Investor Insight

Halcones Precious Metals offers investors exposure to a high-grade gold exploration opportunity in mining-friendly Chile, with multiple surface targets showing significant gold values on a large underexplored property that benefits from excellent infrastructure.

Overview

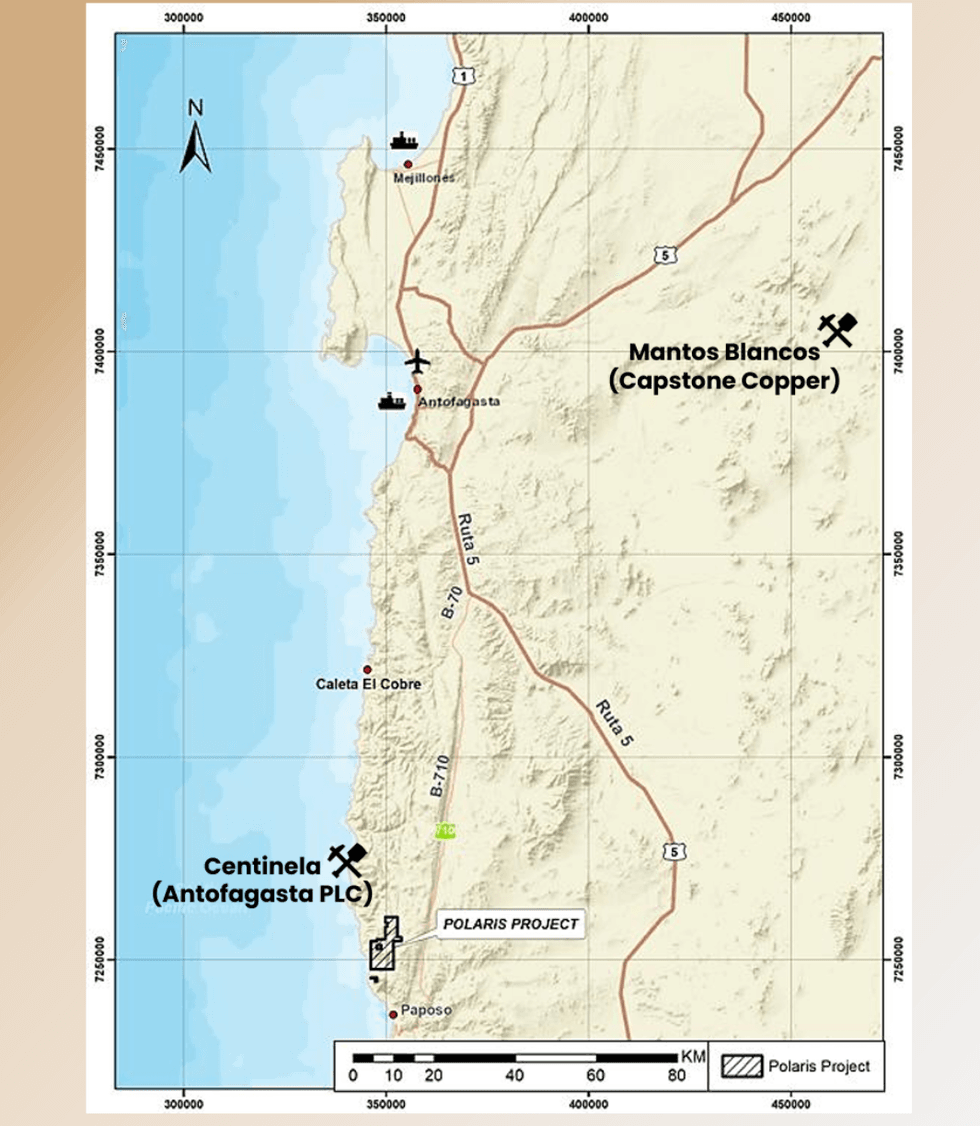

Halcones Precious Metals (TSXV:HPM) is an emerging gold exploration company with a strategic focus on developing high-potential precious metals projects in Chile. The company's flagship Polaris project is located in the prolific mining region of northern Chile, approximately 150 km south of Antofagasta and 70 km north of Taltal.

