January 14, 2026

Red Mountain Mining Limited (ASX: RMX, US CODE: RMXFF, or “Company”), a Critical Minerals exploration and development company with an established and growing portfolio in Tier-1 Mining Districts in the United States and Australia, is pleased to announce a further tranche of outstanding antimony rock chip geochemistry results from the Oaky Creek prospect within the Company’s 100% owned Armidale antimony-gold project in the Southern New England Orogen of northeast New South Wales.

HIGHLIGHTS:

- High grade Antimony (Sb) mineralisation returned from rock chip samples from Oaky Creek Prospect in the New England Oregon, NSW. Highlights include:

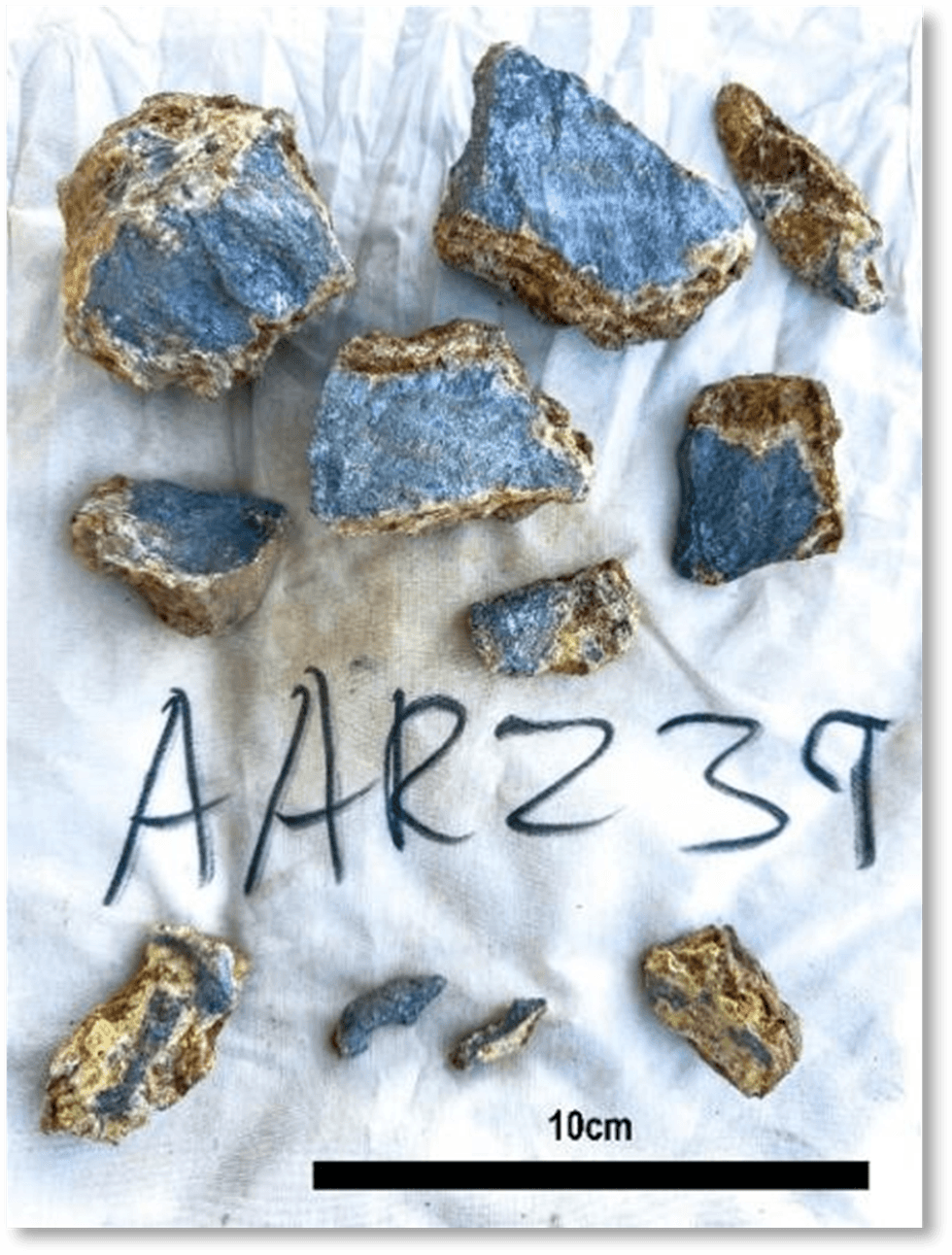

- 34.3% Sb (AAR239) – (Figure 1, Figure 3)

