March 29, 2022

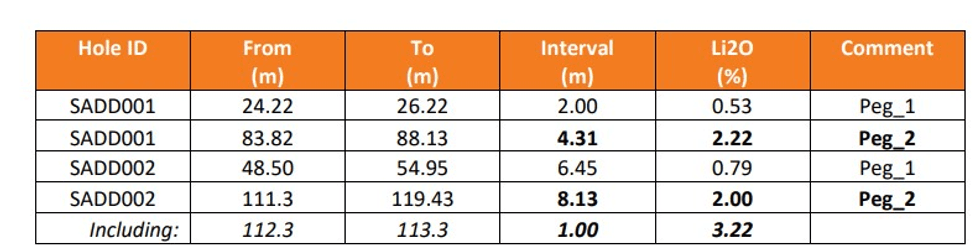

Latin Resources Limited (ASX: LRS) (“Latin” or “the Company”) is pleased to announce that the first assay results from drilling at the Salinas Lithium Project in Brazil (“Salinas Lithium Project”), have confirmed that the previously reported spodumene rich pegmatites contain high-grade lithium with a peak grade of 3.22% Li2O returned from one sample1 . These positive assay results at the Salinas Lithium Project in Brazil are growing Latin’s confidence of a potential new, high-grade lithium discovery. Assay results from the sampled pegmatite zones in the first two diamond holes (SADD001 and SADD002) (Figure 1 and Figure 2), show that the two main logged pegmatites (Figure 2, Peg_1 and Peg_2), both contain significant lithium, with Peg_2 showing a consistent higher grade in both holes (Table 1)1 .

HIGHLIGHTS

- First assay results from the initial two drill holes completed at the Southern Target area of the Salinas Lithium Project in Brazil have confirmed a potential new high-grade lithium discovery.

- Excellent assay results with the presence of high-grade lithium in pegmatites, with a peak individual grade of 3.22% Li2O.

- First major intersections include:

- SADD001: 4.31m @ 2.22% Li2O, from 83.82m Including: 1.13m @ 2.85% Li2O, from 87.0m

- SADD002: 8.13m @ 2.00% Li2O from 111.3m Including: 1.0m @ 3.22% Li2O from 112.3m and: 3.0m @ 2.20% Li2O from 115.3m

- Assay results show consistent down-hole grade profiles in both holes, with a strong grade correlation down dip between the individual pegmatites in each hole.

- Logging of all holes drilled to date indicates the consistent development of the separate pegmatites across a strike length of 500m, which remains open along strike.

- The pegmatites are generally increasing in thickness along strike to the south, where assay results from the next four holes are pending.

- The positive assay results now increase the Company’s growing confidence that it has discovered a significant lithium occurrence.

- The drilling will now be focused on the Southern Target area where the pegmatites are thicker and remain open to the south, where the Company will commence infill and step-out drilling.

Table 1: Selected significant lithium (>0.4% Li2O) pegmatite intersections from Salinas Lithium Project diamond drilling. Refer to Appendix 1, Table 3 for full assay results.

Click here for the full ASX Release

This article includes content from Latin Resources Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRS:AU

The Conversation (0)

02 February 2022

Latin Resources

Developing mineral projects to support the global decarbonization

Developing mineral projects to support the global decarbonization Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00