Investor Insight

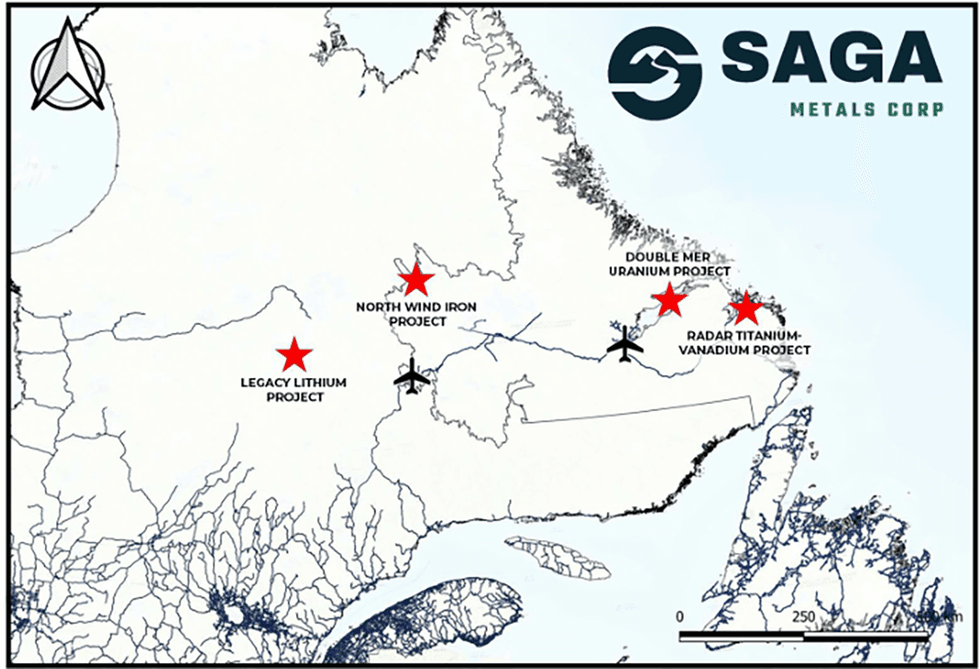

Saga Metals is a Canadian critical minerals explorer advancing its flagship Radar titanium-vanadium-iron project with high-grade results, while also holding lithium, uranium, and iron assets through strategic partnerships and exploration.

Overview

Saga Metals (TSXV:SAGA,OTCQB:SAGMF,FSE:20H is focused on discovering and advancing critical mineral deposits essential to electrification, infrastructure, and defense supply chains. The company’s strategy combines systematic exploration, resource definition drilling, and strategic partnerships to build value across multiple commodities.

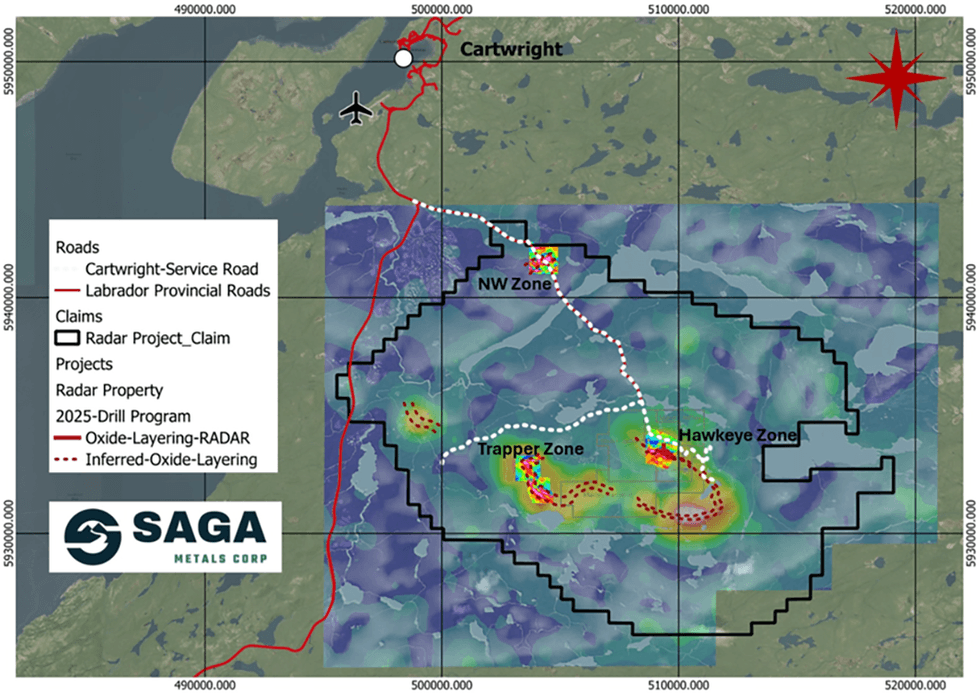

Its flagship Radar project, located near Cartwright, hosts a large layered mafic intrusive complex comparable in scale to major global titanium-vanadium systems. Drilling confirms thick, laterally continuous titanomagnetite zones containing iron, titanium, and vanadium, with consistent grades and substantial thicknesses across multiple zones supporting potential for a large-scale resource.

