Assays for Additional Holes Remain Pending

Silver47 Exploration Corp. (TSXV: AGA,OTC:AAGAF) (OTCQB: AAGAF) ("Silver47" or the "Company") is pleased to announce high-grade assay results from the first batch of holes from the 2025 drill program at the Company's wholly-owned and flagship Red Mountain Project in Alaska, USA. The Company also announces that it has drilled multiple new silver-gold veins east of the Ruby discovery in the Tonopah Mining District, Hughes Project, Nevada.

Key Highlights (Red Mountain):

-

High-Grade Step-Outs at West Tundra Flat:

640 g/t silver equivalent* over 6.9 m (136 g/t Ag, 0.56 g/t Au, 7.06% Zn, 1.99% Pb and 0.16% Cu, including 1,341 g/t silver equivalent over 3.05 m (305 g/t Ag, 1.23 g/t Au, 15.61% Zn, 4.45% Pb and 0.35% Cu) in a 165 m step-out in WT25-38.

736 g/t silver equivalent over 3.0 m (249 g/t Ag, 0.69 g/t Au, 6.16% Zn, 3.43% Pb and 0.12% Cu) in a 165 m step-out in WT25-37.

-

Broad Mineralization at Dry Creek:

344 g/t silver equivalent over 12.8 m (13 g/t Ag, 0.01 g/t Au, 4.93% Zn, 2.22% Pb and 0.17% Cu), including 646 g/t silver equivalent over 1.3 m (335 g/t Ag, 0.71 g/t Au, 3.9% Zn, 1.4% Pb and 0.13% Cu) in DC25-108.

Resource Expansion: The 2025 summer program targeted untested areas near historical high-grade intercepts to enhance Red Mountain's inferred 168.6 million silver equivalent ounce resource (336 g/t AgEq*) at Dry Creek and West Tundra Flat.

Significant Growth Potential: Both the West Tundra Flat and Dry Creek deposits remain open along strike and down-dip, with systematic drilling planned to delineate full scale.

Assays Pending: Results for 8 additional holes from the 2025 program are pending and expected to further enhance results.

*Notes: g/t=grams per tonne; AgEq=silver equivalent; ZnEq=zinc equivalent; m=metres; Ag=silver; Au=gold; Cu=copper; Zn=zinc; Pb=lead; 1ppm=1 g/t. Equivalencies are calculated using ratios with metal prices of US$2,750/tonne Zn, US$2,100/tonne Pb, US$8,880/tonne Cu, US$1,850/oz Au, and US$23/oz Ag and metal recoveries are based on metallurgical work returned of 90% Zn, 75% Pb, 70% Cu, 70% Ag, and 80% Au. Silver Equivalent (AgEq g/t) = [Zn (%) x 47.81] + [Pb (%) x 30.43] + [Cu (%) x 119] + [Ag (g/t) x 1] + [Au (g/t) x 91.93]

Key Highlights (Hughes):

-

High-Grade Silver-Gold Intercepts:

509 g/t silver equivalent** (3.30 g/t Au, 252 g/t Ag) over 1.1 m in SUM24-65

406 g/t silver equivalent (2.47 g/t Au, 217 g/t Ag) over 0.9 m in SUM24-66

546 g/t silver equivalent (3.16 g/t Au, 306 g/t Ag) over 0.5 m in SUM23-60

Expanded Ruby Vein System: Drilling confirms continuity of high-grade silver-gold mineralization across a broad 600m trend at Ruby.

Significant Discovery Potential: Mineralization extends over a 4 km strike length east of the historic Tonopah Mining District, open in all directions, with strong alteration suggesting proximity to a major mineralized structure.

Searching for the "Main Structure": Planned drill fences will target the main high-grade structure, building on mineralized veins and extensive hydrothermal alteration observed in drilling to date.

**Silver equivalent is calculated using US$20/oz Ag, US$1,800/oz Au with metallurgical recoveries of Ag - 90%, Au - 95%. AgEq = (Ag grade x Ag recovery)+((Au grade x Au recovery) x (Au price / Ag price)).

