3 Biggest US Silver Miners in 2026

Overview

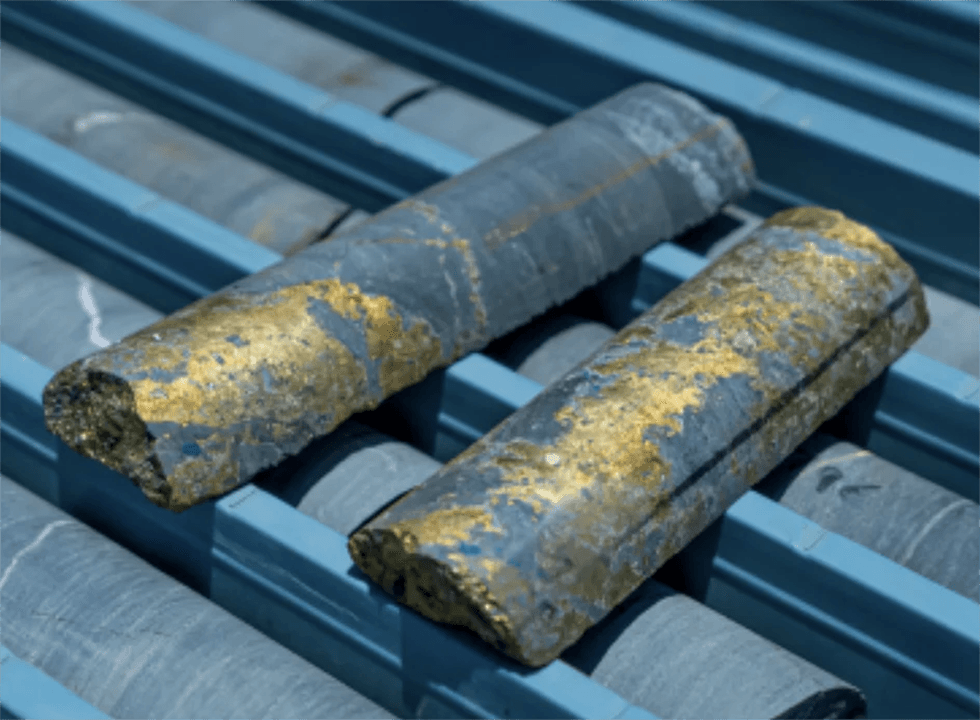

Galena Mining Limited (ASX:G1A, Galena) owns 60 percent of the Abra base metals mine located in the Gascoyne region of Western Australia - home to one of the largest lead and silver deposits in the world, set to produce the highest-grade, cleanest lead concentrate available globally. The company is capitalizing on its Tier 1 asset in a Tier 1 jurisdiction, strengthened by and leveraging partnerships with Japan's largest zinc and lead smelter, as well as with one of the top base metals trading firms in the world.

The company also owns 100 percent of the Jillawarra Project, which covers 76 kilometers of strike extension directly to the west of Abra. The Jillawarra Project contains several large-scale analogous exploration targets including the Woodlands Complex, Quartzite Well and Copper Chert areas.

Galena's major partnerships include Toho Zinc (TSE:5707), Japan's largest zinc and lead smelter, and IXM SA, one of the world's top three base metals trading firms. Toho provided AU$90 million project equity and has a long-term offtake agreement to purchase 40 percent of Abra's production; while IXM has entered into a 10-year take-or-pay offtake contract to purchase the remaining 60 percent.

The company's management team brings decades of experience in the mining and base metals industry and has a proven track record of success throughout all stages of exploration, from development to production.

In November 2020, Galena put in place US$110 million in finalized debt facilities arranged by Taurus Funds Management. The facilities include a US$100-million project finance facility plus a US$10-million cost overrun facility.

The project finance facility consists of a 69-month term loan primarily to fund capital expenditures for the development of Abra. Key terms include:

- Fixed interest of 8 percent per annum on drawn amounts, payable quarterly in arrears.

- 1.125 percent net smelter return royalty.

- No mandatory hedging.

- Early repayment allowed without penalty.

- 15 quarterly repayments commencing on 31 December 2023.

The cost overrun facility is a loan to finance identified cost overruns on the project in capital expenditure and working capital. Fixed interest of 10 percent per annum applies to amounts drawn under the cost overrun facility.

The Taurus debt facilities have been fully drawn and are secured against Abra Project assets and over the shares that each of Galena and Toho own in Abra.

Get access to more exclusive Gold Investing Stock profiles here