June 25, 2024

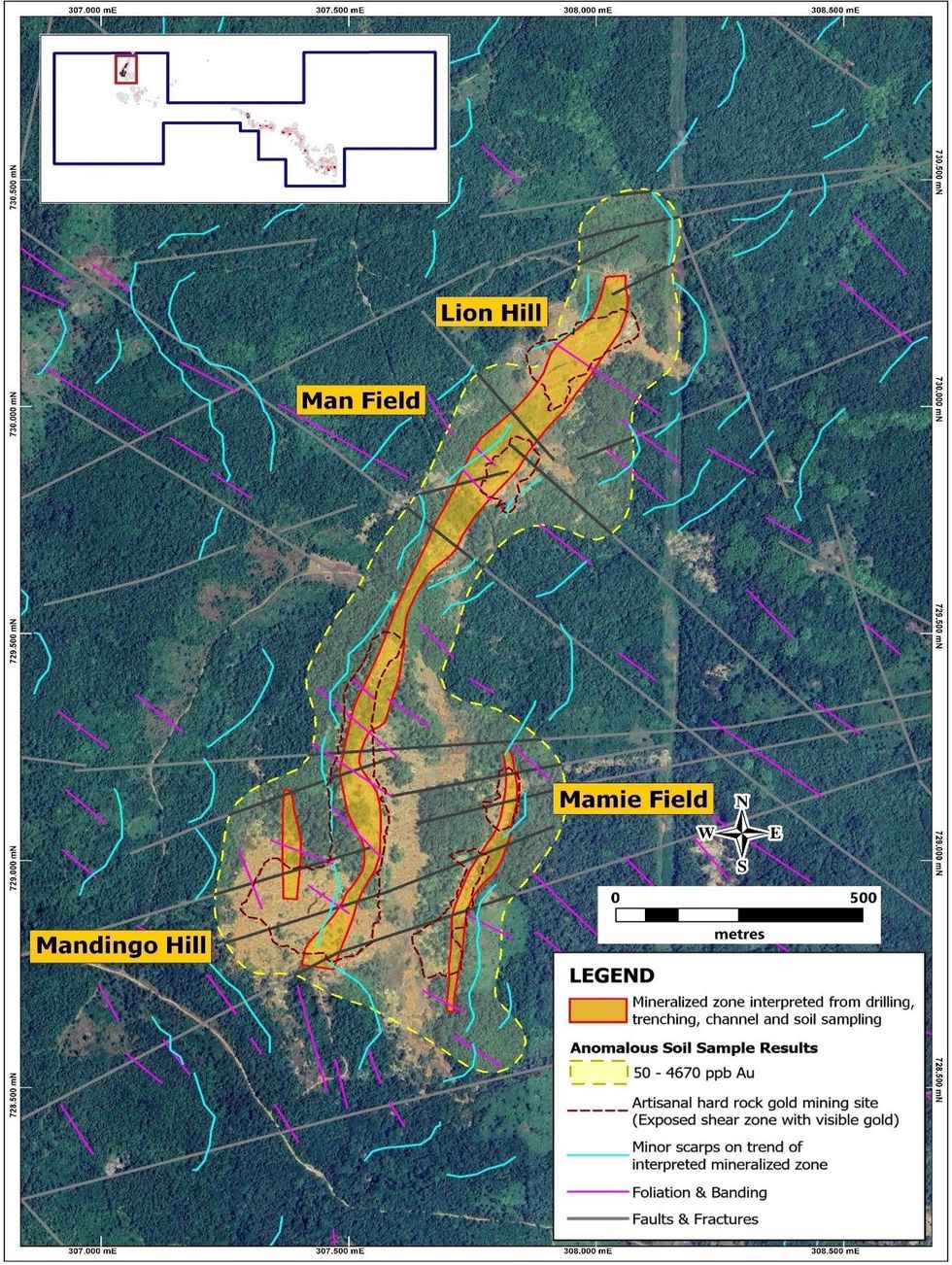

Zodiac Gold Inc. (TSXV: ZAU) ("Zodiac Gold" or the "Company"), a West-African gold exploration company, is pleased to announce that it has completed a satellite data interpretation study (the "Study") covering the Alasala target of the Company's Todi Gold Project, which builds on the regional interpretation completed by A.C.A Howe International Limited ("ACA Howe") in 2021. The Study focused on a 72 km2 area including the 2 km long mineralized trend from Mandingo Hill to Lion Hill (see Map 1 below), delineated by soil sampling, trenching, channel sampling, auger drilling, and extensive artisanal workings with visible gold.

