- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

July 16, 2023

Belararox Limited (ASX:BRX) (“Belararox” or “the Company”) is pleased to announce that the significant mineralisation observed in the drill core as part of the due diligence process at the TMT project in Argentina (Belararox Limited, 2023.b) is supported by significant assay results that are now considered ‘Exploration Results’ to be reported under the JORC (2012) Code.

Key Highlights

- Key mineralised sections of historical drill core stored in trays were inspected and reviewed in Argentina as part of the Company’s due diligence process in acquiring the project. Mineralisation was observed in diamond core holes ARRLSDD0001, ARRLSDD0002, ARRLSDD0003, & ARRLSDD0004, drilled in 2013 at the project’s Toro target, strongly supporting the potential of the project to contain a significant system rich in base and precious metals (Belararox Limited, 2023.b).

- Significant intercepts from diamond drilling completed in 2013 by Votorantim at the Toro target include:

- ARRLSDD0001 - 266m @ 0.76% Zn, 14.6ppm Ag, 0.05ppm Au, 0.04% Cu & 0.09% Pb from 56m* including:

- 72m @ 1.00% Zn, 12.3ppm Ag, 0.07ppm Au, 0.02% Cu & 0.13% Pb from 56m including:

- 6m @ 3.94% Zn, 52.3ppm Ag, 0.35ppm Au, 0.12% Cu & 0.27% Pb from 56m*;

- 2m @ 8.59% Zn, 112.0ppm Ag, 0.63ppm Au, 0.25% Cu & 0.63% Pb from 58m*;

- 2m @ 3.27% Zn, 34.8ppm Ag, 0.15ppm Au, 0.08% Cu & 0.08% Pb from 126m*.

- 140m @ 0.86% Zn, 20.4ppm Ag, 0.05ppm Au, 0.06% Cu & 0.08% Pb from 182m* including:

- 52m @ 1.02% Zn, 7.0ppm Ag, 0.04ppm Au, 0.01% Cu & 0.09% Pb from 184m*;

- 2m @ 4.41% Zn, 41.0ppm Ag, 0.34ppm Au, 0.05% Cu & 0.12% Pb from 186m*;

- 2m @ 3.33% Zn, 9.1ppm Ag, 0.07ppm Au, 0.03% Cu & 0.08% Pb from 220m*;

- 16m @ 1.29% Zn, 11.2ppm Ag, 0.07ppm Au, 0.03% Cu & 0.08% Pb from 268m*.

- 10m @ 1.19% Zn, 53.7ppm Ag, 0.17ppm Au, 0.40% Cu & 0.03% Pb from 318m*.

- 2m @ 1.16% Zn, 7.7ppm Ag, 0.04ppm Au, 0.04% Cu & 0.22% Pb from 56m*.

- 72m @ 1.00% Zn, 12.3ppm Ag, 0.07ppm Au, 0.02% Cu & 0.13% Pb from 56m including:

- o ARRLSDD0003 – 22m @ 1.25% Zn, 41.2ppm Ag, 0.31ppm Au, 0.24% Cu & 0.27% Pb from 10m* including:

- 6m @ 1.72% Zn, 135.9ppm Ag, 1.00ppm Au, 0.80% Cu & 0.78% Pb from 10m*.

- ARRLSDD0001 - 266m @ 0.76% Zn, 14.6ppm Ag, 0.05ppm Au, 0.04% Cu & 0.09% Pb from 56m* including:

*Intersection calculated using Below Detection Limit(s) (BDL) of 0.50 ppm Ag & 0.005 ppm. Note: all Cu, Pb & Zn values exceed BDL

- Significant rock chip assays from 133 samples collected by Votorantim across multiple locations at the Toro target, produced an average grade of: 0.84% Zn, 81ppm Ag, 0.11ppm Au, 0.10% Cu, & 0.58% Pb. Note: Any samples that resulted in a BDL were excluded from the averaging calculation. With peak assay values of: 13.30% Zn, 1,980ppm Ag, 2.56ppm Au, 1.90% Cu, & 12.1% Pb

- Significant intercepts from the Sonoma drill holes completed in 1996/1997 at the Toro target include:

- T1-D – which included:

- 24m @ 2.4% Zn, 38.8ppm Ag, 0.18ppm Au & 0.07% Cu from 24m;

- 60m @ 2.4% Zn, 118ppm Ag, 0.32ppm Au & 0.28% Cu from 114m.

