August 29, 2024

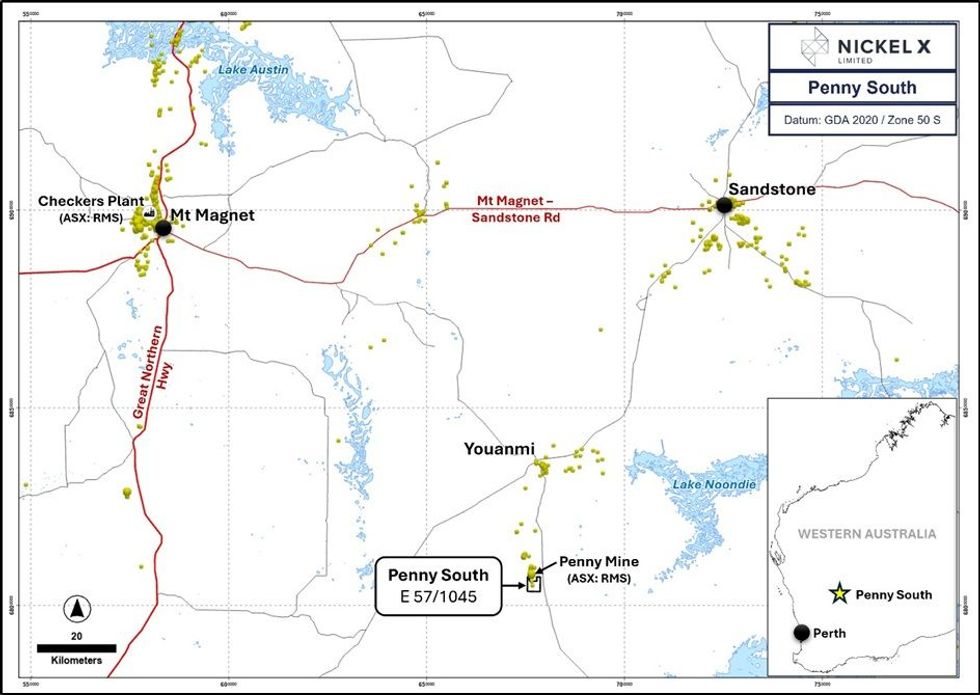

NickelX Limited (“NickelX”, “NKL” or “The Company”) is pleased to announce that it has entered into a binding tenement sale agreement to acquire 100% of tenement E57/1045 known as the Penny South Gold Project.

HIGHLIGHTS

- Binding Tenement Sale Agreement to acquire 100% of the Penny South Gold Project (E57/1045) to bolster West Australian Gold exploration portfolio

- Penny South Gold Project located in world class gold district and ~550m south of one of Australia’s highest grade producing gold mines1, the Penny West/North Gold Mine (“Penny”), owned and operated by Ramelius Resources Limited (ASX:RMS) (“Ramelius”):

- The Penny West mine produced 154,000t at 18g/t Au (89,000 Au) in the early 1990’s2.

- The initial Penny North deposit of 569,000t at 16.8g/t (306,000oz) was discovered by Spectrum Metals Limited and subsequently subject to a takeover by Ramelius for >$200M during 20203, with the deposit now being mined and extended.

- The Penny West Shear, which hosts the Penny deposits, continues south into the Penny South Project (E57/1045) with ~2.5km of strike contained in E57/1045.

- Average historical drill hole depth across E57/1045 is ~42m, with only 18 holes deeper than 100m and 7 holes deeper than 200m4 5, with no diamond drilling.

- Historic drilling within E57/1045 has encountered various significantly anomalous intersections of gold mineralisation5.

- Review of all available data to generate high priority drill targets underway.

Commenting on the acquisition Managing Director Peter Woods said:

“We are extremely pleased to have reached an agreement for the acquisition of the Penny South Project. The addition of this exciting gold exploration asset next door to one of the highest-grade gold mines in production in Western Australia, and in a district seeing current M&A activity, greatly enhances our existing portfolio. Given the minimal deeper drilling and lack of diamond drilling, it is the Company’s view there may be substantial value to be unlocked at depth and we are eager to execute a path forward to test the theory as the momentum for gold continues.”

Penny South Gold Project, WA

The Penny South Gold Project (E57/1045) (Map 1) lies only 550m south of Ramelius’ operating Penny West/North gold mine project (Map 2), which is estimated to contain 440,000t of ore at 22g/t Au (320,000oz Au) (“Penny”)6. NKL’s Penny South Gold Project captures a ~2.5km strike extension of the Penny West Shear immediately south of Ramelius’ Penny deposits, southern Youanmi Greenstone Belt (Map 3).

Click here for the full ASX Release

This article includes content from NickelX Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

NKL:AU

The Conversation (0)

16h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

18h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

22h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00