Investor Insight

Adjacent to Hudbay’s Copper Mountain mine (700 Mt reserve) and just 1.5 km from the mine’s deposits, Canada One’s Copper Dome project is in British Columbia’s Quesnel porphyry belt. With five-year drill permits secured and porphyry cluster-style mineralization targets currently being evaluated, the project is positioned for near-term catalysts. Committed to avoiding dilutive financing below $0.10, the company is self-funding to maintain the project until market conditions improve, aligning management with shareholders. Year-round road access, grid power and proximity to Vancouver reduce costs and accelerate timelines. Historical results show high-grade copper with gold and silver credits, and modern four-acid digestion assays are expected to capture stronger grades than legacy methods.

Overview

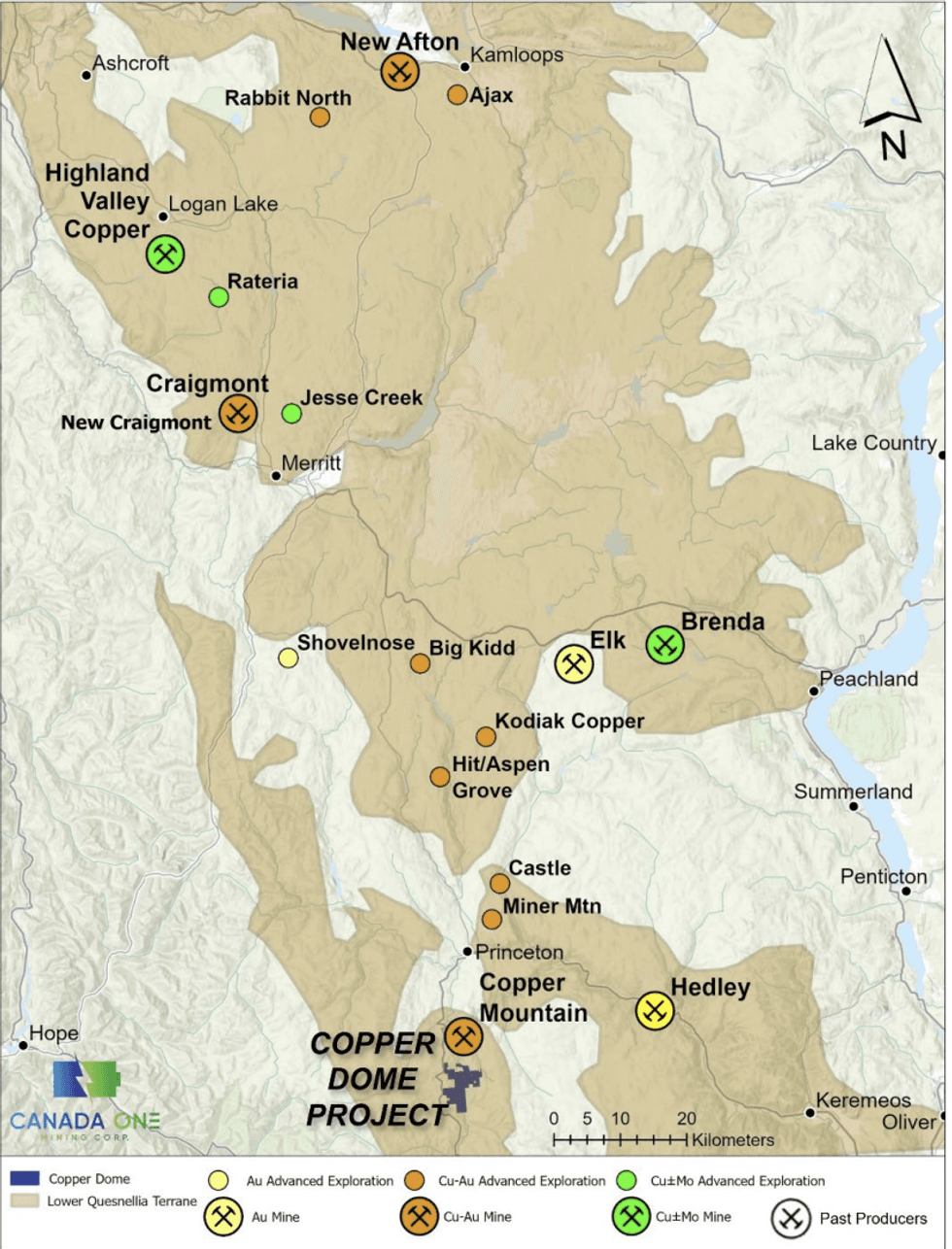

Canada One Mining (TSXV:CONE, OTC:COMCF, FSE:AU31) is an emerging exploration company focused on one of Canada’s most prolific critical mineral belts, the Quesnel porphyry belt. The flagship Copper Dome project, adjacent to the producing Copper Mountain mine, is a brownfield porphyry copper style system with excellent discovery potential. The proximity to Copper