March 14, 2023

Marquee Resources Limited (“Marquee” or “Company”) (ASX:MQR) is pleased to update the market about the ongoing exploration activities at the West Spargoville Project (“WSP” or “Project”).

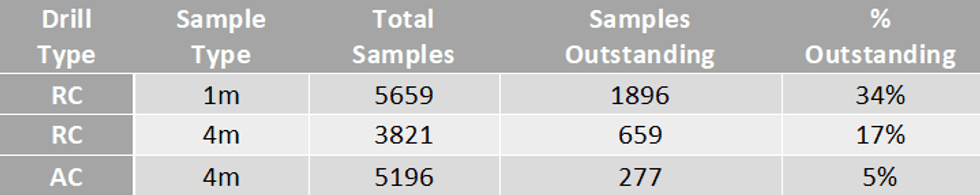

During Q4-2022, Marquee completed its maiden lithium focused drilling program which consisted of 123 reverse-circulation drill holes for 18,776m and 351 aircore drill holes for 24,324m. The first pass drilling program focused on testing geochemical anomalism defined from auger geochemical sampling. Due to increased processing times at laboratory facilities, a significant number of assay results remain outstanding as highlighted in Table 1.

Exploration Update & Forward Work Plan

The Company has prioritised samples with logged granitic or pegmatitic material (1 metre assays) in an effort to improve turn-around times for key assay results. 1-metre assay results have been received for 101 reverse- circulation drillholes with 1 metre results for 22 reverse-circulation drillholes remaining. A peak assay of 1m @ 1.1% Li2O has been returned from MQRC081 with significant results (>2,000ppm Li2O) received thus far outlined in Table 2.

Results from the first 328 aircore holes have been returned with 24 holes outstanding, and significant results (>250ppm Li2O) received thus far are outlined in Table 3. The eastern portion of the tenure, where aircore drilling has been employed, is covered by a thin veneer (<2m) of transported overburden and has a well- developed regolith profile that extends up to 100m vertical depth. Due to the nature and depth of the weathering profile, aircore drilling is required initially to target blind pegmatites for follow-up RC drilling. As such, the AC drilling is considered reconnaissance in nature, however multiple pegmatites have been intersected with significant geochemical anomalism. The assay results show a clear LCT-pegmatite association (Table 3) with tantalum concentrated preferentially in the upper saprolite and lithium concentrated in the lower saprolite. The geological setting is analogous to the Cade Pegmatite at the Dome North Project where mineralised pegmatite is hosted within the Black Flag Beds beneath a well-developed weathering profile (Refer ESS ASX Release 14th January 2022).

