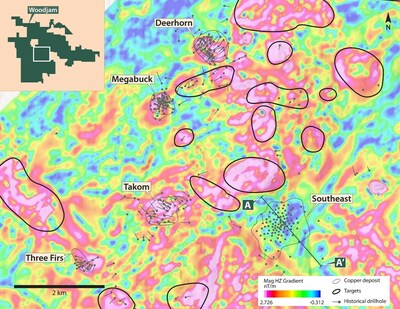

Vizsla Copper Corp. (TSXV: VCU) (OTCQB: VCUFF) ( FRANKFURT : 97E0) (" Vizsla Copper " or the " Company ") is pleased to report additional results from an interpretation of a high-definition aeromagnetic geophysical survey recently completed over the Southeast deposit (" Southeast ") on the Company's 65,252-hectare Woodjam Project (" Woodjam "). Woodjam is prospective for copper-gold porphyry mineralization and is located 55 kilometres east of Williams Lake, BC (Figure 1).

HIGHLIGHTS

- Southeast deposit remains open: High-grade areas of porphyry-related copper and gold mineralization at Southeast (e.g., 144.9m of 1.21% Cu and 0.55 g/t Au; WJ 08-84) remain open, both laterally and at depth.

- Recent drilling results : Drilling completed at Southeast by Consolidated Woodjam Copper in 2021 intersected strong zones of copper and gold mineralization (e.g., 142.4m averaging 0.56% Cu and 0.23 g/t Au; SE21-089).

- Similar nearby magnetic features are untested: Inverted geophysical models generated from the newly acquired aeromagnetic survey data suggest that untested targets remain – particularly immediately southeast of the deposit.

"The Southeast deposit contains the majority of the copper-gold porphyry-related historical resources at the Woodjam project," commented Steve Blower , Vice President of Exploration . "The deposit is open for expansion and there are look-a-like features nearby that have yet to be drilled. Our exploration team is very eager to evaluate these targets. "

SOUTHEAST DEPOSIT

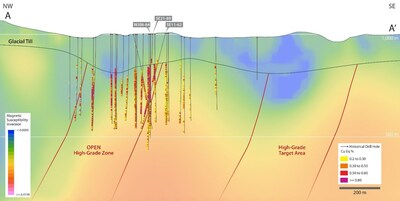

The Southeast deposit is a large porphyry-related copper and gold deposit within the prospective Takomkane batholith; a large, composite body of early Jurassic calc-alkaline intrusive rocks. At Southeast, copper and gold mineralization is best developed above and on the northwest flank of a broad magnetic high anomaly which strengthens with depth (Figures 2 and 3). The deposit includes zones of considerable high-grade copper and gold mineralization. For example, recent drilling in 2021 intersected 142.4m @ 0.71% CuEq (0.56% Cu and 0.23 g/t Au) in the last hole of the program and earlier drilling in 2008 intersected 144.9m @ 1.57 % CuEq (1.21% Cu and 0.55 g/t Au). Further drilling and modelling are required to better constrain the controls and orientations of the higher grade zones.

Highlights from previous drilling at Southeast are shown in Table 1, below. A historical mineral resource estimate is summarized in Table 2.

Table 1 – Southeast Deposit Drilling Highlights

| Drill hole | From (m) | To (m) | Int. (m) | Au (g/t) | Cu (%) | AuEq (g/t) | CuEq (%) |

| SE21-089 | 115.6 | 258.0 | 142.4 | 0.23 | 0.56 | 1.08 | 0.71 |

| SE11-062 | 100.6 | 211.1 | 110.5 | 0.17 | 0.45 | 0.86 | 0.56 |

| and | 256.5 | 462.4 | 205.9 | 0.18 | 0.57 | 1.05 | 0.69 |

| WJ08-084 | 125.9 | 485.0 | 359.1 | 0.28 | 0.70 | 1.34 | 0.88 |

| inc | 166.7 | 311.6 | 144.9 | 0.55 | 1.21 | 2.41 | 1.57 |

Note: Cueq and Aueq are calculated with prices of US$1,800 /oz Au and US$4.00 /lb Cu.

Table 2 –Historical Mineral Resource Estimate for the Southeast Deposit, Effective Date May 30, 2013

| Deposit | Category | Tonnage | Grade | Metal Content | ||

| | | M tonnes | % Cu | g/t Au | M lbs Cu | 000 oz Au |

| Southeast 1,2 | Inferred | 221.7 | 0.31 | 0.05 | 1,507 | 383.7 |

| | |

| Notes: | |

| 1. | Source: "NI 43-101 Technical Report for Woodjam Property, Horsefly, British Columbia, Canada", prepared by Susan Lomas, P.Geo. of Lions Gate Geological Consulting inc. (LGGC). and issued on December 16, 2022. The historical mineral resource estimate was prepared for Goldfields and Consolidated Woodjam Copper with an effective date of May 30, 2013. The NSR calculation used US$1,650/oz Au, US$3.90/lb Cu and recoveries of 56% Au and 64% Cu. The Southeast Historical Estimate was reported within a resource limiting pit shell based on a price assumption of US$1,650/oz Au and US$3.90/lb Cu. |

| 2. | Historical Estimates are considered historical in nature and as such are based on prior data and reports prepared by previous property owners. The reader is cautioned not to treat them, or any part of them, as current mineral resources or reserves. A qualified person has not done sufficient work to classify the Historical Estimates as current resources and Vizsla Copper is not treating the Historical Estimates as current resources. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. |