Mountain, a 45,000 t/day operation with reserves of 702 million tons (Mt) at 0.24 percent copper, 0.09 grams per ton (g/t) gold, and 0.72 g/t silver, provides both geological credibility and infrastructure advantages.

The company’s technical team believes the porphyry-style mineralization at Copper Mountain extends to the Copper Dome property, supported by alteration patterns, historical drilling and sampling that have already identified multiple copper-gold anomalies on the property.

Backed by an experienced management team and advisory board that includes proven mine builders and corporate developers, Canada One is advancing its assets with a disciplined, results-driven approach. The combination of tier-one jurisdictions and district-scale geology provides investors with a potential for asymmetric upside in an environment of growing global copper demand.

Company Highlights

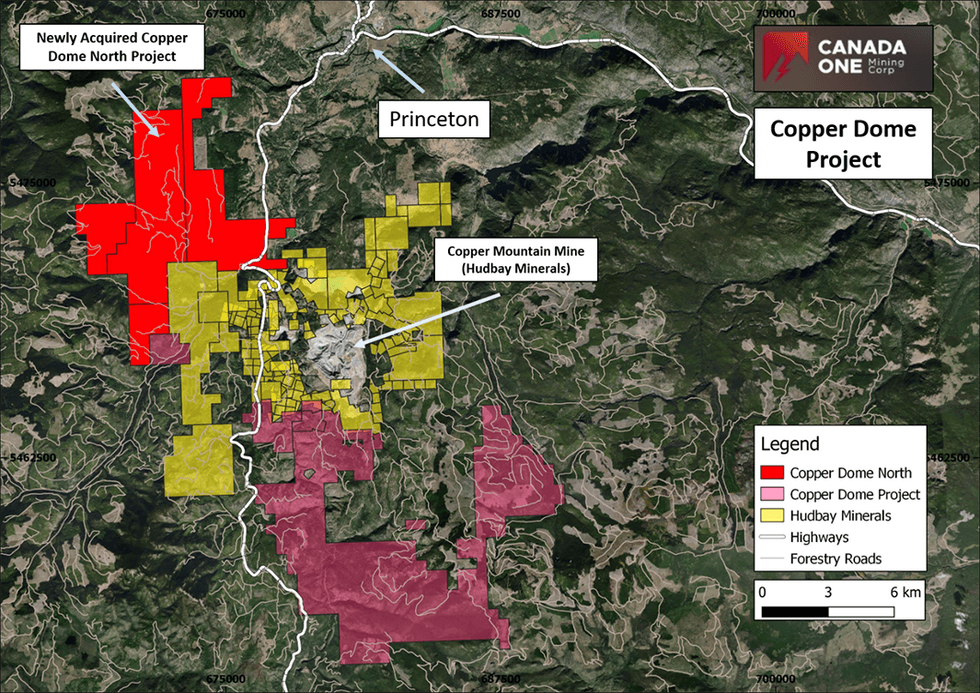

- Flagship Copper Project in Tier-1 Jurisdiction: 12,800 ha Copper Dome land package, adjacent to Hudbay’s Copper Mountain mine, one of Canada’s most prominent copper operations.

- Discovery Thesis: Porphyry cluster-style deposit potential; Copper Mountain deposit analogs average ~150 to 200 Mt.