- T1-R – 29m @ 1.7% Zn, 24.0ppm Ag, & 0.11ppm Au from 17m.

- T3-D – 18m @ 0.9% Zn, 74.5ppm Ag, 0.13ppm Au & 0.08% Cu from 125m.

- T5-R – 32m @ 1.4% Zn, 30.3ppm Ag & 0.11ppm Au from 19m including:

- C6m @ 6% Zn, 136.5ppm Ag, 0.2ppm Au & 0.2% Cu from 34m.

- T5-R – 75m @ 0.7% Zn, & 11.4ppm Ag from 69m.

- T5-R – 45m @ 1.0% Zn, & 15.0ppm Ag & from 237m.

- T1-D – which included:

Cautionary Statement: The intercepts from the 1996-1997 Sonoma Resource Development Argentina S.A. Diamond Drilling (“DD”) and Reverse Circulation (“RC”) drilling campaign are suitable for the reporting of ‘Exploration Results’ for mineral prospectivity, further exploration work would be needed to produce a ‘Mineral Resource’.

Managing Director, Arvind Misra, commented:

“Prior to acquiring the Toro-Mambo-Tambo project our due diligence identified historic core drill results undertaken at the southern end of the property. We believed these finds added credence to our belief that the property is highly prospective for zinc, an in-demand base metals used in a wide range of clean energy processes.

With the historic drilling results brought up to JORC 2012 code compliance, we are able to confidently disclose these ‘Exploration Results’ to the market. While we still have work to do before we can produce a ‘Mineral Resource Estimate’ at the TMT Project, these strong ‘Exploration Results’ add to the mounting evidence that the TMT Project is a game-changing acquisition for Belararox.”

