July 30, 2023

SensOre (ASX: S3N or the Company) is pleased to present its quarterly activities report for the period ending June 2023.

Highlights

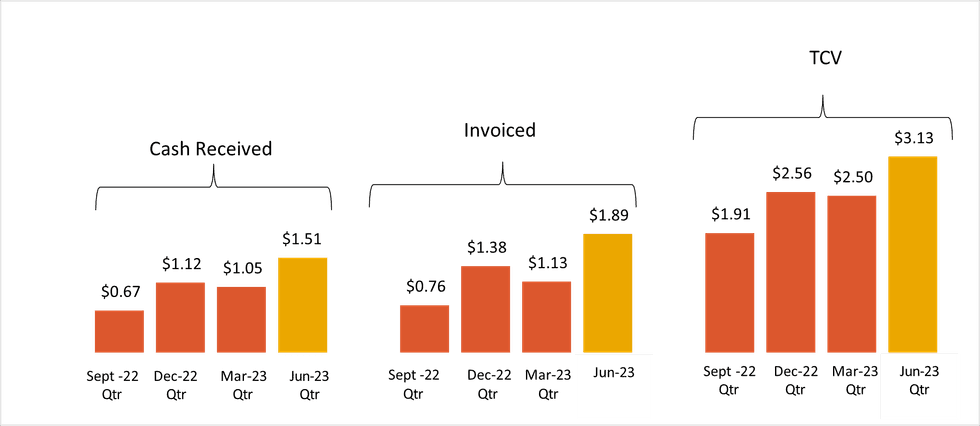

- Record quarterly invoices $1.89m (revenue from sales and grants) in Q4 FY2023

- Total revenue and grants increased 80% year-on-year to $7.02m (based on invoices for financial year 2023) when compared to combined SensOre-Intrepid 2022 performance of $3.89m.

- Operating cashflow positive for the quarter - excluding one-off items such as technology investment ($0.39m) and non-recurring exploration expenditure ($0.21m)

- Total Contract Value (TCV) has increased to $3.13m up from $2.50m in Q3 with several long-term software contracts being renewed

- Software and services significant milestones achieved:

- Commercial sales of new products Cauchy Downward Continuation (CDC), Simclust and AGLADS

- Significant inbound interest coincident with positive global developments in Artificial Intelligence

- Advances in utilising natural language processing on continental-scale geological meta data

- Exploration gathering momentum:

- Lithium targets – ramping up of joint-venture fieldwork and negotiation of final lithium targets in collaboration with Deutsche Rohstoff AG

- EIS Funding – successful in applications for $0.35m from the Exploration Incentive Scheme (EIS) WA to fund drilling on Auralia (nickel) and Moonera (copper)

- Corporate – completed capital raising $1.00m, SPP $0.95m (SPP $0.55m and $0.40m shortfall placement).

- Cash balance at 30 June 2023 $1.88m

CEO Richard Taylor commented:

“The team at SensOre are extremely encouraged by the performance of the group across all business segments this quarter and financial year. Operationally we reported another record quarter for invoices, an increase of 67% versus the prior quarter. TCV increased 25% compared to Q3 FY2023. Importantly for a high growth company, we achieved positive operating cashflow this reporting period.

We continued to see strong demand from existing and new clients for our technology, with sales of key geochemistry and geophysics tools accelerating in the June quarter. Our Lithium targeting with Deutsche Rohstoff is ramping up and we expect this to be a key focus area next year. Post the capital raise in the June quarter we are poised for another transformative year of growth across Technology Products, Services and Exploration.”

Contracts and Financial Results

Invoices raised during the quarter were $1.89m, an increase of 67% over the prior quarter. Cash receipts from customers and grants during the quarter were $1.51m, an increase of 46% from Q3 FY2023. Operational cashflow was positive for the quarter excluding one-off capital costs. The June quarter is historically strong for sales revenue. Billings, and subsequently cash receipts, vary month-by-month and quarter-by-quarter due to the anniversary dates of key contracts and the timing of services revenue in reaching project milestones. With closing trade receivables of $1.08m at the end of the quarter, cash receipts related to this will be received next quarter.

Total Contract Value (TCV) increased 25% compared to Q3 FY2023, on a net basis after depletion, with TCV of $3.13m this quarter compared to $2.50m previous quarter. TCV is the remaining value of current contracts. It depletes monthly, as the remaining term of the contract reduces. Several larger software renewals for 3-year periods contributed to the increase.

Technology

SensOre’s technology applies advances in AI and machine learning to large geoscience datasets to increase discovery performance, reduce exploration costs and minimise both the environmental footprint of exploration.

Productisation of Key Products

SensOre continued customer trials of its data platform solution for client engagements and a broader customer base to deliver seamless continental geoscience data. The commercial rollout continued at a measured pace as new learnings from client interaction and feedback were assimilated into the data layers in the platform.

SensOre accelerated sales of key geochemistry and geophysics services through proprietary innovation tools including SimClust, AGLADS, Moksha 2.5D and Cauchy Downward Continuation (CDC) in the June quarter.

Click here for the full ASX Release

This article includes content from SensOre, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

S3N:AU

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00