- Logistics Advantage: Year-round access, no camp/helicopters; 3 to 3.5 hrs from Vancouver; pine-beetle-thinned cover aids access.

- Technical Uplift: Transitioning to four-acid digestion (industry standard) vs. the historical three-acid will, on average, return materially high metal values especially where minerals are more resistant to dissolution.

- Near-term Catalysts: Five-year drill permits in place; upcoming geophysics, geochemistry and drill programs across multiple porphyry copper/gold zones.

- Multiple Assets in Canada: In addition to Copper Dome, Canada One’s other exploration assets include the historical small-scale, past-producing Goldrop property and the Zeus gold project.

- Valuation Upside: Market cap just below C$3 million provides significant leverage to discovery and exploration success.

- Capital Strategy: Management will not finance below $0.10; interim self-funding to minimize dilution.

- Experienced Leadership: Management team is supported by resource veterans such as Dave Anthony, head of the company’s advisory board, past COO of Barrick Africa and current CEO of Assante Gold Corporation (TSX:ASE) with a $1.7 billion market capitalization.

Key Project

Copper Dome Project

The flagship Copper Dome project is a 12,800-hectare, 100-percent-owned land package adjacent to the south of Hudbay Minerals’ Copper Mountain mine, about 1.5 km away from the mine’s deposits. Located just 18 km south of Princeton, BC and within a three-hour drive from Vancouver, Copper Dome benefits from year-round road access, grid power, water supply and local services including lodging in Princeton, requiring no camp or helicopters. The project lies within the lower portion of the Quesnel porphyry belt, one of Canada’s most prolific porphyry copper belts. With a fully permitted, five-year drill program in place, Copper Dome provides significant opportunities for near-term exploration and game-changing catalysts.

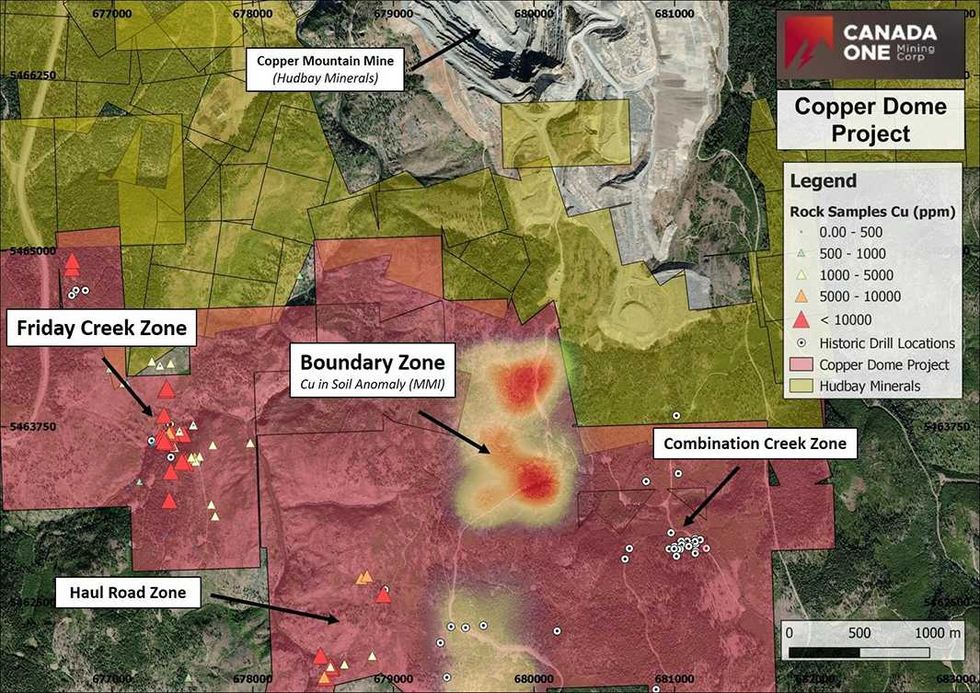

Copper Dome hosts at least two classic alkalic copper porphyry style systems, exhibiting strong geological similarities to Copper Mountain, where deposits average ~150 to 200 Mt. Copper Dome aims to test drill for mineralization of comparable scale. NE-trending structural controls, alteration halos and mineralization styles are directly analogous. Historic drilling shows a high intercept hit rate, and the maiden drill program will prioritize long intervals over isolated mineralized hits. While historic work used three-acid digestion, current work will use four-acid to better capture total copper, gold and silver returns.

