August 20, 2023

Siren Gold Limited (ASX: SNG) (Siren or the Company) is pleased to provide a maidenMineral Resource Estimate for the Auld Creek Prospect.

Highlights

- A maiden Mineral Resource Estimate (MRE) of 132koz @ 7.1g/t AuEq containing 66koz @ 3.5g/t Au & 8,700t of antimony @ 1.5% Sb.

- The MRE comprises the Fraternal Shoot only and is based on existing surface trenches and drillholes and extends to approximately 170m below the surface.

- The Fraternal Shoot remains open at depth and there are three other shoots identified at Auld Creek (Fraternal North, Bonanza and Bonanza East Shoots).

- The MRE includes the following significant intersections;

- 35.0m @ 4.1g/t Au, 2.9% Sb or 35.0m @ 11.0g/t AuEq,

- 6.0m @ 4.1g/t Au, 4.1% Sb or 6.0m @ 13.8g/t AuEq,

- 34.0m @ 1.6g/t Au, 0.7% Sb or 34.0.0m @ 3.3g/t AuEq, and

- 20.7m @ 5.9g/t Au, 2.6% Sb or 20.7m @ 12.0g/t AuEq.

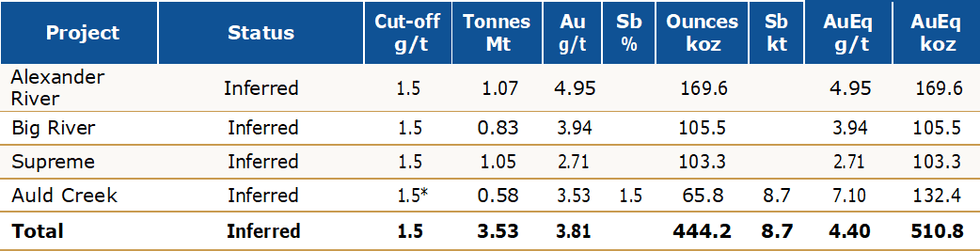

- Siren’s Reefton Mineral Resource estimate now stands at 444koz of gold and 8.7kt of Sb for 511koz @ 4.4 g/t AuEq.

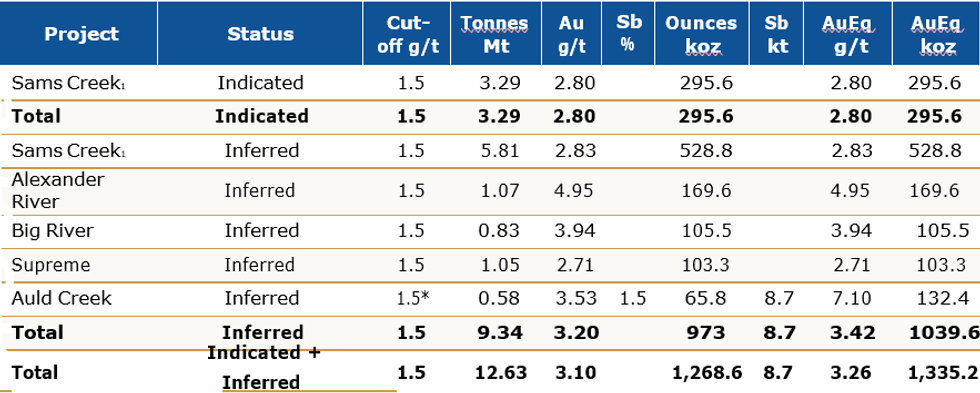

- Siren’s Global Mineral Resource estimate now stands at 1.27Moz of gold and 8.7kt of Sb for 1.33Moz @ 3.3 g/t AuEq (100% basis).

Executive Chairman Brian Rodan commented:

“The Auld Creek Resource is the fourth high grade Resource defined at Reefton with all Resources remaining open along strike and at depth. The Auld Creek deposit is the first with high grade antimony which is a critical mineral in the global transition to clean energy. Siren’s vision is to be a multiple million-ounce high grade gold and antimony producer and with a global MRE now above 1.3Moz, we are well on track with this vision.”

*Based on gold equivalent formula of AuEq = Au g/t + 2.36 x Sb% using a gold price of US$1,750/oz & antimony price of US$13,000 per tonne.

*Based on gold equivalent formula of AuEq = Au g/t + 2.36 x Sb% using a gold price of US$1,750/oz & antimony price of US$13,000 per tonne.

1Siren owns 81.2% of the Sams Creek Project.

Background

The Auld Creek Prospect is contained within Siren’s Golden Point exploration permit and is situated between the highly productive Globe Progress mine, which historically produced 418koz @ 12.2g/t Au, and the Crushington group of mines that produced 515koz @ 16.3g/t Au (Figure 1). More recently OceanaGold (OGL) mined an open pit and extracted an additional 600koz of gold from lower grade remnant mineralisation around the historic Globe Progress mine. Collectively these mines produced 1.6Moz at 10g/t Au.

Click here for the full ASX Release

This article includes content from Siren Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SNG:AU

The Conversation (0)

18 March 2024

Siren Gold

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00