Galen McNamara, CEO, stated: "Our high-grade intercepts at Red Mountain and expanded mineralization at Hughes position Silver47 as a leader in silver and critical minerals exploration in premier U.S. jurisdictions. With silver's expected inclusion on the critical minerals list, our 2025 results and planned drilling underscore our commitment to unlocking value for shareholders. We are excited to accelerate our exploration at our U.S. projects in 2026 and beyond."

Gary R. Thompson, Executive Chairman, stated: "It's exciting times for silver companies with the recent breakout of silver to all time high prices and it feels like we have a new higher base with lots of room to move dramatically higher from here. Silver47 is well positioned to capitalize on this renewed interest in the sector as we advance our wholly owned high-grade silver assets within the USA."

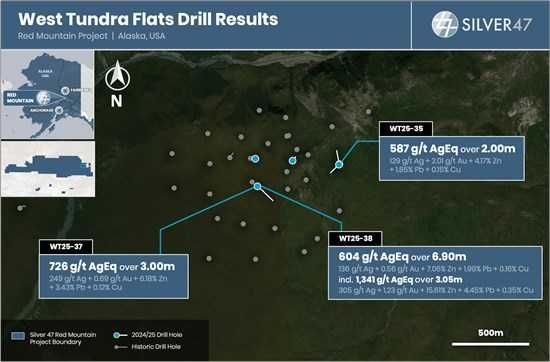

Figure 1: West Tundra Flats Drill Hole Locations

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10967/270471_ff20cdbd44a06bf3_002full.jpg

Figure 2: Dry Creek Drill Hole Locations

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10967/270471_ff20cdbd44a06bf3_003full.jpg

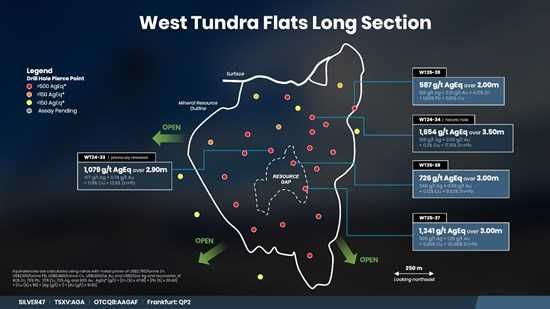

Figure 3: West Tundra Flats Long Section

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10967/270471_ff20cdbd44a06bf3_004full.jpg

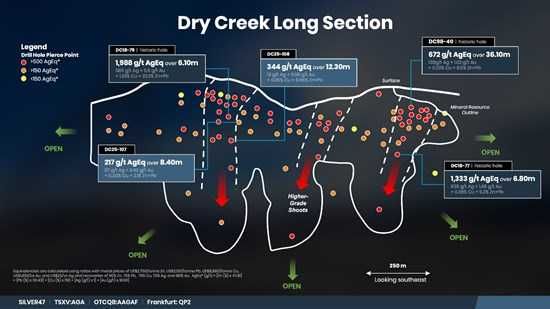

Figure 4: Dry Creek Long Section

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10967/270471_ff20cdbd44a06bf3_005full.jpg

The Red Mountain Drill Program

The 2025 drill program at the Red Mountain Project, 100 km south of Fairbanks, Alaska, consisted of fifteen drill holes - eight holes at the Dry Creek target (Figure 1) and seven holes were completed at the West Tundra Flats target. The Dry Creek and West Tundra Flat targets together account for an inferred resource of 15.6 Mt at 336 g/t AgEq* for 168.6 million silver equivalent ounces. Drilling at both targets consisted of a series of infill and step-out holes designed to test areas near historical high-grade drill intercepts and modelled domains.