Exploration zones at Copper Dome include:

- Boundary Zone: A 1 km x 2 km high-priority target defined by MMI geochemistry, returning copper values up to 40,000 parts per billion. Anomalies in this zone are of similar footprint to Copper Mountain’s Pit 1 and Pit 2 deposits. Infill MMI surveys, drone magnetics and induced polarization (IP) are planned to refine drill targets.

- South Zone: Geochemical and IP surveys suggest a buried copper-gold porphyry style system surrounded by pyritization. Copper and gold anomalies coincide with geophysical signatures, reinforcing its potential as a priority porphyry target.

- Other Targets: Friday Creek, Combination Creek, Haul Road and Orb Zone each show historical drilling or geophysical signatures consistent with porphyry-style systems. The northern border of Copper Dome lies just 1.5 km from Copper Mountain’s pits.

Given that Copper Mountain’s porphyry deposits occur in clusters, Canada One believes Copper Dome could potentially host cluster-style mineralization of similar scale to Copper Mountain (where deposits range between 150 to 200 Mt).

Key Management

Peter D. Berdusco – CEO, Interim CFO and President

Peter Berdusco brings over 20 years of executive experience in natural resources, corporate development and finance. He has led multiple public companies through reverse takeovers, acquisitions and listings, with projects spanning Africa, South America, the US and Canada. His expertise lies in structuring deals, capital raising and steering junior exploration companies through growth phases.

Dave Anthony – Head of Advisory Board

Dave Anthony brings 40+ years of mine project development and operations experience. He served as COO of African Barrick Gold, has worked across Canada, Africa, Ecuador, Brazil, Indonesia, Chile and Argentina, and has designed, delivered, and operated both open-pit and underground mines. He was COO of Cardinal Resources, which was acquired by Shandong Gold for AU$565 million, and is currently CEO of Asante Gold Corporation (TSXV:ASE), with a market capitalization of ~C$1.7 billion (as of Oct 2025).

Peter Holbek – Head Technical Advisor

Peter Holbek is a founding member of Copper Mountain Mining, whose Copper Mountain property is contiguous with the company’s Copper Dome project. He served as vice-president, exploration at Copper Mountain from 2006 to 2022, leading programs across discovery, resource definition and mine development. With 40+ years of experience in geology, mineral exploration, resource estimation and project execution, he has directed exploration that led to the discovery and/or development of copper-gold porphyry deposits. He has also authored numerous peer-reviewed papers on a range of deposit types, contributing practical insight and scholarly depth to the field.

Edward Rochette – Acquisition

Edward Rochette is the former senior vice-president of Ivanhoe Mining, with 25+ years’ experience negotiating and acquiring projects in more than 35 countries. He led or was responsible for the acquisitions of Monywa Copper, Bong Mieu gold mine, Bakyrchik gold mine and the Miwah gold project. He also consolidated and reopened the Cripple Creek mining district, now owned by Newmont and host to a ~13 Moz gold reserve. He currently serves as a consultant to Robert Friedland, founder and executive co-chairman of Ivanhoe Mines.

Dean Bertram – Exploration

A geologist with more than 35 years of global exploration experience, Dean Bertram currently also serves as VP exploration at Asante Gold. He has led exploration teams across West Africa and Australia and now oversees Canada One’s geology programs. His experience in porphyry and orogenic gold systems is instrumental in guiding exploration at Copper Dome.

David Mark – Geoscientist

David Mark has over 50 years of experience in geophysics and mineral exploration across North America, South America, Europe and Asia. He is recognized for his work in IP, EM and MMI surveys and operates Geotronics Consulting. A University of British Columbia-trained geophysicist, he provides technical leadership on geophysics for Canada One’s exploration programs.