June 14, 2022

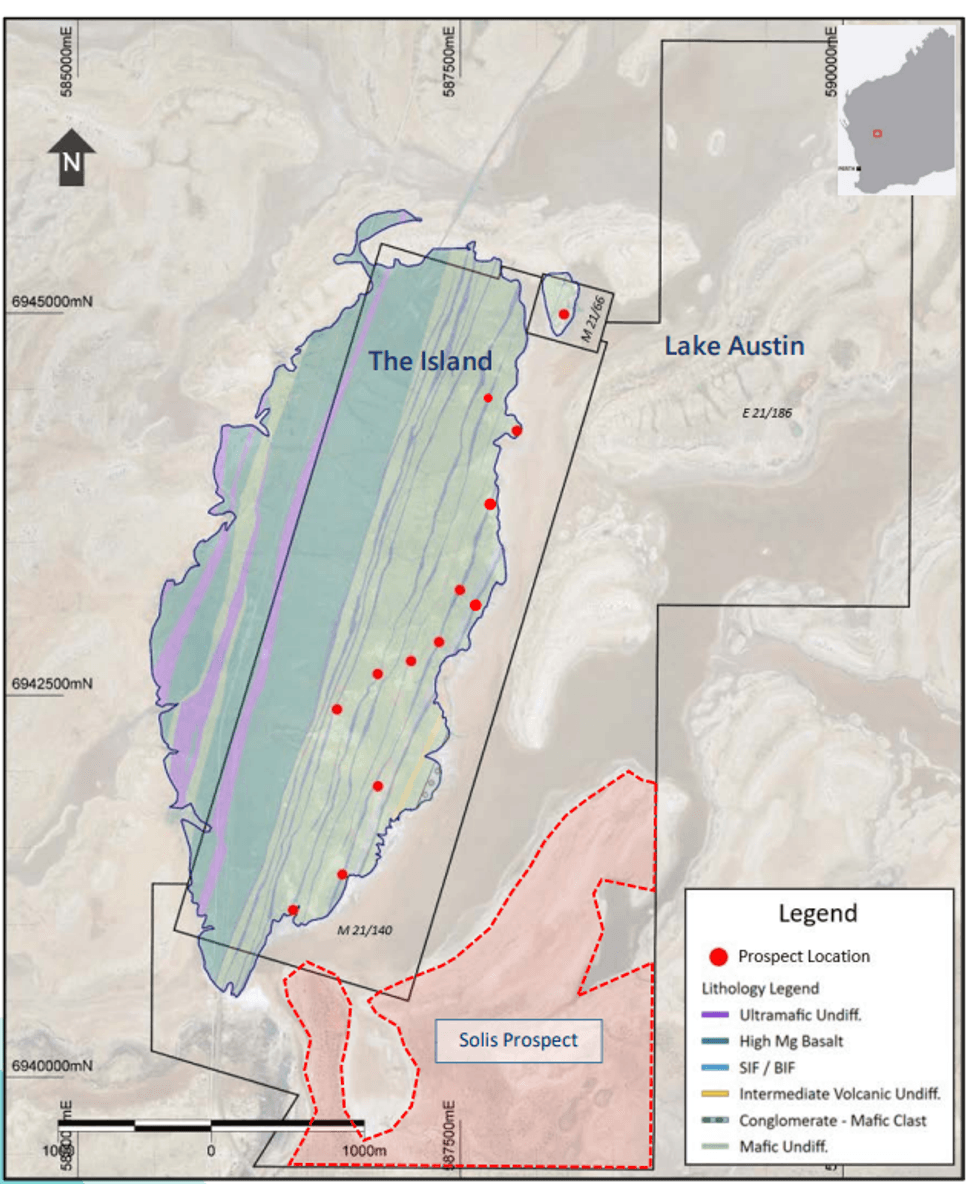

Caprice Resources Ltd (ASX: CRS) (“Caprice” or “the Company”) is pleased to provide an exploration update for the Solis Prospect, at the southern end of the Island Gold Project (“IGP”, “Project”), located in the Murchison Region of Western Australia.