Chile is one of the world's premier mining jurisdictions, known for its stable regulatory framework, developed infrastructure, and rich mineral endowment. The country is the world's largest copper producer and has a long history of successful mining operations by both major and junior companies. Chile's mining-friendly policies, skilled workforce, and established support services make it an attractive destination for mineral exploration and development.

The gold market is currently experiencing favorable macroeconomic tailwinds. Persistent global inflation concerns, geopolitical uncertainties, and central bank gold purchasing have pushed gold prices to record levels in 2025. As investors seek safe-haven assets amid economic volatility, gold exploration companies with promising early-stage assets like Halcones are well-positioned to capitalize on these market conditions.

Company Highlights

- Strategic Land Position: Controls 5,777.5 hectares in a historically productive gold district with multiple high-grade surface targets

- Proven High-grade Gold at Surface: 30 samples returned assays above 10 g/t gold, with values up to 55 g/t gold

- Large Mineralized Footprint: Recent sampling extended the gold-bearing trend to 3.9 km, with potential for further expansion

- Bulk Tonnage Potential: Gold-bearing stockwork mapped over a 250 m x 500 m area, suggesting potential for a large-scale open-pit operation

- Favorable Project Economics: Low-to-moderate elevation project with year-round access and proximity to established infrastructure

- Experienced Leadership: Management team with extensive experience in geology, mining exploration, and capital markets

- Geological Setting: Mineralization similar to well-known Abitibi gold deposits like Sigma-Lamaque, Goldex and Dome

Key Project: Polaris

The Polaris project is Halcones' flagship asset located in Chile's Coastal Belt, a region known for its significant mining history and mineral potential. The 5,777.5-hectare property is easily accessible via the Pan-American Highway and Route B-710, situated only 4 km from the Pacific Ocean. This strategic location provides exceptional logistical advantages, including proximity to the major mining center of Antofagasta, the ports of Antofagasta and Mejillones, and established power infrastructure.

The project is situated within the metallogenic belt of the Atacama Fault Zone, a major geological structure that hosts numerous significant mineral deposits throughout Chile. Mineralization at Polaris is primarily controlled by major faults, including the Izcuña Fault and Médano Fault, which created open spaces for mineralizing fluids, resulting in vein-hosted and stockwork gold mineralization.

Currently, exploration efforts are focused on two main target areas in the southern part of the property adjacent to the Atacama fault:

- North Zone: A historic mining district with excellent gold assay results at surface

- South Zone: Another area of historic mining activity with high-grade gold values

Historical mining at Polaris dates back to the early 20th century, when artisanal miners extracted high-grade gold from quartz veins and breccias. In the 1970s, smaller operations by local miners extracted approximately 5 tons of material per month over a decade. Despite this history of production, the property has never been systematically explored using modern techniques.

Recent surface sampling programs have significantly expanded the known mineralized footprint, extending the gold-bearing trend to 3.9 km with potential extensions of 2 km north and 1.5 km south. Chip channel samples have returned impressive values including 29.04, 20.05, 13.08, and 10.67 grams per ton (g/t) gold. The gold mineralization is strongly related to diorite rocks and quartz veins, with extensive stockwork veining indicating a well-developed system.

A particularly promising aspect of the Polaris project is the potential for bulk-minable stockwork mineralization. Gold-bearing stockwork has been mapped over a 250 m x 500 m area, with unknown limits. Initial surface sampling returned encouraging results, including an 85-meter channel sample averaging 1.21 g/t gold and a 30-meter sample in an old adit averaging 1.02 g/t gold.

The geological setting at Polaris is analogous to certain well-known Abitibi gold deposits such as Sigma-Lamaque, Dome and Goldex. Like these deposits, Polaris is:

- Adjacent to a large, long-lived and active continental-scale crustal break

- Host to historic high-grade mining focused on larger quartz veins at surface

- Characterized by a large surface expression of highly anomalous gold mineralization

- Potentially amenable to both high-grade selective mining and bulk tonnage approaches

With most of the large property remaining unexplored, Halcones is committed to an aggressive exploration program, including plans to complete 2,000 meters of drilling within 12 months as part of its acquisition commitments. The near-surface nature of the mineralization suggests potential for cost-effective open-pit mining if sufficient resources are delineated.