Dry Creek Drilling: Holes DC25-107 and DC25-108 were collared on the northeast extent of the Dry Creek deposit and tested the down-dip extent of VMS mineralization below and offset from hole DC24-106. Hole DC24-106, drilled in 2024, intersected multiple massive sulfide horizons within a significant 24.5 m semi-massive mineralized zone (e.g., 2,939 g/t silver equivalent (249.5 g/t Ag, 14.95 g/t Au, 21.97% Zn, 7.03% Pb and 0.42% Cu) over 2.48 m and 2,235 g/t silver equivalent (225 g/t Ag, 8.08 g/t Au, 21.2% Zn, 6.68% Pb and 0.42% Cu) over 0.91 m, see November 18th, 2024 News Release).

Both holes DC25-107 and DC25-108 intersected multiple horizons of semi-massive with locally massive sulfides (e.g., sphalerite, galena and chalcopyrite) within pyritic metavolcanics and metasediments of the Totatlanika Schist. This prospective unit is traced for ~4,500 m along the Dry Creek Deposit where it dips steeply to the north and hosts multiple VMS horizons that locally pinch and swell along strike. Holes are primarily drilled to the south to intersect the lenses at close to true-widths.

The high-grade interval in DC25-108 at 232.9m downhole (654 g/t silver equivalent (79 g/t Ag, 0.40 g/t Au, 8.3% Zn, 4.2% Pb and 0.12% Cu) over 1.3 m, Table 1) is approximately 65 m downdip from the high-grade zone in DC24-106 and demonstrates a strong down-dip extension potential along the VMS horizon in this section of the Dry Creek Deposit. Further drilling is warranted to fully test the down-dip potential in the northeastern part of the Dry Creek deposit.

West Tundra Flat Drilling

Holes WT25-35 to WT25-38 were collared as 150-175 offsets from previously drilled holes in the West Tundra Flat Deposit (e.g., 1,079 g/t silver equivalent (417.4 g/t Ag, 0.74 g/t Au, 9.1% Zn, 4.7% Pb and 0.1% Cu) over 2.9 m in WT24-33, see November 21st, 2024 News Release). All holes except WT25-36 intersected semi-massive to massive sulfide at the targeted horizon (e.g. sphalerite, galena and chalcopyrite at the contact between metavolcanics and metasediments of the Totatlanika Schist. The prospective contact is traced for ~800 m along the West Tundra Flat Deposit where it dips moderately to the south.

The VMS-related mineralization intersected in holes WT25-35, WT25-37 and WT25-38 represent 150m to 175m step outs from previously drilled holes. The mineralization intersected in these holes are outside of the current mineral resource estimated and suggest potential to contribute additional inferred tonnes to the block model.

Next Steps

Based on results from drill holes DC25-107 and 108 at Dry Creek and WT25-33 to 39 at West Tundra Flat together with observations from all holes (see October 1st, 2025 News Release) and ongoing geological modelling, multiple mineralized lenses and domains at both deposits remain open along strike and down-dip. Assays are pending from the remaining eight holes at Red Mountain.

Table 1. Assay Results

| Drill Hole | From (m) | To (m) | Length (m) | Ag (g/t) | Au (g/t) | Zn (%) | Pb (%) | Cu (%) | AgEq* (g/t) | ZnEq (%) |

| WT25-35 | 67.10 | 69.10 | 2.00 | 129 | 2.01 | 4.17 | 1.85 | 0.15 | 587 | 12.27 |

| WT25-36 | No significant Intersections | |||||||||

| WT25-37 | 241.60 | 244.60 | 3.00 | 249 | 0.69 | 6.18 | 3.43 | 0.12 | 726 | 15.17 |

| WT25-38 | 173.00 | 179.90 | 6.90 | 136 | 0.56 | 7.06 | 1.99 | 0.16 | 604 | 12.63 |

| including | 176.90 | 179.90 | 3.00 | 305 | 1.23 | 15.61 | 4.45 | 0.35 | 1,341 | 28.04 |