SUMMARY

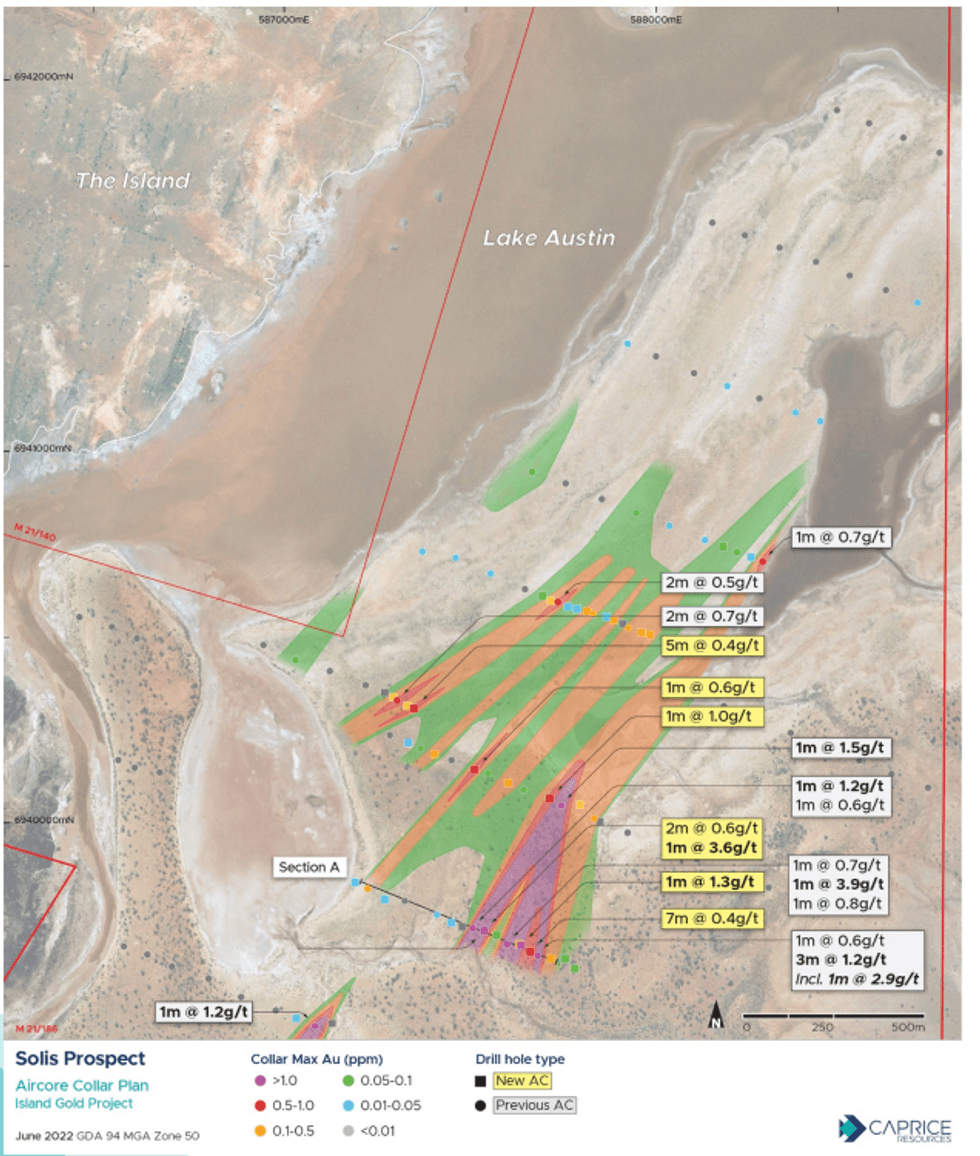

- The maiden aircore program at Solis defined a +1km long regolith gold anomaly (see ASX 16 March 2022) from coarse spaced drilling.

- Recent infill aircore drilling has successfully confirmed the gold anomalism, yielding results consistent with the maiden program.

- Better results from the infill drilling include:

- 1m @ 3.6g/t Au from 37m,

- 1m @ 1.3g/t Au from 34m and

- 1m @ 1.0g/t Au from 17m.

- The program has tightened the hole spacing to 20-50m and given important insights into the dip of the anomalism within the regolith profile.

- The results from the infill program at Solis will be used to design an RC drilling program, which is scheduled for late June to early July.

The maiden aircore program at Solis in early 2022 delineated a +1km long regolith gold anomalous zone. The maiden program was drilled on 400m line spacing with 80m spaced holes. An infill program consisting of 39 holes for 1,146m was recently completed at Solis, tightening the hole spacing in the main anomalous areas.

The program has successfully returned grades in line with the maiden program and confirmed the +1km gold anomaly. In addition, the closer spaced drilling enabled a preliminary interpretation of the anomaly’s geometry within the regolith profile.

The information from the combined aircore programs has been used to plan a follow up RC program, which is scheduled for late June/early July. The RC program will look to test depths of c.100m, compared to the average aircore depth of c.30m, and will give insights into the mineralisation in fresh rock.

Managing Director, Andrew Muir, commented:

“The maiden aircore program at Solis was an exceptional success, generating a large-scale anomaly in an untested area. The scale and coherence of the anomaly is outstanding.

This infill aircore program has confirmed the +1km gold anomaly and, in addition, it has enabled Caprice to effectively plan deeper RC drilling to test for mineralisation in fresh rock. We look forward to assessing the depth potential within the next few weeks.”

Click here for the full ASX Release

This article includes content from Infinity Lithium Corporation Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CRS:AU

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00