December 02, 2024

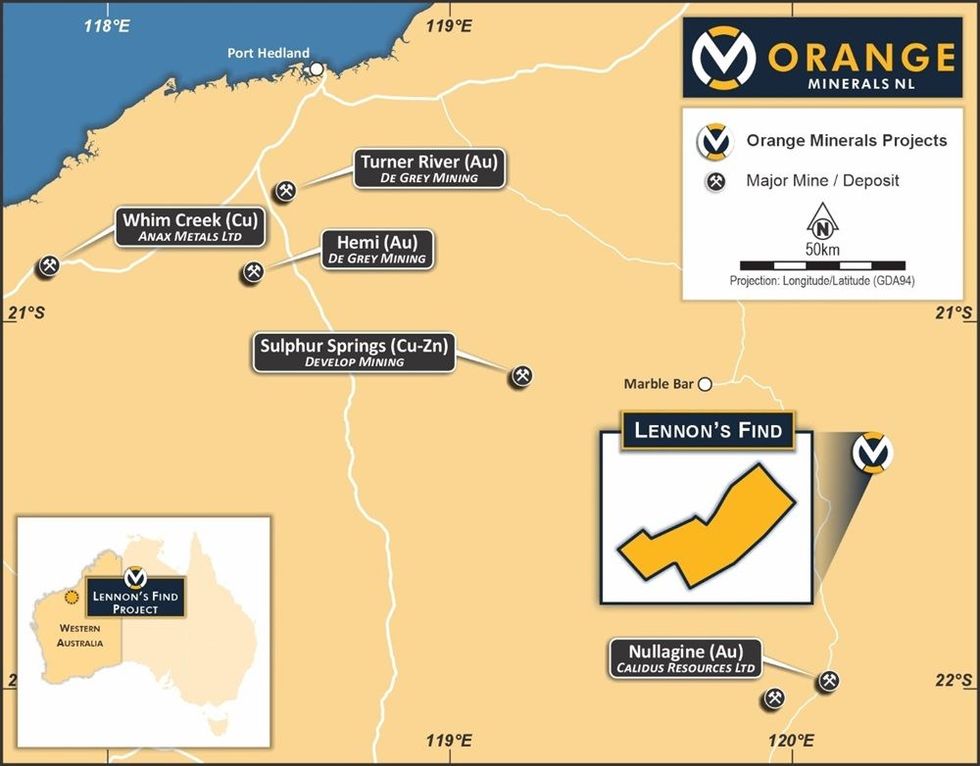

Orange Minerals NL (ASX: OMX) (“Orange” or “the Company”) is pleased to announce that it has received significant assay results from recent rock chip sampling at the Lennon’s Find project near Marble Bar in the Pilbara (Figure 2).

HIGHLIGHTS

- Significant gold, silver and base metal results from rock chips, validating historical work at Hammerhead and Tiger deposits.

- Highest values: Gold (5.45 g/t OLRS4), Silver (988 g/t OLRS4), Copper (4.96% OLRS4), Lead (12.07% OLRS2) and Zinc (4.44% OLRS6)

- Planning for further ground works in Q1 2025 underway, in-conjunction with application for Exploration Incentive Scheme (EIS) for co-funding of a deep diamond drill program