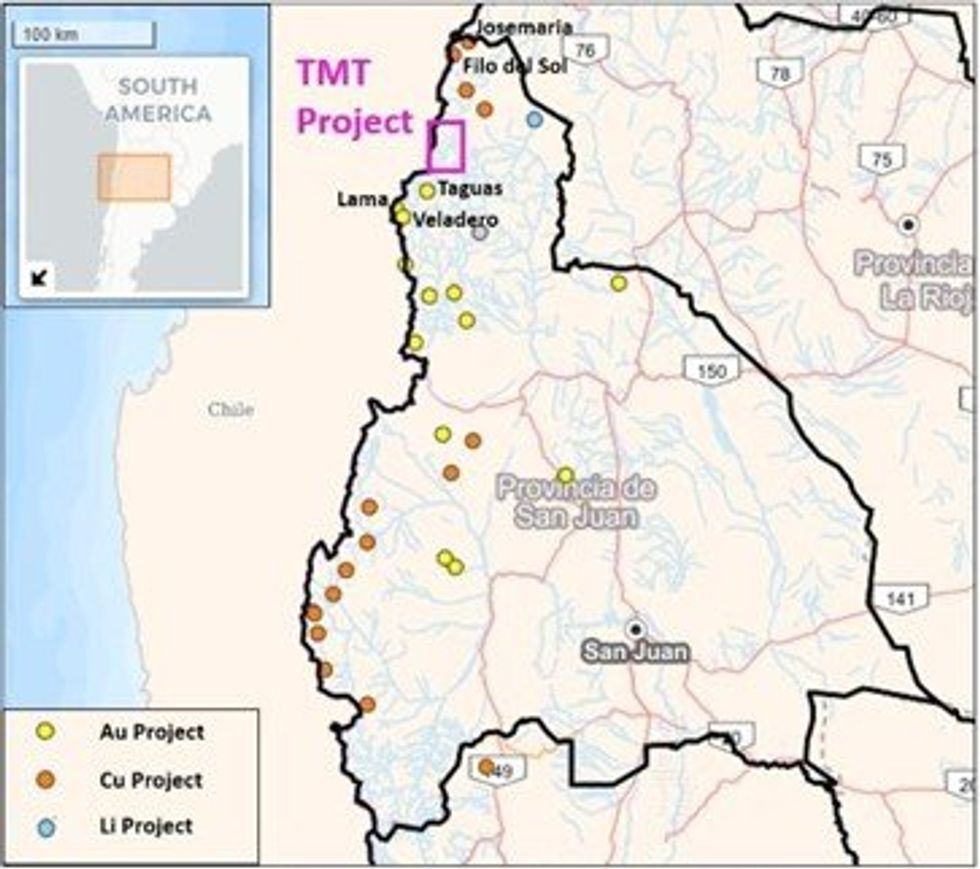

Toro – Malambo – Tambo (“TMT”) Project

Toro Target – Exploration Results reported to the JORC (2012) Code

The Toro target in the south of the TMT project had been the focus of historical exploration activities completed by Sonoma Resource Development Argentina SA (“Sonoma”) during 1995-1999 and Votorantim Metais Argentina S.A. (“Votorantim”) during 2012-2014.

Drill core from historical diamond drill holes ARRLSDD0001, ARRLSDD0002, ARRLSDD0003, and ARRLSDD0004, was inspected in Argentina by the Belararox Team, with logistical and onsite support provided by the Condor Prospecting SA Exploration Team. Mineralisation observed in the due diligence process strongly supports the potential of the project to contain a significant system rich in base and precious metals (Belararox Limited, 2023.b).

The Toro target has been divided into a North Zone where intense hydrothermal argillic alteration is observed and Central and South Zones – also exhibiting intense hydrothermal alteration – where the bulk of historical exploration was focused. This announcement focuses on the verified drill core information for ARRLSDD0001, ARRLSDD0002, ARRLSDD0003, & ARRLSDD0004 with the Due Diligence site visit providing the opportunity to physically verify additional results of historical drilling and exploration activities at the Toro target (Belararox Limited, 2023.b).

Post completion of the due diligence process, the Toro target ‘Exploration Results’ have been verified in order to be reported to the JORC (2012) Code by a team of Professionals led by Jason Ward. The current ASX Release displays these Exploration Results as having been reported to the JORC (2012) Code.

Toro Target - Historical Geochemistry

Through the Company’s data validation process, records of historical surface samples over the Toro Target’s Central and Southern Zones were examined. A total of 133 rock chip samples supported the delineation of distinct zones of significant mineralisation. The samples were collected by Votorantim during 2013/2014 and subsequently submitted to ALS Laboratories Mendoza for assay preparation and then to ALS Laboratories Lima in Peru for assay.

From the rock chip sample data available it appears the surface sampling assay results were significant and encouraging. Across the group of rock chip samples, individual samples produced assay grades that ranged up to 13.3% zinc, 12.1% lead, 2.56 ppm gold, 1.9% copper and 1,980ppm silver. When excluding samples that assayed below the detection limit the 133 samples averaged grades of 0.84% zinc, 0.58% lead, 0.11ppm gold, 0.10% copper and 81ppm silver.

Rock chip sampling at the Toro target strongly indicates the presence of potentially economic zinc mineralisation, appearing most prevalent in the Central Zone. Geological maps with the assay values for zinc, copper and gold at the Toro Target are presented in Figure 2, respectively. Mapped assay values for silver, arsenic, molybdenum, lead and tin are presented within Appendix E in Figure 11, Figure 13, Figure 14, Figure 16, Figure 15, Figure 18 and Figure 17, respectively.

Click here for the full ASX Release

This article includes content from Belararox Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BRX:AU

The Conversation (0)

14 September 2023

Belararox Limited

Developing Precious and Base Metal Assets to Meet Future Demand

Developing Precious and Base Metal Assets to Meet Future Demand Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00