Management Commentary

David Kol, CEO, commented, "Completing this satellite data interpretation study marks a significant step forward in our exploration efforts at the Alasala target. The detailed insights into the geological setting and the identification of new structural trends improve our understanding of the controls on mineralization and enhance our confidence in the potential for high-grade gold mineralization. We are excited to advance to the next phase of our drill program and further unlock the value of the Todi Gold Project."

Highlights

The Study was completed by ACA Howe in advance of Zodiac Gold's upcoming drill program at Alasala and serves to improve the understanding of the geological setting and history of the area, as well as providing information on potential controls on mineralization. Specifically, the Study has revealed the following key points:

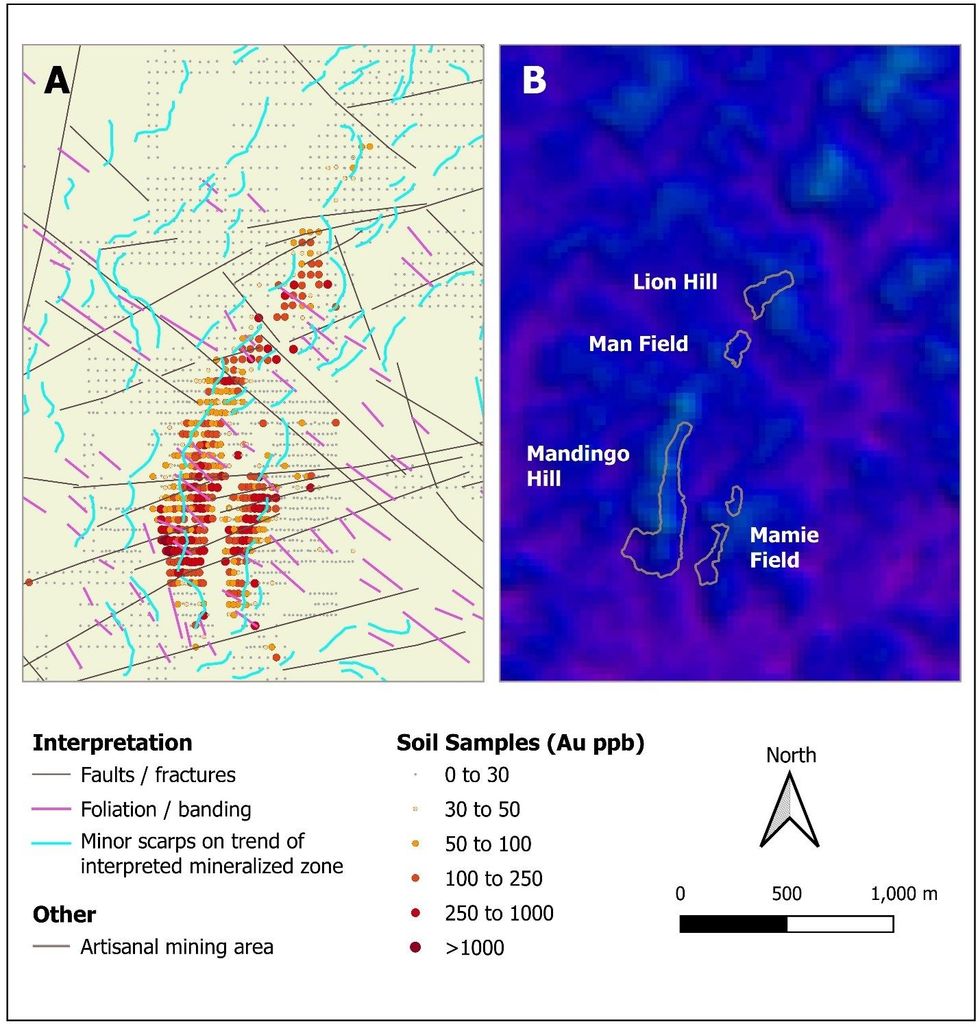

- The 2 km mineralized trend broadly follows a topographical high shown in radar data (see Map 2 below). A series of scarps has been identified on this trend and these continue along strike to the north and south. Initial follow-up on the ground by Zodiac Gold's geological team has identified weathered amphibolites and gneisses aligned with the north-northeast trending feature.

