Tintina Mines Limited ("Tintina" or the "Company") (TSXV: TTS,OTC:TNNTF) is pleased to announce the completion of its 2025 drilling campaign at the Domeyko Sulfuros Project, located in the Atacama Region, Chile. The primary objective of the campaign was to upgrade the Inferred Resources reported in January 2025 NI 43-101, and to support the development of a Preliminary Economic Assessment (PEA) in accordance with NI 43-101 standards, reinforcing the Company's commitment to the technical and strategic development of this asset.

Preliminary drill results confirm the resource and demonstrate the potential to expand the deposit both to the northwest and at depth. Geometallurgical tests conducted during this phase indicate good copper liberation, low pyrite association, and favorable metallurgical recoveries, validating the technical potential of the ore under operating conditions.

Drilling Campaign

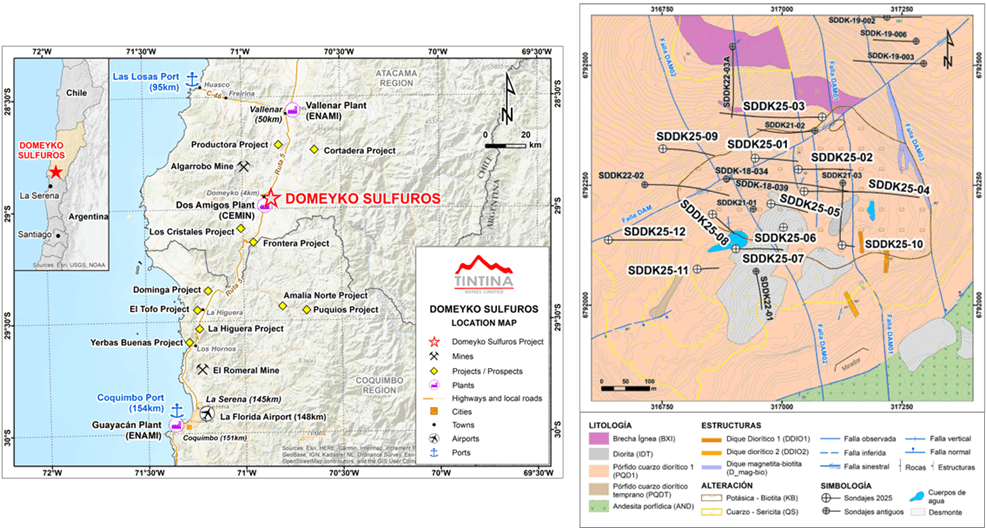

The 2025 Domeyko Sulfuros drilling campaign included 12 diamond drill holes, totaling 5,810 meters (Figure 1). This campaign provided key information for updating the 3D geological models, as well as collecting geotechnical data and core samples for geomechanical testing.

The updated resource estimate is expected in September, while complete Cu-Au assay results will be available by the end of August. Currently, 20% of the geochemical results have been received. Some of the main intercepts in quartz-diorite porphyry are shown in Table 1.

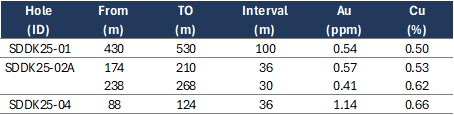

Table 1. Partial intercept results from the 2025 drilling program.

Figure 1. Location map of the Domeyko Sulfuros Project and drill hole locations executed in 2025.

Geometallurgical Test Results

Mineralogical results confirmed that chalcopyrite (Cpy) is the primary copper-bearing mineral, with high liberation and low association with pyrite (Py), while gold occurs mainly as native gold and electrum, with fine particles (

Comminution tests indicated low ore abrasiveness (low Ai), medium to hard hardness in primary grinding (SMC, SPI), and soft to medium hardness in secondary grinding (BWi), supporting the design of a conventional grinding circuit. In rougher flotation, five-stage kinetic tests yielded average recoveries of 92.6% Cu and 74.9% Au at P80 = 150 µm. No significant differences were observed between seawater and freshwater use.

Preliminary Economic Assessment (PEA)

For PEA development, Andean Belt Resources engaged SRK Consulting, a firm with extensive experience in mining and economic studies. SRK will be responsible for resource estimation, cost estimation, generation of economic scenarios, and sensitivity analysis. Additionally, SRK will provide technical support to Andean Belt Resources throughout the process, including periodic technical meetings, financial model reviews, and guidance on key parameters. This collaborative work will continue until the official delivery of the final report, scheduled for December 2025.

Qualified Person

The scientific and technical content of this news release has been reviewed and approved by Mr. José Luis Bello Soto, Mining Resources and Development Manager, CEMIN Holding Minero, a geologist with more than 26 years of experience, registered member of the "Comision Minera" (Chilean Mining Commission; Reg N°. 460), as well a member of the Colegio de Geólogos de Chile, a "qualified person" as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"). The QP confirms he has visited the project area, has reviewed relevant project information, is responsible for the information contained in this news release, and consents to its publication.

About Tintina Mines Limited

Tintina Mines is a Canadian-based company with over two decades of experience in the junior mining sector, focused in the acquisition, exploration, and development of base and precious metal properties in South America and Canada. Recently, Tintina expanded its portfolio with the addition of five new projects in Chile, following the acquisition of a majority stake in Andean Belt Resources. Tintina is committed to advancing the exploration and development of the copper-gold (Cu-Au) Domeyko Sulfuros Project in the Atacama Region of northern Chile. Tintina Mines Limited's common shares are listed on the TSXV under the symbol TTS.

For further information about Tintina Mines Ltd., please contact:

contact@tintinamines.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statements

This press release contains forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and assumptions and accordingly, actual results and future events could differ materially from those expressed or implied in such statements. You are hence cautioned not to place undue reliance on forward-looking statements. All statements other than statements of present or historical fact are forward-looking statements. Forward-looking statements include words or expressions such as "proposed", "will", "subject to", "near future", "in the event", "would", "expect", "prepared to" and other similar words or expressions. The forward-looking statements in this press release include, but are not limited to, statements regarding the Company's future operational goals and strategies. Where the Company expresses or implies an expectation or belief as to future events or results, such expectation or belief is based on assumptions made in good faith and believed to have a reasonable basis. Such assumptions include, without limitation: that the Company will be able to execute on its intended business plans and strategies; that the Company will be able to conduct its intended exploration plans on its recently-acquired property; and that the Company will be able to repay existing debt on the terms described herein or at all.

Factors that could cause future results or events to differ materially from current expectations expressed or implied by the forward-looking statements include: general business, economic, competitive, political and social uncertainties; the state of capital markets; failure to realize the anticipated benefits of the recent property acquisition described herein; risks related to the mining industry generally; other unforeseen events, developments, or factors causing any of the aforesaid expectations, assumptions, and other factors ultimately being inaccurate or irrelevant; and any risks associated with the ongoing COVID-19 pandemic. You can find further information with respect to these and other risks in filings made with the Canadian securities regulatory authorities that are available at www.sedarplus.ca. The Company disclaims any obligation to update or revise these forward-looking statements, except as required by applicable law.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/cfa60fa5-5a95-46e4-ba61-44e45307c28e

https://www.globenewswire.com/NewsRoom/AttachmentNg/9d6b01aa-edd0-4050-a257-0751da41749e