| DC25-107 | 84.90 | 93.30 | 8.40 | 87 | 0.42 | 1.44 | 0.66 | 0.02 | 217 | 4.53 |

| and | 154.70 | 155.50 | 0.80 | 3 | 0.03 | 0.01 | 0.02 | 1.80 | 221 | 4.62 |

| and | 160.00 | 160.60 | 0.60 | 3 | 0.02 | 7.08 | 0.74 | 0.23 | 393 | 8.21 |

| and | 171.20 | 171.60 | 0.40 | 11 | 0.46 | 2.20 | 0.71 | 0.03 | 184 | 3.85 |

| and | 173.50 | 173.90 | 0.40 | 182 | 0.19 | 5.48 | 3.18 | 0.05 | 565 | 11.81 |

| DC25-108 | 103.30 | 107.00 | 3.70 | 61 | 0.33 | 1.86 | 0.75 | 0.03 | 207 | 4.32 |

| and | 119.70 | 132.00 | 12.30 | 13 | 0.09 | 4.93 | 2.22 | 0.17 | 344 | 7.20 |

| and | 135.00 | 139.10 | 4.10 | 5 | 0.07 | 2.28 | 0.70 | 0.05 | 149 | 3.11 |

| and | 148.80 | 149.60 | 0.80 | 22 | 0.11 | 2.19 | 0.80 | 0.04 | 166 | 3.47 |

| and | 171.40 | 174.40 | 3.00 | 169 | 0.44 | 2.08 | 0.76 | 0.18 | 353 | 7.39 |

| including | 173.10 | 174.40 | 1.30 | 335 | 0.71 | 3.92 | 1.43 | 0.13 | 646 | 13.51 |

| and | 196.70 | 197.00 | 0.30 | 4 | 0.01 | 0.01 | 0.00 | 2.52 | 306 | 6.40 |

| and | 221.80 | 224.70 | 2.90 | 33 | 0.33 | 3.04 | 1.28 | 0.03 | 251 | 5.24 |

| and | 232.90 | 234.30 | 1.40 | 79 | 0.40 | 8.28 | 4.21 | 0.12 | 654 | 13.68 |

| DC25-109 | Hole Lost Before Target | |||||||||

*Notes: g/t=grams per tonne; AgEq=silver equivalent; ZnEq=zinc equivalent; m=metres; Ag=silver; Au=gold; Cu=copper; Zn=zinc; Pb=lead; 1ppm=1 g/t. Equivalencies are calculated using ratios with metal prices of US$2,750/tonne Zn, US$2,100/tonne Pb, US$8,880/tonne Cu, US$1,850/oz Au, and US$23/oz Ag and metal recoveries are based on metallurgical work returned of 90% Zn, 75% Pb, 70% Cu, 70% Ag, and 80% Au. Silver Equivalent (AgEq g/t) = [Zn (%) x 47.81] + [Pb (%) x 30.43] + [Cu (%) x 119] + [Ag (g/t) x 1] + [Au (g/t) x 91.93]

Table 2. Collar information

| Target Area | Drill Hole | Easting | Northing | Elevation | Azimuth | Dip | Final Depth |

