- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

July 23, 2024

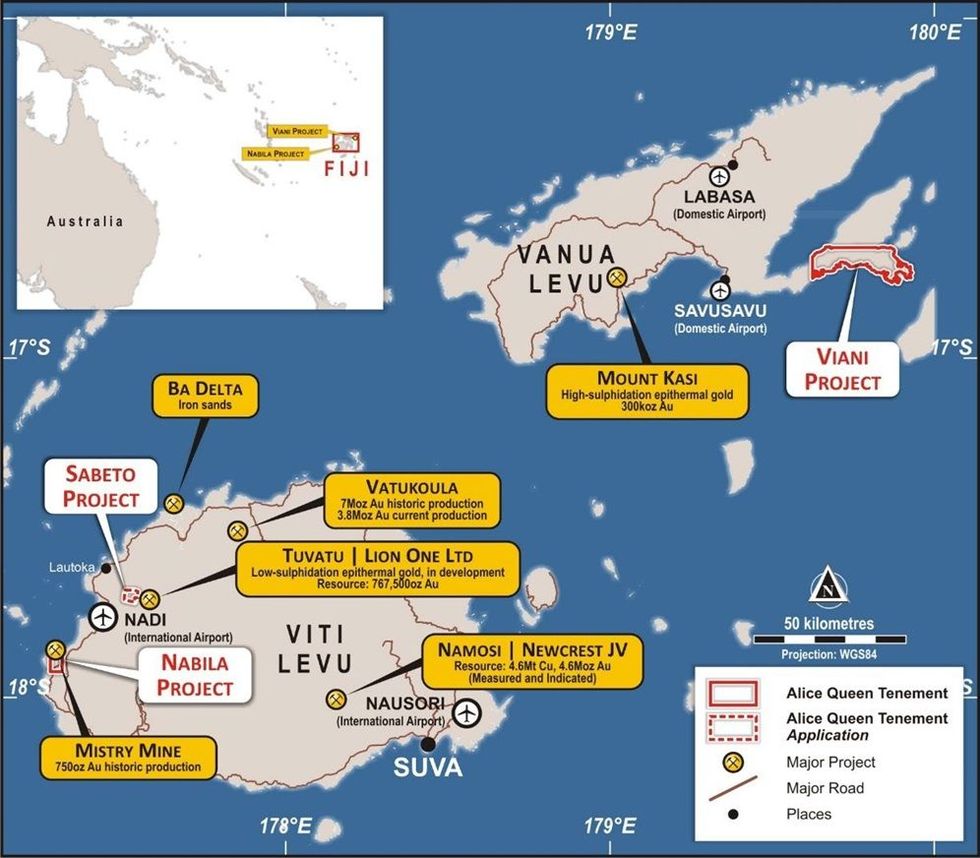

Advanced gold and copper explorer, Alice Queen Limited (ASX:AQX) (Alice Queen or the Company), is pleased to advise that it has received notification from the Mineral Resources Department (MRD) of Fiji that its highly prospective low sulphidation epithermal (LSE) gold project, Viani (SPL1513) located on the Pacific Rim of Fire, on Fiji’s second biggest island Vanua Levu, has been renewed for a further three years, commencing on 3 July 2024.

Highlights

- MRD notified Alice Queen on Friday 19 July 2024 via email that its Viani license (SPL1513) has been renewed for a further three years with effect from Wednesday 3 July 2024.