Beyond Radar, Saga maintains a diversified pipeline of earlier-stage exploration assets spanning uranium, lithium, and iron. This portfolio provides exposure to multiple high-demand commodities while infrastructure advantages across projects enhance long-term development potential.

Company Highlights

- District-Scale Flagship: Radar spans 24,175 hectares covering the full Dykes

River intrusion.

- Drilling Success: 100 percent success rate in 2025 (22/22 holes

intersected oxide mineralization).

- Large Mineralized System: ~16 + km confirmed strike extent of mineralized

layering.

- Resource Catalyst: ~15,000 m MRE drill program underway (2026).

- High-Grade Intercepts

(2026 Program):

- 135.50 m @ 50.03 percent

iron oxide, 7.87 percent titanium dioxide, 0.352 percent vanadium oxide

- 87.20 m @ 50.67 percent

iron oxide, 10.15 percent titanium dioxide, 0.339 percent vanadium oxide

- 67.60 m @ 46.15 percent

iron oxide, 9.21 percent titanium dioxide, 0.311 percent vanadium oxide

- High-Grade Intercepts (Final 2025 Assays):

- 100.70 m @ 38.56 percent

iron oxide, 6.8 percent titanium dioxide, 0.229 percent vanadium oxide

- 111.50 m @ 37.08 percent

iron oxide, 5.14 percent titanium dioxide

- 41.20 m @ 36.17 percent

iron oxide, 6.36 percent titanium dioxide

- Rio Tinto Lithium JV: C$44.4 million earn-in option allowing Rio Tinto to

earn up to 75 percent.

- Uranium Exposure: 1,024 claims totaling 25,600 ha with samples up to

0.428 percent triuranium octoxide.

- Iron Optionality: Separate project hosts values up to 75 percent iron

oxide.

- Leadership: Experienced technical and capital markets team.

Key Projects

Radar Titanium-Vanadium-Iron Project (Flagship)

The Radar project is Saga Metals’ cornerstone asset and primary exploration focus, representing a district-scale titanomagnetite system within a large layered mafic intrusion near Cartwright. Ongoing drilling is aimed at defining the project’s first mineral resource, supported by strong grade continuity, thick oxide intervals, and extensive geophysical anomalies that suggest a large mineralized footprint.

Recent programs have confirmed laterally continuous zones of iron-titanium-vanadium mineralization across a broad strike length, validating Radar as a potentially globally significant system. With infrastructure access and year-round logistics advantages, the project is positioned for efficient advancement through resource delineation and technical studies.

Project Highlights:

- Covers entire Dykes River intrusion (~160 sq km).

- Semi-massive to massive oxide layers confirmed across drilling.

- 2026 MRE program targeting 3+ km Trapper Zone.

- Geophysics correlates magnetic

anomalies with mineralized layering.

-

Mineralogy indicates ilmenite within magnetite,

supporting concentrate potential.