| Dry Creek | DC25-107 | 480899 | 7088578 | 1195 | 140 | -55 | 247 |

| Dry Creek | DC25-108 | 480899 | 7088579 | 1195 | 110 | -65 | 265 |

| Dry Creek | DC25-109 | 480084 | 7088634 | 1328 | 145 | -52 | 98 |

| West Tundra Flat | WT25-35 | 484414 | 7090964 | 964 | 350 | -50 | 155 |

| West Tundra Flat | WT25-36 | 484411 | 7090960 | 964 | 228 | -59 | 157 |

| West Tundra Flat | WT25-37 | 483875 | 7090818 | 971 | 136 | -59 | 302 |

| West Tundra Flat | WT25-38 | 483874 | 7090820 | 971 | 60 | -59 | 277 |

WGS84 6N

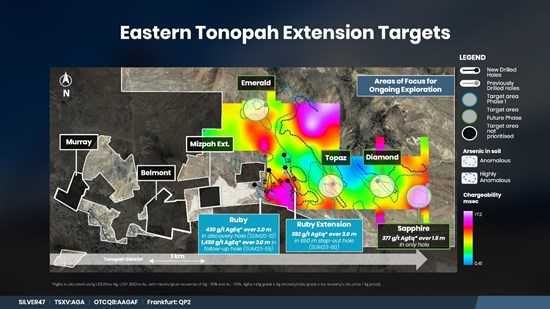

The Hughes Drill Program

Over 3,700 m of combined reverse circulation and diamond drilling (RC pre-collars with diamond tails) in seven holes were completed along strike from the significant Ruby discovery, part of the eastern extension of the Tonopah Mining District, near Tonopah Nevada. The purpose of the exploration drill program was to test for mineralization across a 475 m untested gap between the Ruby discovery (e.g., SUM23-59 1,450 g/t silver equivalent* (8.41 g/t Au, 813 g/t Ag) over 3.0 m) and a significant mineralized vein discovered in hole SUM23-60 (392 g/t silver equivalent* (3.04 g/t Au, 147 g/t Ag) over 3.0 m, Figure 1). Program highlights include:

Drilling first consisted of a series of four step-out holes (e.g., SUM25-65, 66, 67, and 68, Figure 2) with pierce-points on 50 to 100 m centers from two pad setups. All four holes intersected zones of strong and pervasive epithermal-related argillic and phyllic alteration with local zones of mineralized quartz veining and vein-stockwork. Hole SUM24-65 intersected two mineralized vein zones 50 m apart within a broad >500 m zone of locally intense alteration - 221 g/t silver equivalent (1.22 g/t Au, 130 g/t Ag) over 0.6 m and 509 g/t silver equivalent (3.30 g/t Au, 252 g/t Ag) over 1.1 m (Table 1).

A north-south, 450m fence of three holes offset from hole SUM23-60 were drilled through the projected Ruby vein system. These holes were designed to test for potential parallel structures and the up- and down-dip extent of silver-gold mineralization intersected in SUM23-60. RC pre-collars were completed for the three holes (SUM25-69, 70 and 71) and holes SUM24-69 and 71 were completed with diamond tails (Figure 2). Hole SUM25-69, a 130m down-dip step-out from SUM23-60, intersected 190 g/t silver equivalent (1.12 g/t Au, 106 g/t Ag) over 1.8 m including 546 g/t silver equivalent (3.16 g/t Au, 306 g/t Ag) over 0.5 m. This hole intersected multiple broad zones of strong argillic-quartz alteration with polyphase quartz-pyrite veining.

The scale and intensity of the epithermal-related hydrothermal alteration observed in every hole demonstrates the potential scale and complexity of the Ruby system. All holes intersected significant zones of argillic-pyrite alteration punctuated by local zones of strong silicification, quartz-carbonate veins, poly-phase vein stockworks and breccia. The nature of the high-level alteration assemblages and textures may suggest proximity to a stronger mineralized system. Many of the intervals of strong alteration are associated with broad structural zones of faulting with increasing alteration near lithological boundaries. These structural and alteration relationships are observed across all previous holes into the Ruby target (e.g., SUM21-10 and SUM23-59) and suggests the Ruby system is broader and more complex than previously understood. Additional drilling is clearly warranted along this east-west trend as well as stepped back to the north, down-dip to better constrain the lateral and vertical extent of silver-gold mineralization.

Figure 5: Hughes Drill Hole Locations

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10967/270471_ff20cdbd44a06bf3_006full.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10967/270471_ff20cdbd44a06bf3_007full.jpg

Next Steps

Structural and lithological data from the recently completed holes have been integrated into the Ruby vein model. Planning is now underway for a follow-up drill program which will be aimed at further targeting high-grade veins east of the Ruby discovery across the eastern extension of the historic Tonopah Mining District.