Management Team

Ian Parkinson - CEO and Director

Ian Parkinson brings a unique combination of industry and capital markets experience to Halcones. He spent 16 years as a sell-side mining analyst for several leading brokerage firms including Stifel GMP, GMP Securities, and CIBC World Markets. Prior to his analyst career, he worked for 10 years with Falconbridge and Noranda in various roles spanning exploration, development, metals trading, marketing, and business development. Parkinson holds an earth science degree from Laurentian University in Sudbury, Ontario.

Vern Arseneau - COO and Director

Vern Arseneau has over 40 years of experience in exploration, project management and development, with the last 25 focused in South America, particularly Peru, Chile and Argentina. He spent 20 years working as exploration manager and senior geologist for Noranda and served as general manager of Noranda's Peru office. As vice-president exploration for Zincore Metals, he oversaw exploration and feasibility studies of two zinc deposits and discovered the Dolores copper-molybdenum porphyry in Peru. Arseneau holds a Bachelor of Science in geology.

Greg Duras - CFO

Greg Duras is a senior executive with over 20 years of experience in the resource sector, specializing in corporate development, financial management, and cost control. He has held CFO positions at several publicly traded companies, including Savary Gold, Nordic Gold and Avion Gold. Currently, he also serves as CFO of Red Pine Exploration. Duras is a certified general accountant and a certified professional accountant with a Bachelor of Administration from Lakehead University.

Larry Guy - Chairman

Larry Guy is a managing director with Next Edge Capital focused on strategic partnerships, initiatives, and new product development. His previous roles include vice-president with Purpose Investments and portfolio manager with Aston Hill Financial. He also co-founded Navina Asset Management, where he served as chief financial officer and director before the company was acquired by Aston Hill Financial. Guy holds a BA in Economics from the Western University and is a chartered financial analyst.

Patrizia Ferrarese - Director

Patrizia Ferrarese brings over 20 years of experience in capital markets, entrepreneurship and strategy consulting to the board. Currently VP of business design and innovation at Investment Planning Counsel, she oversees strategic growth initiatives in wealth management. Her career includes equity and options market making and trading in North America and co-founding an investment management company. Ferrarese is pursuing her Doctorate in Business Administration at SDA Bocconi and holds an MBA from Wilfrid Laurier University and a Bachelor of Arts (Honours) in Economics from York University.

Michael Shuh - Director

Michael Shuh is a managing director of investment banking at Canaccord Genuity with over 20 years of experience. He leads the Financial Institutions Group at Canaccord Genuity, Canada's largest independent investment bank, and has deep expertise in structured finance and special purpose acquisition corporations. He serves as CEO and chairman of Canaccord Genuity Growth II, a publicly-listed SPAC that raised $100 million to pursue acquisitions. Shuh holds an Honours Bachelor of Business Administration from the Lazaridis School of Business & Economics at Wilfrid Laurier University and an MBA from the Richard Ivey School of Business at Western University.

Ben Bowen - Director

Ben Bowen has 20 years of experience building businesses across multiple sectors. After beginning his career with Xerox Canada, he acquired Seaway Document Solutions in 2002, which was subsequently sold in 2013. He later co-founded and served as CEO of a software company serving the global shared workspace industry. Bowen currently operates Open Door Media, a full-stack marketing firm focused on the lifestyle industry, and is a founder of Innovate Kingston.

Damian Lopez - Corporate Secretary

Damian Lopez is a corporate securities lawyer who works as a legal consultant to various TSX and TSX Venture Exchange listed companies. He previously worked as a securities and merger & acquisitions lawyer at a large Toronto corporate legal firm, where he worked on a variety of corporate and commercial transactions. Lopez obtained a Juris Doctor from Osgoode Hall and received a Bachelor of Commerce with a major in Economics from Rotman Commerce at the University of Toronto.