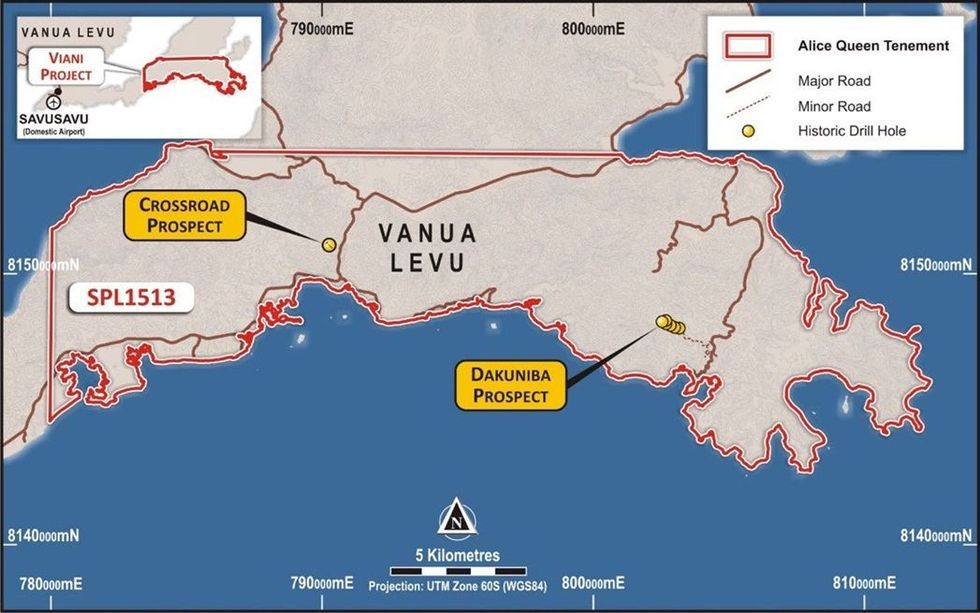

- Viani, located on the Pacific Rim of Fire on Vanua Levu in Fiji, covers an area greater than 200km2 and is largely under explored (see Figures 1 and 2).

- The Dakuniba prospect within Viani has been previously sampled where epithermal gold mineralisation has been recorded in outcrop samples over a >3km strike length.

- Multiple epithermal veins within the Dakuniba prospect area, 5km by 1.5km surface gold-in- soil geochemical anomaly - the footprint of the epithermal mineralisation is comparable to other economically productive gold epithermal deposits globally.

- Previous drilling by Japanese International Cooperation Agency (JICA) in 1997 focused on a small, shallow part of the overall system and intersected high grade epithermal gold mineralisation.

- (Hole MJFV-5 (see Figure 3) over 6 vein zones at 50 to 100m below surface with best results, 0.6m @ 27.6 g/t Au & 900 g/t Ag and 0.4m @ 11.7 g/t Au1 and remains open in all directions.

- The JICA drilling was limited to only 600m of strike-length of the 5km long gold-in-soil anomaly (>10ppb Au) supported by epithermal geochemistry i.e., Ag and As.

- Based on discovery knowledge from epithermal systems worldwide, it is apparent the historical drilling was an inadequate test of the Viani gold system.

Alice Queen’s Managing Director, Andrew Buxton said,

We are delighted the SPL1513 license has been renewed for a further three years and look forward to continuing to work alongside the Fiji Mineral Resources Department as we commence our next phase of exploration activities. The Viani Gold Project is a tremendous prospect which has demonstrated it has the potential to become a significant epithermal system. With the license now renewed and the Company fully funded for its Fiji exploration plans, Alice Queen will continue the systematic exploration of the Viani Gold Project with the Company having commenced planning for its upcoming exploration programs.

Viani

The Viani project (SPL1513) covers an area greater than 200km2 on the Caukadrove Peninsula on the Pacific Rim of Fire, Vanua Levu, Fiji. It is well serviced from Savu Savu on Vanua Levu and is highly prospective for a high-grade LSE gold system (see ASX releases 2 December 2022, “VIANI UPDATE” and 6 March 2023, “ALICE QUEEN UPGRADES VIANI EPITHERMAL PROJECT”.

Following a renewal process for Viani (SPL1513) which the Company commenced earlier this year (including as announced in the Quarterly Activities Report released to ASX on 23 April 2024), MRD notified Alice Queen on Friday 19 July 2024 that the license had been renewed with effect from Wednesday 3 July 2024 for a further three years. The renewed license includes typical terms for a license of this nature, including minimum work program and expenditure requirements.

Whilst the greater project area remains under explored, extensive sampling, trenching and (historic) limited drilling of the Dakuniba prospect area has been previously completed.

Previous drilling by JICA in 1997 returned multiple epithermal gold intersections in shallow drilling. Hole MJFV-5 (see Figure 2) intersected 6 vein zones at 50 to 100m below surface (best results include 0.6m @ 27.6ppm Au & 900ppm Ag, 0.4m @ 11.7ppm Au & 4.3ppm Ag)1. The JICA drilling was limited to only 600m of strike-length of the 5km long gold-in-soil anomaly (>10ppb Au) supported by epithermal geochemistry i.e., Ag and As.

Further details in relation to upcoming exploration plans at Viani will be announced in due course.

Click here for the full ASX Release

This article includes content from Alice Queen Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Alice Queen Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

21 August 2025

Alice Queen

Exploring the Pacific Rim: High-grade epithermal gold and near-term production potential

Exploring the Pacific Rim: High-grade epithermal gold and near-term production potential Keep Reading...

Latest News

Sign up to get your FREE

Alice Queen Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00