Rock Chip Sampling

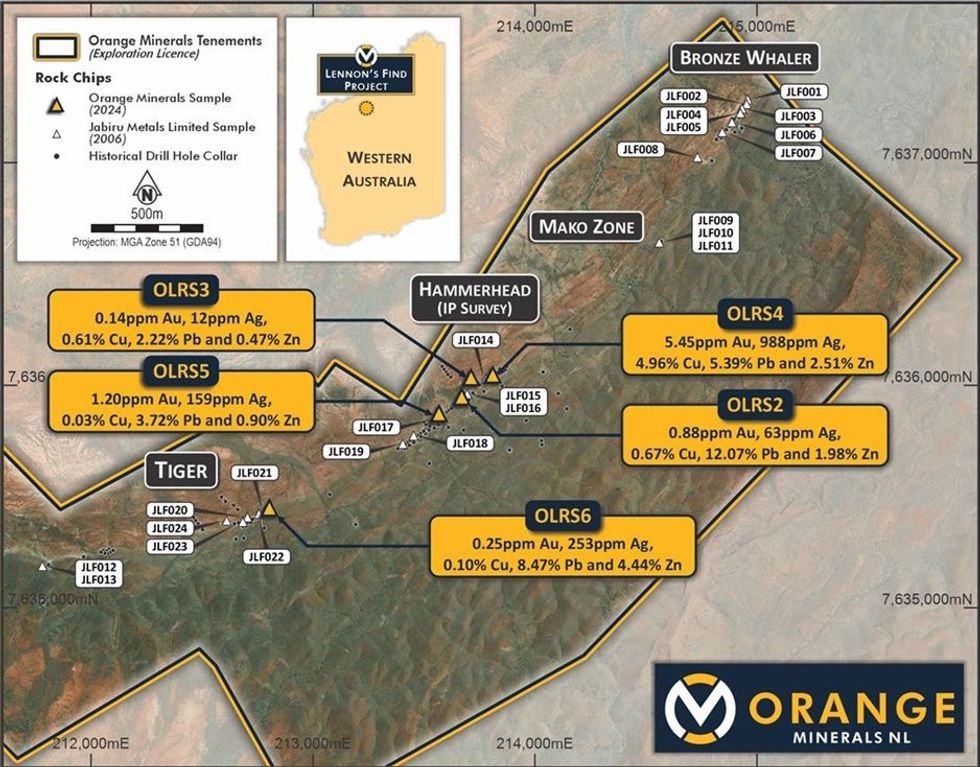

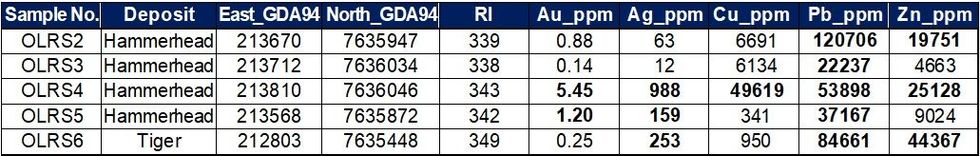

Five rock chip samples were collected during the recent Lennons Find IP survey to validate samples collected by Jabiru Metals Limited in 2005 (Figure 1). Four of the samples were taken on the Hammerhead gossan and one sample from the Tiger deposit. Twenty-four samples were collected by Jabiru Metals Limited in 2005, over a strike length of 4km along the Lennons Find main zone. The highest assay results from the Orange Minerals sample were gold (5.45 g/t OLRS4), silver (988 g/t OLRS4), copper (4.96% OLRS4), lead (12.07% OLRS2) and zinc (4.44% OLRS6). These results correlated well with high grade values in the Jabiru Metals samples. Jabiru Metals assays are reproduced in Appendix 1 and Orange Minerals samples in Table 1. For historical drillhole collars and results see Laconia Resources Limited ASX announcements (9 March 2011, 3 October 2011 and 12 October 2011).

Background Lennon’s Find

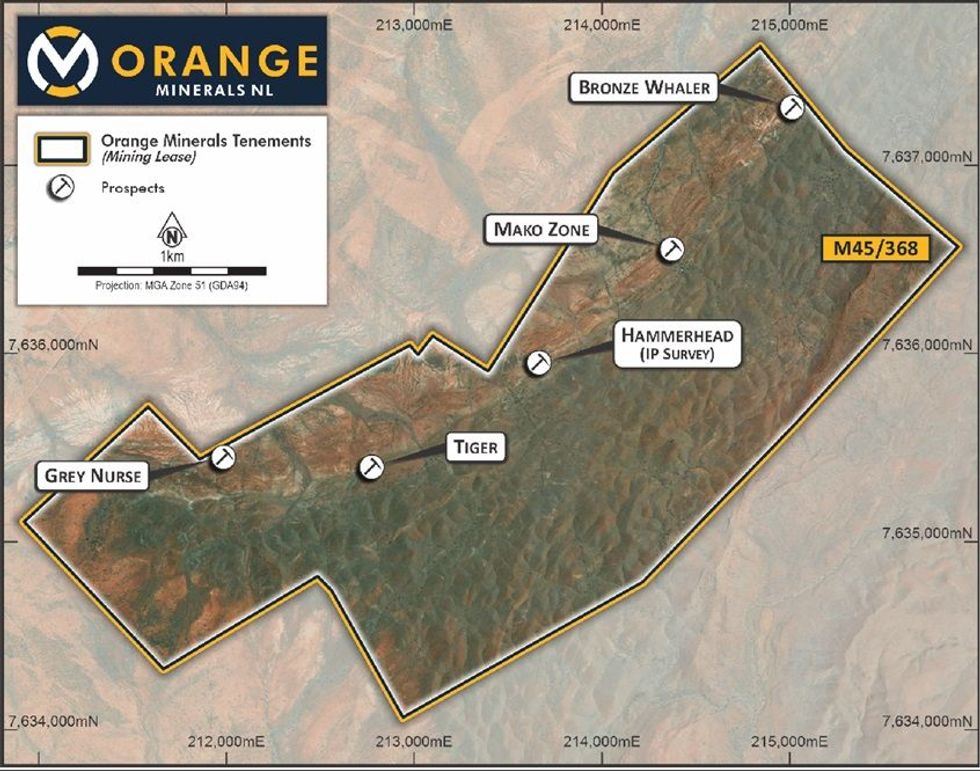

In August 2023 a binding term sheet was entered into with Musketeer Mining Ltd, to acquire up to a 75% share in the Lennon’s Find Polymetallic Project 75km south-east of Marble Bar in the Pilbara region, WA. Lennon’s Find includes a Mining Lease with an Inferred Mineral Resource of 1.55 Mt at 5.9% zinc, 0.2% Cu, 1.6% Pb, 0.28 g/t Au, and 84g/t Ag (Optiro 2019).

Orange can earn 51% of the Lennon’s Find Project (M45/368) by spending A$500,000 by 31 March 2026 (which included an upfront payment of A$200,000). Orange may earn up to 75% of the Lennon’s Find Project by spending an additional A$500,000 (A$1.0 million in total) by 31 March 2028.

Geological Setting

The Lennon’s Find project is located in the Archean Marble Bar greenstone belt on the SE boundary of the Mount Edgar Batholith. The greenstone rocks are comprised of felsic schists of the Duffer Formation overlain by the Apex Basalt, and both formations are part of the Warrawoona Group. The package dips to the SE beneath, or faulted against, rocks of the Fortescue Group. The Duffer Formation is comprised of three laterally persistent units: a basal quartzo – feldspathic schist (Unit 1), meta sedimentary rocks, mostly psammites and pelites (Unit 2) and an upper quartz – muscovite schist (Unit 3). All the known base metal sulphide deposits occur within the upper part of the Duffer Formation.

Base metal mineralisation at Lennon’s Find is considered to be VMS style and has been mapped over a strike of 4.5km as discontinuous gossans and disseminated sulphide zones (Figure 4). The base metal mineralisation is predominantly Zn – Pb – Cu – Ag – Au, with significant amounts of barite, and occurs as stratiform, lenticular bodies. Five deposits have been identified being Grey Nurse, Tiger, Hammerhead, Mako and Bronze Whaler (Figure 3).

Click here for the full ASX Release

This article includes content from Orange Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00