EXPLORATION POTENTIAL AT THE SOUTHEAST DEPOSIT

High-grade porphyry-related copper and gold zones at Southeast remain open laterally and at depth. Further, limited drilling has been completed peripheral to the deposit and several target areas are evident in the recently completed, high-definition aeromagnetic survey results. The cross-section in Figure 3 shows a good example of a look-a-like magnetic feature immediately southeast of the Southeast deposit. Here, a broad magnetic high anomaly that strengthens with depth is very similar to that present at the Southeast deposit. The top and flanks of this feature are interpreted to be highly prospective for porphyry-related copper and gold mineralization but have yet to be drilled.

NEXT STEPS

Inverted models of the data continue to be refined by Kyle Patterson , P.Geo., of Convolutions Geoscience Corp. Targets continue to be ranked and prioritized ahead of core drilling programs planned for later in the year. In addition, Geotech Ltd. has been contracted to complete an airborne Z-Axis Tipper Electromagnetic ("ZTEM") survey over an area like that covered by the aeromagnetic survey. Targets from the magnetic gradient inversions and the ZTEM survey will be the primary focus for the upcoming drilling programs.

Figure 1 – Woodjam Location Map

Figure 2 – Southeast Deposit Area Plan Map

Figure 3 – Southeast Deposit Cross Section

The Woodjam Project

The 65,252-hectare Woodjam Project is located 55 kilometres east of the community of Williams Lake in an area characterized by a low elevation, flat to gently undulating landscape that is well accessed by logging roads. Geologically, the project is located within the prolific Quesnel Terrane – a large regional depositional belt commonly dominated by alkalic volcanic units and related volcaniclastic lithologies. The Quesnel terrane hosts both alkaline and calc-alkaline porphyry copper+/-gold+/-molybdenum deposits, including the Copper Mountain, New Afton, Highland Valley, Gibraltar , Mount Polley, Mount Milligan and Kemess mines.

To date, six zones of porphyry-related mineralization (Megabuck, Deerhorn, Takom, Three Firs, Southeast, Megaton) have been identified at the Woodjam Project by drilling (95,092 metres in 281 holes since 2009 and a further 114 holes, 30,092 metres predominantly from 1998). These six mineralized zones form a cluster approximately 5 kilometres in diameter.

About Vizsla Copper

Vizsla Copper is a Cu-Au-Mo focused mineral exploration and development company headquartered in Vancouver, Canada . The Company is focused on its flagship Woodjam project, located within the prolific Quesnel Terrane, 55 kilometers east of the community of Williams Lake, British Columbia . It has two additional copper exploration properties, the Blueberry and Carruthers Pass projects, well situated amongst significant infrastructure in British Columbia . The Company's growth strategy is focused on the exploration and development of its copper properties within its portfolio in addition to value accretive acquisitions. Vizsla Copper's vision is to be a responsible copper explorer and developer in the stable mining jurisdiction of British Columbia, Canada and is committed to socially responsible exploration and development, working safely, ethically and with integrity.

Vizsla Copper is a spin-out of Vizsla Silver (TSX.V: VZLA) (NYSE: VZLA) and is backed by Inventa Capital Corp., a premier investment group founded in 2017 with the goal of discovering and funding opportunities in the resource sector. Additional information about the Company is available on SEDAR ( www.sedar.com ) and the Company's website ( www.vizslacopper.com ).

Qualified Person

The Company's disclosure of technical or scientific information in this press release has been reviewed and approved by Ian Borg , P.Geo., Senior Geologist for Vizsla Copper. Mr. Borg is a Qualified Person as defined under the terms of National Instrument 43-101.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS

The information contained herein contains "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future, including, without limitation, planned exploration activities. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof.

Such forward-looking information and statements are based on numerous assumptions, including among others, that the results of planned exploration activities are as anticipated, the anticipated cost of planned exploration activities, that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company's planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves or resources, the limited operating history of the Company, the influence of a large shareholder, aboriginal title and consultation issues, reliance on key management and other personnel, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, availability of third party contractors, availability of equipment and supplies, failure of equipment to operate as anticipated; accidents, effects of weather and other natural phenomena and other risks associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

SOURCE Vizsla Copper Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/April2023/20/c7358.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/April2023/20/c7358.html