Table 3. Assay Results

| Drill Hole | From (m) | To (m) | Length (m) | Au (g/t) | Ag (g/t) | AgEq* (g/t) |

| SUM24-65 | 491.4 | 492.0 | 0.6 | 1.22 | 130 | 221 |

| and | 552.8 | 553.9 | 1.1 | 3.30 | 252 | 509 |

| SUM24-66 | 540.9 | 541.8 | 0.9 | 2.47 | 217 | 406 |

| SUM24-67 | 545.8 | 546.5 | 0.7 | 1.59 | 198 | 314 |

| SUM24-68 | 560.6 | 561.4 | 0.8 | 0.67 | 89 | 137 |

| SUM25-69 | 292.7 | 294.5 | 1.8 | 1.12 | 106 | 190 |

| including | 294.0 | 294.5 | 0.5 | 3.16 | 306 | 546 |

| SUM25-70 | RC Pre Collar Only | |||||

| SUM25-71 | No Significant Intercepts | |||||

**Silver equivalent is calculated using US$20/oz Ag, US$1,800/oz Au with metallurgical recoveries of Ag - 90%, Au - 95%. AgEq = (Ag grade x Ag recovery)+((Au grade x Au recovery) x (Au price / Ag price)).

Table 4. Collar information

| Target Area | Drill Hole | Easting | Northing | Azimuth | Dip | Final Depth (m) |

| Ruby | SUM24-65 | 482542 | 4214094 | 113 | -56 | 676.4 |

| Ruby | SUM24-66 | 482788 | 4214336 | 187 | -59 | 647.7 |

| Ruby | SUM24-67 | 482790 | 4214336 | 176 | -54 | 611.7 |

| Ruby | SUM24-68 | 482793 | 4214335 | 138 | -49 | 659.0 |

| Ruby | SUM25-69 | 483087 | 4214397 | 155 | -49 | 612.0 |

| Ruby | SUM25-70 | 483068 | 4214612 | 165 | -50 | 213.4 |

| Ruby | SUM25-71 | 483125 | 4214149 | 145 | -50 | 484.6 |

NAD83 Z 11N

Qualified Person

The technical content of this news release has been reviewed and approved by Galen McNamara, P. Geo., the CEO of the Company and a qualified person as defined by National Instrument 43-101.

Quality Assurance and Quality Control

Drill core was sawn in half at Silver47's core logging and processing facilities at the Red Mountain, near Fairbanks Alaska. Core samples were typically taken at 1.0 m intervals in mineralized zones, and 3.0 m intervals outside of mineralized zones. Sample lengths were adjusted as necessary so as not to cross lithologic and mineralogic boundaries. QAQC check samples were inserted into the sample stream with one blank, one duplicate (coarse), and one certified reference material (CRM) occurring within every 20 samples. Drill core was cut in half, bagged, sealed and delivered directly to ALS Minerals Fairbanks, Alaska for transport to the ALS Minerals Laboratories labs in North Vancouver, British Columbia. ALS Minerals Laboratories are registered to ISO 9001:2008 and ISO 17025 accreditations for laboratory procedures. Core samples were analyzed at ALS Laboratory facilities in North Vancouver using four-acid digestion with an ICP-MS finish (ME-MS61). Gold analysis was by fire assay with atomic absorption finish (Au-ICP21). Over-limits for silver, zinc, copper, and lead were analyzed using Ore Grade four-acid digestion (MEOG-62). The standards, certified reference materials, were acquired from CDN Resource Laboratories Ltd. of Langley, British Columbia and selected to represent expected mineralization.

