented, “These results continue to demonstrate strong copper mineralisation extending to the north and south of the original Picha Project mineralisation previously disclosed. As outlined in Figure 1, a strong mineralisation trend runs through the project area to the nearby San Gabriel Project owned by Buenaventura SAA (NYSE:BVN)”.

“In the past few weeks we have seen the San Gabriel Project (7.6 Moz AuEq Indicated and Inferred Mineral Resource1) receive mining approval from the relevant authorities which provides Buenaventura with a green light to proceed with the development of this project, which is located within 10km of the Picha Project”.

“Work continues with field work on the Picha Project along with working on the permitting process for the commencement of our maiden drill program this year”.

Click here for the full ASX Release

This article includes content from Valor Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

VAL:AU

The Conversation (0)

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00