May 14, 2024

Perpetual Resources Limited (“Perpetual” or “the Company”) (ASX: PEC), is pleased to announce that it has entered into a binding Term Sheet (Binding Term Sheet) for an option to acquire 100% of the rare earth elements, niobium and scandium mineral rights located on four (4) tenements (Exploration Tenements) with Mineracao Serra Do Sao Domingos Ltda (Sao Domingos).

HIGHLIGHTS

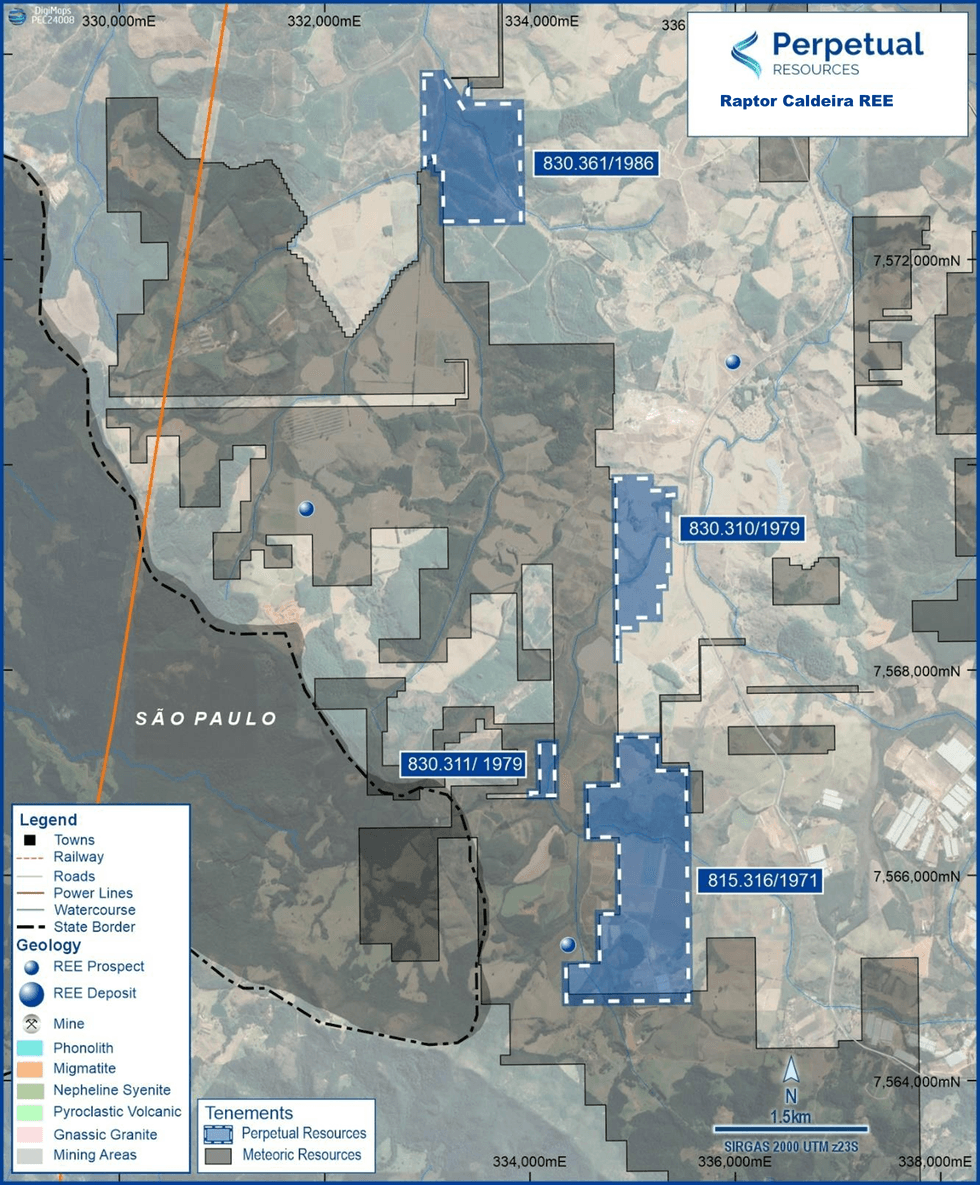

- Perpetual has entered into a binding Term Sheet to acquire (subject to due diligence) a low-cost option over the “Raptor” project which includes REE, Niobium and Scandium mineral rights within a strategic tenement package located in the prolific Tier 1 Caldeira Rare Earth complex in Minas Gerais, Brazil.

- Option agreement comprises 4 licenses, which cover a strategic area of 380 hectares all located proximal to Meteoric Resources (ASX:MEI) Tier 1 Caldeira ionic clay REE project, which boasts a JORC Mineral Resource Estimate of 545 million tonnes @ 2,561ppm TREO comprising 24.1% MREO1.

- oMultiple of the Raptor Project licenses have active mining rights and exhibit near surface bauxite mining operations and are not located within any environmental protection zones.

- Perpetual to immediately commence due diligence, with plans to undertake sampling and drilling activities after an initial reconnaissance program in May.

- Perpetual intends on undertaking an aggressive exploration campaign should the option exercise be completed.

- All tenements are situated nearby established infrastructure, water access and existing mining activities.

- The option agreement is considered highly strategic for Perpetual, which has built an enviable multi-commodity footprint now spanning Lithium and Rare Earths in a jurisdiction that is experiencing a rapid escalation in interest from mining exploration companies seeking exposure to critical minerals projects.

- Perpetual remains in discussions with other landowners to further strategically expand its existing highly prospective critical minerals portfolio in Brazil.

The Binding Term Sheet allows Perpetual to undertake due diligence for an initial 90-day period, for the payment of US$30,000, with Perpetual also holding the right for an additional 90-day due diligence extension period for an additional US$30,000, if required.

Tenement Overview

Perpetual considers the location of the Exploration Tenement package it has secured exposure to as being in one of the most prospective geological settings for REE exploration in the world, evidenced by the high quality of the nearby projects.

The “Raptor” Tenements are located proximal to and on the same geological formation as Meteoric Resources (ASX:MEI) Tier 1 Caldeira ionic clay REE project, which boasts a JORC Mineral Resource Estimate of 545 million tonnes @ 2,561ppm TREO comprising 24.1% MREO2 which is considered one of the world’s highest grade ionic adsorption clay REE deposits.

Click here for the full ASX Release

This article includes content from Perpetual Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

4h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00