Drill core was sawn in half at Silver47's core logging and processing facilities at the Hughes Project, Tonopah Nevada. All core samples were sent to Paragon Geochemical Laboratories in Sparks, Nevada for preparation and analysis. Paragon meets all requirements of the International Accreditation Service AC89 and demonstrates compliance with ISO/IEC Standard 17025:2017 for analytical procedures. Samples were analyzed for gold via fire assay with an AA finish and samples that assayed over 8 ppm were re-run via fire assay with a gravimetric finish. Silver, and trace elements were analyzed via inductively coupled plasma mass spectroscopy after four-acid digestion. Samples that assayed over 100 ppm Ag were re-run via fire assay for Ag with a gravimetric finish. In addition to Paragon quality assurance / quality control ("QA/QC") protocols, Silver47 implements an internal QA/QC program that includes the insertion of sample blanks, duplicates and certified reference materials at systematic and random points in the sample stream.

About Silver47 Exploration

Silver47 Exploration Corp is a mineral exploration company, focused on uncovering and developing silver-rich deposits in North America. The Company is creating a leading high-grade US-focused silver developer with a combined resource totaling 236 Moz AgEq at 334 g/t AgEq inferred and 10 Moz at 333 g/t AgEq Indicated. With operations in Alaska, Nevada and New Mexico, Silver47 Exploration is anchored in America's most prolific mining jurisdictions. For detailed information regarding the resource estimates, assumptions, and technical reports, please refer to the NI 43-101 Technical Report and other filings available on SEDAR at www.sedarplus.ca. The Company trades on the TSXV under the ticker symbol AGA and OTCQB under the ticker symbol AAGAF.

For more information about the Company, please visit www.silver47.ca and see the Technical Report filed on SEDAR+ (www.sedarplus.ca) and titled "Technical Report on the Red Mountain VMS Property Bonnifield Mining District, Alaska, USA with an effective date January 12, 2024, and prepared by APEX Geoscience Ltd."

Follow us on social media for the latest updates:

- X: @Silver47co

- LinkedIn: Silver47

On Behalf of the Board of Directors

Mr. Galen McNamara

CEO & Director

For investor relations

Giordy Belfiore

604-288-8004

gbelfiore@silver47.ca

No securities regulatory authority has either approved or disapproved of the contents of this release. Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking statements" within the meaning of applicable Canadian securities laws. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "plans", "intends", "estimates", "potential", "target", "strategy", "forecast", "budget", "goals", "objectives", "may", "will", "should", "could", or similar expressions, or variations (including negative variations) of such words and phrases, or statements that certain events, conditions or results "may", "will", "could", "would" or "should" occur or be achieved.

Forward-looking statements in this release include, but are not limited to, statements regarding: the interpretation of exploration results; the potential for extensions or expansions of known mineralized zones; the potential for the discovery of new mineralized areas; the completion, timing and results of future exploration work, drilling programs, sampling, mapping, or geophysical surveys; the estimation or realization of mineral resources or mineral reserves; the timing of technical reports or feasibility studies; the Company's expectations regarding metal prices, exchange rates, and market conditions; and other statements that are not historical facts.

Forward-looking statements are based on the opinions, estimates and assumptions of management as of the date such statements are made, including, but not limited to: that the Company's exploration and development activities will proceed as expected; that financing will be available if and when required on reasonable terms; that general business and economic conditions will not change in a materially adverse manner; that all necessary governmental, regulatory and third-party approvals will be obtained on favourable terms and in a timely manner; and that the Company will be able to continue to access qualified personnel, contractors, equipment and supplies.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company to differ materially from those expressed or implied by such forward-looking statements. These factors include, among others: risks related to exploration, development and mining operations; the speculative nature of mineral exploration; uncertainty of resource estimates; capital and operating cost estimates; fluctuations in commodity prices and exchange rates; availability of financing; reliance on key personnel; title, permitting, environmental and regulatory risks; political and social risks in jurisdictions of operation; and the additional risks and uncertainties identified in the Company's continuous disclosure filings available under its profile on SEDAR+ at www.sedarplus.ca.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Readers are cautioned not to place undue reliance on forward-looking statements.

Forward-looking statements contained in this news release are made as of the date of this release, and the Company does not undertake any obligation to update or revise any forward-looking statements contained herein, except as required by applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/270471