- A number of previously unknown cross-cutting east-northeast trending structures have been interpreted and it has been determined that a higher intensity structural corridor coincides with highly anomalous soil sample results at Mandingo Hill and Mamie Field (see Map 2 below). Notably, Zodiac Gold's recent rock chip samples of 32 and 33 g/t Au from Mandingo Hill (reported in Zodiac's press release dated May 28th, 2024), are in close proximity to interpreted cross-cutting east-northeast trending structures.

- High grade soil samples and the Man Field artisanal pit are also located on an interpreted cross-cutting east-northeast trending structure (see Map 2 below).

- Several northwest trending structures were also interpreted and the foliation and banding in the metamorphic rocks of the area is confirmed as being predominantly to the northwest and dipping to the southwest (see Map 2 below), in line with the regional scale Todi shear zone.

- The follow up drill program is expected to begin on the Todi Gold Project in roughly 2 weeks.

Zodiac Gold believes the interaction of these structural features, as well as the presence of favorable host rocks, provides potential for high grade gold mineralization as demonstrated by the recent rock chip samples and historical drilling results (reported in Zodiac's press release dated May 28th, 2024).

Map 1: Satellite data interpretation for the Alasala Target

Map 2: Correlation of soil anomalism with topographical feature shown on SRTM data at Alasala. A) Soil sample results with satellite data interpretation. B) SRTM data with artisanal mining areas.

Investor Relations Engagement

The Company is pleased to announce that it has retained the services of Peak Investor Marketing Corp. ("Peak") a full-service marketing and consulting services focused on the junior mining sector. Peak is an independent arms-length entity and will assist Zodiac Gold with marketing strategy and planning, corporate communications and public relations, with the goal of increasing market awareness for the company. Under the terms of the Agreement, the Company will compensate Peak $12,000 per month for an initial term of six months, will grant Peak 200,000 stock options pursuant to the Company's Omnibus Equity Incentive Plan and are subject to the approval of the TSXV. Following the initial term, the Company will pay Peak $12,000 per month. The options will have an exercise price of $0.18 per share and vest in four stages over a period of 12 months, with ¼ of the options vesting three months after the date they are granted and every three months thereafter. The options will remain exercisable until 90 days after the termination of the agreement with Peak, to a maximum of two years from the date the options are granted.

Qualified Person

Efdal Olcer, Vice President of Exploration at Zodiac Gold, is a member of the Society of Economic Geologists, Geological Society of London, Australian Institute of Geoscientists, the Society of Geology Applied to Mineral Deposits, and the Turkish Association of Economics Geologists and a Qualified Person as defined by NI 43-101. He has reviewed and approved the technical and scientific information provided in this release.

For further information, please visit the ZodiacGold website at www.zodiac-gold.com or contact:

David Kol, CEO

info@zodiac-gold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Information

This news release includes certain "forward-looking statements" within the meaning of Canadian securities legislation.

Forward-looking statements include predictions, projections, and forecasts and are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "estimate", "forecast", "expect", "potential", "project", "target", "schedule", "budget" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the Company's planned exploration programs and drill programs and potential significance of results are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are based on a number of material factors and assumptions. Important factors that could cause actual results to differ materially from Company's expectations include actual exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital, and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, defects in title, availability of personnel, materials, and equipment on a timely basis, accidents or equipment breakdowns, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Although the Company has attempted to identify important factors that could cause actual actions, events, or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events, or results to differ materially from those anticipated. There can be no assurance that forward-looking statements will prove to be accurate, and accordingly readers are cautioned not to place undue reliance on forward-looking statements.

The Conversation (0)

17 September 2024

Zodiac Gold

Advancing a district-scale West African gold discovery in a stable, mining-friendly jurisdiction

Advancing a district-scale West African gold discovery in a stable, mining-friendly jurisdiction Keep Reading...

17h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

18h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

22h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00