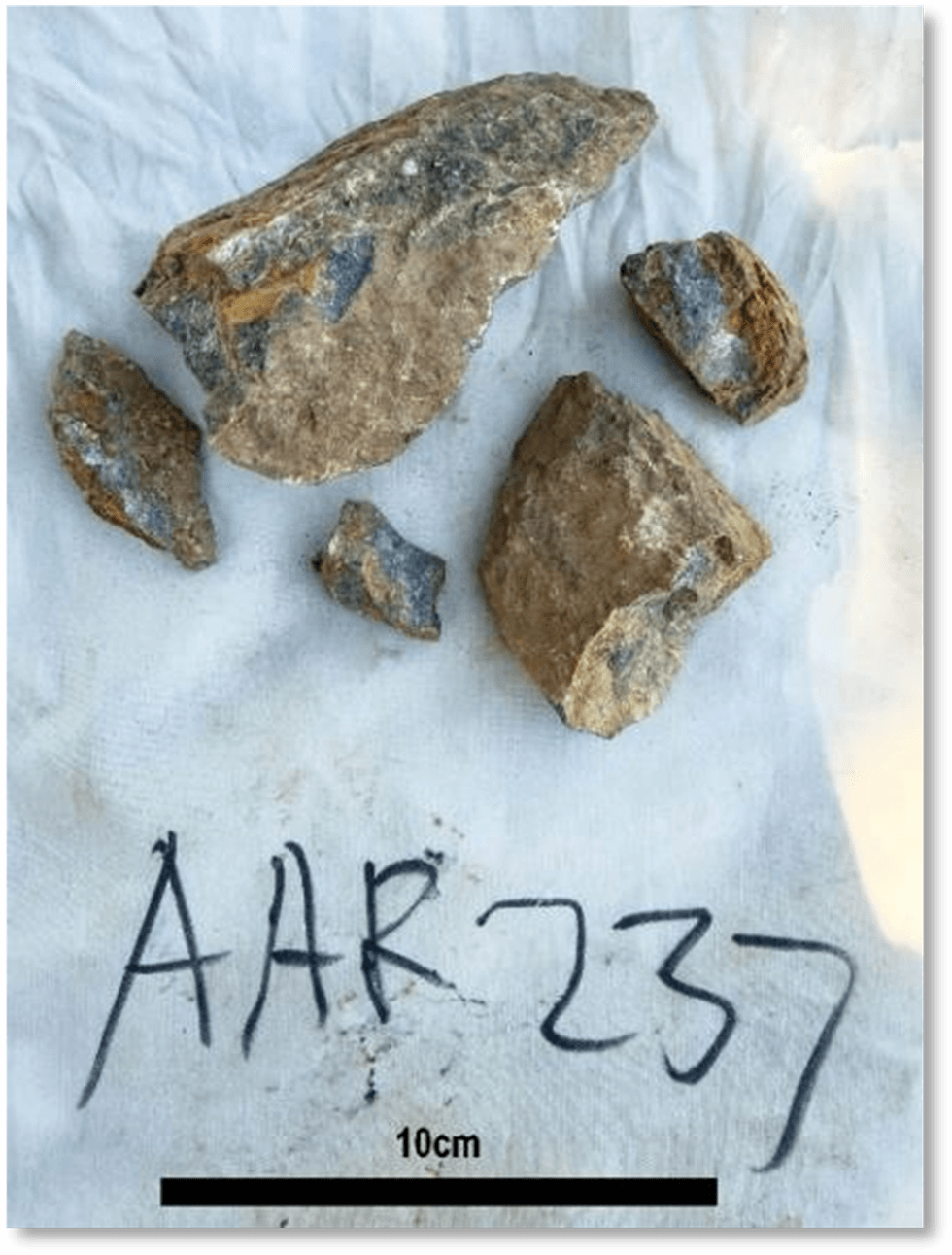

- 23.1% Sb (AAR237) – (Figure 2)

- 19.1% Sb (AAR240)

- The Oaky Creek prospect continues to return exceptional Antimony assay results with 11 of 13 samples collected from the Oaky Creek North soil anomaly returning in excess of 1.9% Sb.

- Strongly Antimony mineralised rock-chip samples highlight a 1.6km strike extent, NNW-trend of at Oaky Creek North, providing indications of the presence of a large-scale orogenic antimony-gold vein system, analogous to Larvotto Resources’ Hillgrove project, at surface.

- Assay results for the December 2025 auger program at Oaky Creek North and South are expected to be received this month and additional field work is planned to complete the auger sampling program at both Oaky Creek prospects.

- Red Mountain anticipates that the auger sampling will define multiple orogenic Antimony- gold targets for drill testing at Oaky Creek during the first half of 2026.

- The Company plans a high-resolution airborne magnetic-radiometric survey to better define additional orogenic Antimony and or Gold targets.

- The Australian Government has prioritised Antimony in its A$1.2B Critical Minerals Strategic Reserve and Strategy, providing strong policy validation for RMX’s Antimony projects.

Eleven of thirteen grab samples collected across the southern half of the 1.2km-long Oaky Creek North soil anomaly returned antimony values of greater than 1.9% Sb (Table 1), with the highest recorded value of 34.3% Sb for sample AAR239 (Figure 3).

Click here for the full ASX Release

This article includes content from Red Mountain Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

11h

As Gold Investment Surges, Fake Platforms and AI Drive New Fraud Wave

As gold prices continue to soar past record highs, investors are pouring billions into bars, coins, and digital tokens. However, regulators and analysts warn that the same rally is fueling a surge in scams that are quietly draining retirement accounts and life savings.Gold has long been marketed... Keep Reading...

13h

Peruvian Metals Announces the 10-Year Renewal of the Use of Surface Rights at the Aguila Norte Processing Plant

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that the Company has renewed the lease on the use of the surface rights at its 80-per-cent-owned Aguila Norte processing plant ("Aguila Norte" or the "Plant") located in... Keep Reading...

27 February

American Eagle Announces $23 Million Strategic Investment Backed by Eric Sprott

Highlights:The investment adds a third strategic investor, when combined with investments by mining companies South32 Group Operations PTY Ltd. and Teck Resources LimitedThe Offering funds significantly expanded drill programs for 2026 and 2027 at the Company's NAK copper-gold porphyry project... Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00