October 24, 2023

New tenements cover key lithium pegmatite targets only 5km northeast of AzureMinerals’ Andover discovery

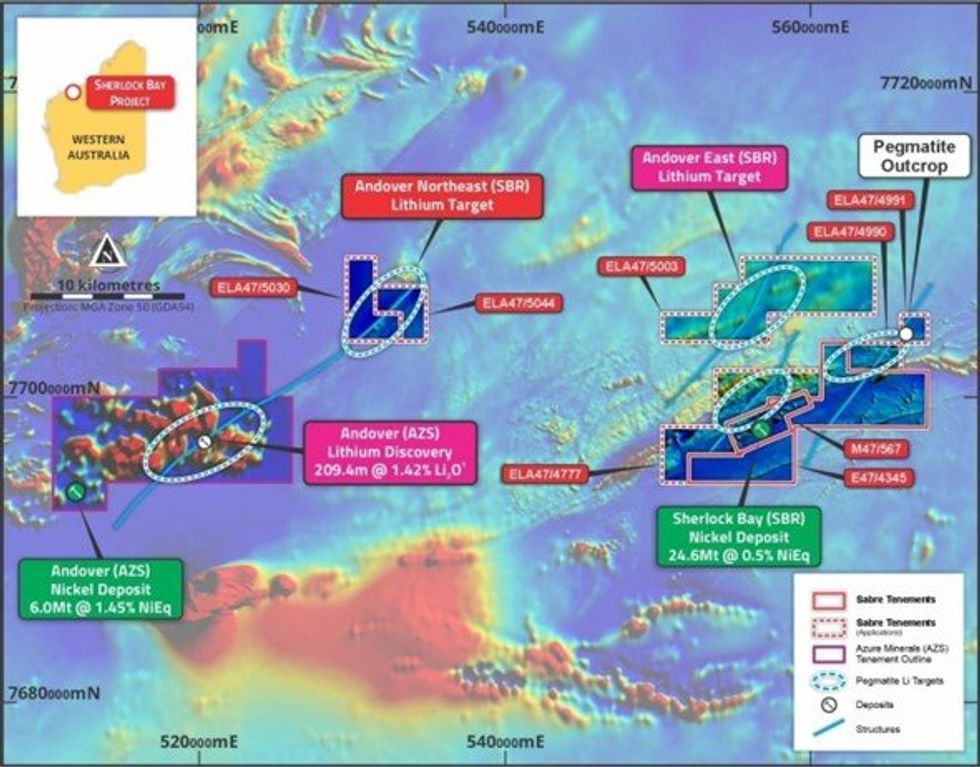

Sabre Resources Ltd (ASX: SBR) (“Sabre” or “the Company”) is pleased to announce the Company has added two highly prospective tenement applications to its ground holding in the northwest Pilbara region of WA, along strike and only 5km to the northeast of the Andover lithium discovery of Azure Minerals Ltd (ASX:AZS) (Figure 1).

- Sabre has acquired two additional tenement applications directly along strike - and just 5km northeast - of the major Andover lithium (spodumene) pegmatite discovery of Azure Minerals Ltd (ASX:AZS) which has produced drilling intersections of up to 209.4m @ 1.42% Li2O1.

- The Andover discovery lies within a five kilometre wide structural corridor which extends northeast under shallow cover. The new Sabre tenements lie over an inflexion in the structure close to a magnetic intrusion in a similar setting to the Andover discovery.

- Sabre is now one of the major tenement holders in what is emerging as a world class lithium pegmatite region, having established a 235 square kilometre holding along strike to the northeast, and on parallel structures to the Andover discovery.

- Priority geophysics and aircore drilling programs set to commence to test new pegmatite targets.

Sabre Resources CEO, Jon Dugdale commented:

“Sabre has established itself as one of the major tenement holders in the highly prospective northwest Pilbara region, having built a more than 235 square kilometre tenement holding along strike to the northeast of, and on parallel structures to the east of, the major Andover lithium pegmatite discovery of Azure Minerals.

“The geology of our tenements appears similar to Andover – the only difference being the extent of cover over our target areas.

“Following grant of the new tenement applications, the next steps will include detailed geophysical programs including gravity measurements to locate buried pegmatites which will then be tested with bedrock aircore drilling.

“The drilling will test for buried lithium bearing pegmatites within this highly prospective tenement package within what is now recognised as a world class lithium pegmatite region.”

The new tenements include ELA47/5030 which will be acquired under a share purchase agreement (see details Appendix 1) and ELA 47/5044 which was pegged by the Company. These new tenements take the Company’s tenement holding to >235 sq. km. (Figure 1) in what is emerging as a world-class lithium region.

The Andover discovery has produced drilling intersections which include up to 209.4m @ 1.42% Li2O1. The pegmatites intersected at Andover occur within a northeast trending structural corridor over 5km wide which is clearly evident in magnetic imagery extending northeast of Andover, in an area of shallow cover.

The two new Sabre Tenements lie only 5km along strike to the northeast of Andover and cover a target zone (“Andover Northeast”) where there is a bend in the structural corridor associated with a magnetic intrusion –a similar setting to the Andover lithium discovery (Figure 1).

These new tenement applications are in addition to the large area of tenements and applications at Sherlock Bay which cover the Andover East targets2 and also include significant northeast trending magnetic depletion zones indicative of structures intruded by buried, possibly pegmatitic intrusions (Figure 1).

Field investigation located a large area of outcropping pegmatites on the eastern side of the Andover East tenements in an erosional gully across a more than 140m wide zone (see location, Figure 1)2. Sampling of the outcropping pegmatites produced anomalous lithium (Li), cesium (Cs), rubidium (Rb) and gallium (Ga) results, indicating that the outcropping pegmatites may be at the eastern edge of a higher-grade lithium zone. Sampling of pegmatites intersected by drillhole SBDD0043 at Sherlock Bay nickel deposit also include highly anomalous lithium, rubidium and cesium results, indicative of LCT pegmatites4.

Zones of magnetic depletion to the north and west of the outcropping pegmatites, including a major northeast trending target corridor within the large new application, E47/5003, at Andover East (see Figure 1), represent targets for lithium bearing pegmatites of similar scale to the Andover lithium discovery.

The Sabre tenements at Andover Northeast and Andover East include northeast trending structural corridors and interpreted mafic/ultramafic intrusions. This is a similar geological scenario to the Andover lithium discovery. However, the lithium pegmatites at Andover outcrop, whereas the Company’s Andover Northeast and Andover East targets are located under soil/alluvium cover and have not been explored previously.

Following the grant of the new tenement applications, the Company will carry out a detailed geophysical program over the identified lithium-pegmatite target zones, including gravity and passive seismic measurements. This program will be designed to detect low-density (low-gravity) pegmatite intrusives within the northeast trending structural corridors along strike from Andover at Andover Northeast and on parallel structures at Andover East. Aircore drilling to bedrock will then test these buried targets for lithium bearing pegmatites.

Click here for the full ASX Release

This article includes content from Sabre Resources Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00