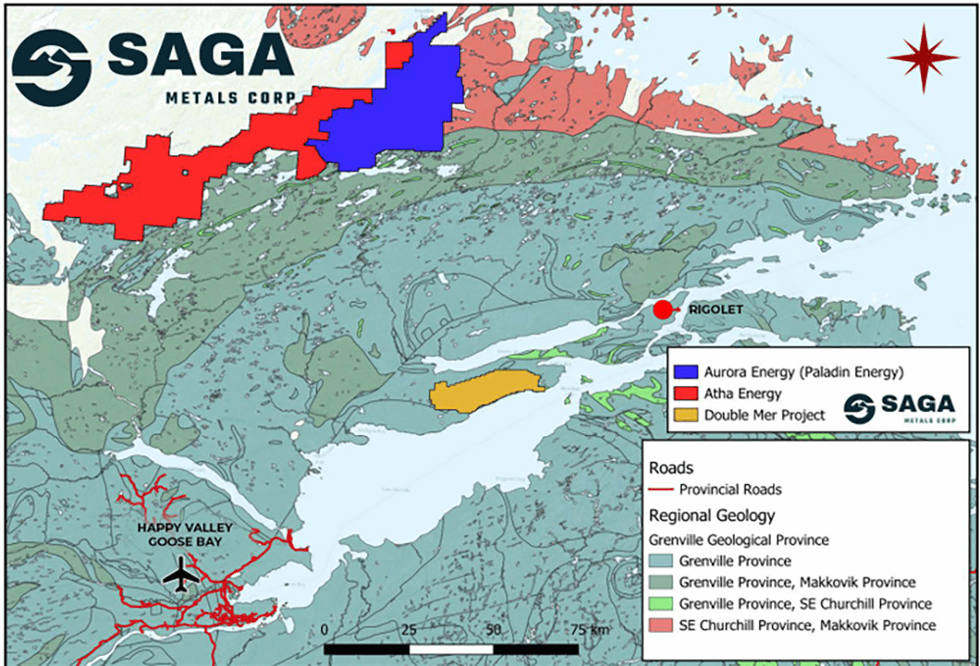

Double Mer Uranium Project

Regional map of the Double Mer uranium project in Labrador, Canada

Double Mer provides Saga with exposure to large tonnage uranium discovery potential across a large underexplored land package in Labrador. The property covers 1,024 claims totaling 25,600 ha. Three zones occur along an 18 km mineralized trend, supported by historical sampling results and radiometric anomalies indicating strong exploration potential. Its scale, grade indicators, and geological similarities to productive uranium belts suggest the project could host structurally controlled mineralization systems.

Project Highlights:

- 1,024 claims covering

25,600 ha

- Three zones along 18 km

mineralized trend

- Samples up to 0.428

percent triuranium octoxide

- Radiometric readings to

27,000 cps

- Drill-ready with a ten person winterized camp

Legacy Lithium

The Legacy property positions Saga Metals within the rapidly emerging lithium district of the James Bay region in Quebec. The project benefits from a partner-funded exploration model that enables systematic target testing while limiting capital exposure.

Geological mapping has identified numerous pegmatite occurrences across the property, indicating strong prospectivity for lithium-bearing systems. With regional exploration activity increasing and infrastructure development expanding, Legacy provides strategic upside tied to battery-metal demand growth.

Project Highlights:

- C$44.4 M earn-in option agreement.

- Rio Tinto may earn up to 75 percent interest and acts as operator.

- 100 + documented pegmatite outcrops.

North Wind Iron Project

North Wind adds additional scale potential through historically mineralized iron formations located near Schefferville within the Labrador Trough. The area hosts extensive banded iron formations known for high-grade iron occurrences and large deposit potential. Historical drilling and sampling indicate strong grades across multiple zones, while recent fieldwork confirms a continuous mineralized trend. As a result, North Wind offers long-term optionality tied to iron ore demand and represents a secondary growth asset within Saga’s portfolio.

Project Highlights:

- 6,375 ha across 255

claims

- Historical drilling

averaged ~21percent iron oxide

- Samples up to 75 percent

iron oxide

- ~4 km mineralized trend

confirmed

Management Team

Michael Stier — Director

and CEO

Michael Stier brings over 20 years of capital markets and corporate leadership experience, including corporate structure, finance, business development, IPOs, mergers & acquisitions, and wealth management. He has served in senior financial roles, including as CIBC IIROC licensed senior financial advisor and analyst for private equity, and holds executive and directorship roles with multiple public and private issuers.

Terence Lee — Chief

Financial Officer

Terence Lee is a CPA with over nine years of finance experience under International Financial Reporting Standards (IFRS). His background includes financial planning, analysis, and reporting across mining, technology, real estate, life sciences, and other industries.

Michael Garagan —

Director and Chief Geological Officer

Michael Garagan holds a B.Sc. in Geology and brings approximately 20 years of international exploration experience across North and South America, Africa, and Asia. His work spans multiple deposit styles including gold, base metals, uranium, and lithium pegmatites.

Michael Waldkirch —

Independent Director

Michael Waldkirch is a CPA, CGA with over 25 years of professional accounting and business consultancy experience. He has served as CFO for public companies and currently acts as an independent board member of US Gold Corp., with experience across TSX, TSX‑V, NASDAQ, NYSE‑American, and OTC markets.

Harrison Pokrandt —

Independent Director

Harrison Pokrandt has seven years of mineral exploration experience across various geological settings and jurisdictions worldwide. His project experience includes major gold and base metal districts with roles spanning grassroots through development stages.

Technical Team

Len Gal — Geologist

Len Gal holds an MSc in Geology and has over 30 years of global mineral exploration experience, including government surveys, field mapping, and drill programs across Canada, the USA, and internationally.

Geominex Consultants

Inc. — Geological Consulting Team

A Canadian geological consulting group with over 35 years of collective experience, providing exploration services, project management, 43‑101 reporting, GIS, and technical support.

Riley Ledoux — Geominex

Consultant, Exploration Manager

Riley Ledoux is a professional geologist with experience in exploration program planning, core logging, mapping, and technical reporting across multiple commodities and Canadian regions.

Ryan Pownall — Geominex

Consultant, Operations Manager

Ryan Pownall brings field operations experience from international and Canadian exploration programs, including drilling, remote camp logistics, and geophysics support.