December 07, 2023

Queensland Pacific Metals Limited (ASX:QPM) ) (“QPM” or “the Company”) is pleased to present an update on the completion of the successful operation of the HPA Demonstration Plant in conjunction with partners Lava Blue.

Highlights

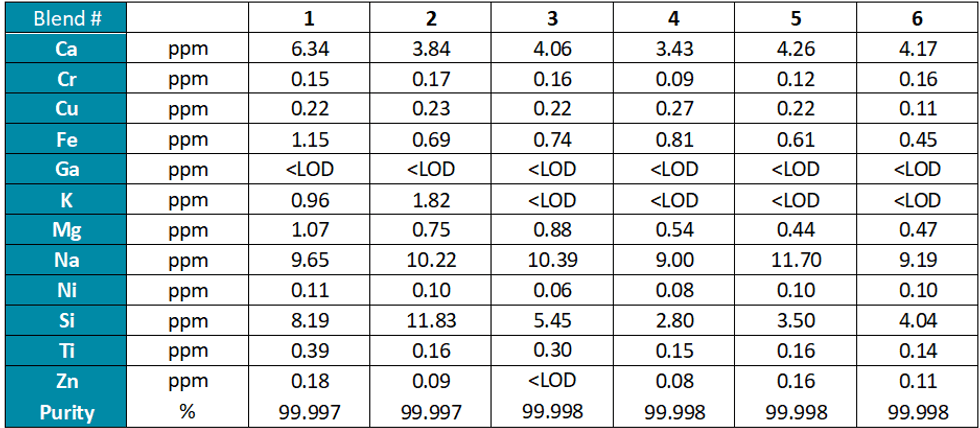

- 62 kg >99.99% High Purity Alumina (“4N HPA”) produced from Lava Blue Demonstration Plant.

- Average purity across blends approaching 5N (99.999%), far exceeding the 4N threshold.

- 6 x ~10 kg 4N HPA blends have been transported to the United States to provide to potential offtakers.

- Initial target offtakers are from the LED market

Demonstration Plant

QPM and Lava Blue have recently completed the first campaign of HPA Demonstration Plant operation, which successfully produced 62 kg of 4N HPA. The two primary objectives of this technical work have been well and truly met, being:

- Confirmation of HPA flowsheet for the TECH Project; and

- Production of samples for offtake marketing purposes.

HPA produced from the Demonstration Plant has been split into six ~10 kg blends and have been transported to the USA. The blends have been assayed and results have far exceeded 4N purity.

QPM’s technical and marketing team have been working closely with a specialised US consultant in identifying potential offtakers. The initial focus has been on the LED market (sapphire glass). The blends will be provided to potential offtakers for testing.

Click here for the full ASX Release

This article includes content from Queensland Pacific Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

QPM:AU

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

20 April 2022

Queensland Pacific Metals

Developing a Sustainable and High-Purity Battery Materials Refinery Project

Developing a Sustainable and High-Purity Battery Materials Refinery Project Keep Reading...

Keep reading...Show less

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

19 December 2025

Nickel Price 2025 Year-End Review

After peaking above US$20,000 per metric ton (MT) in May 2024, nickel prices have trended steadily down. Behind the numbers is persistent oversupply driven by high output from Indonesia, the world’s largest nickel producer. At the same time, demand from China's manufacturing and construction... Keep Reading...

Latest News

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00