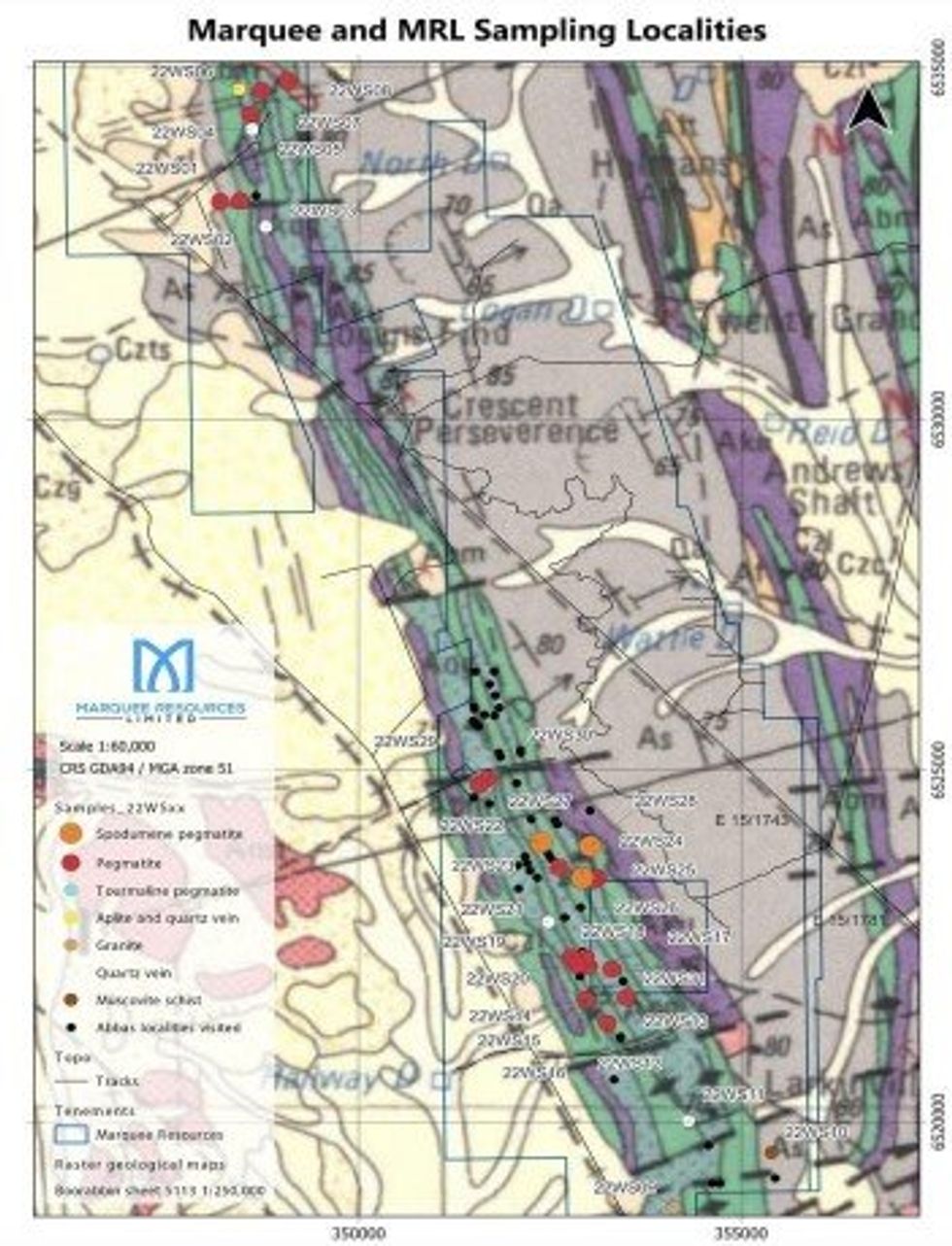

Additionally, Marquee and Mineral Resources geologists have completed further surface mapping (Figure 1) and identified multiple, new outcropping pegmatite occurrences with 3 samples observed to contain visual spodumene grains (Figure 2 and Table 4). Peak assays of 1.6% Li2O (22WS22) and 1.5% Li2O (22WS28) were returned from the rock chip sampling and correspond to observed spodumene occurrences.

Once all outstanding assay results have been received and interpreted, the Company will update the market with future exploration plans.

Due to the large volume of samples and labour shortages at laboratory facilities, results have been significantly behind schedule.

The West Spargoville Project

The West Spargoville Project is located in the core of the Southern Yilgarn Lithium Belt, an area that is well known for spodumene deposits that include; the Bald Hill Mine, the Mt Marion Mine, the Buldania Project and Essential Metals Pioneer Dome Project. The world-class Earl Grey deposit and the Mt Cattlin Mine are located further west and south respectively (Figure 4). Marquee entered into an Option Agreement to acquire the West Spargoville project (refer ASX Release dated 7th July 2020 and 23rd August 2021) which consists of 80km2 of highly prospective tenure with very limited drilling historically completed on the Project.

Click here for the full ASX Release

This article includes content from Marquee Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MQR:AU

The Conversation (0)

12 July 2022

Marquee Resources

Capitalizing on the Electric Revolution with a Diverse Battery Metal Portfolio

Capitalizing on the Electric Revolution with a Diverse Battery Metal Portfolio Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00