Highlights:

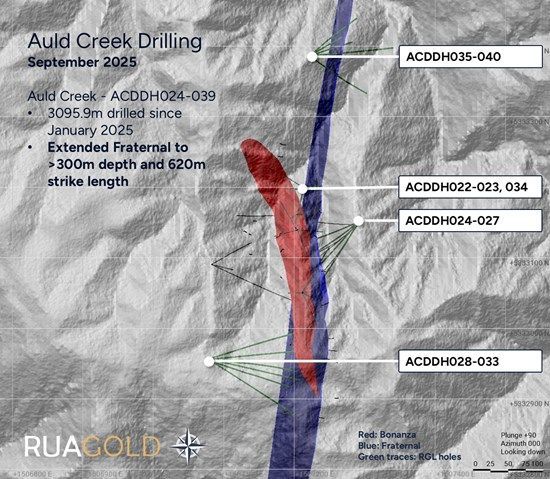

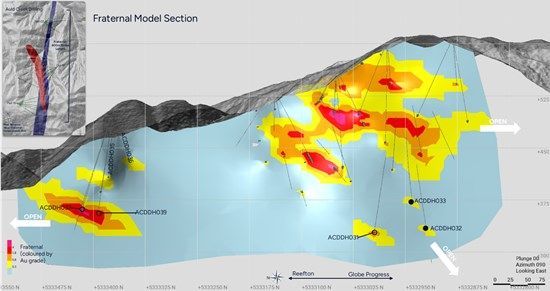

- Auld Creek hosts an inferred resource contained within two mineralized shoots, Bonanza and Fraternal, which outcrop at surface. Recent drilling has increased the vertical extent of the resource from 160m to 300m and increased the strike length from 350m to 620m. The resource remains open in all directions, with every drill hole intersecting the structure.

- Highlighted assay results show:

- ACDDH037: 8m @ 8.9g/t AuEq1 (6.2g/t Au & 0.6% Sb) from 158m depth

- Including 5m @ 11.1 g/t AuEq1 (7.0g/t Au & 1.0% Sb)

- Including 5m @ 11.1 g/t AuEq1 (7.0g/t Au & 1.0% Sb)

- ACDDH039: 17m @ 9.8 AuEq1 (3.6g/t Au & 1.5% Sb) from 155m depth

- Including 10m @ 15.3 g/t AuEq1 (5.0g/t Au & 2.4% Sb)

- Including 10m @ 15.3 g/t AuEq1 (5.0g/t Au & 2.4% Sb)

- ACDDH037: 8m @ 8.9g/t AuEq1 (6.2g/t Au & 0.6% Sb) from 158m depth

- Two rigs are currently drilling at Auld Creek, testing the Bonanza shoot in the north and the Fraternal shoot in the south. Surface soil geochemistry has confirmed the system can be traced over a 2.5km strike length.

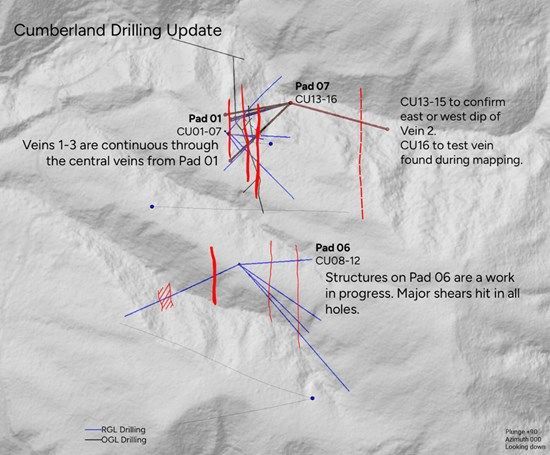

- The drilling program at the first Cumberland target, Gallant, has concluded after sixteen drill holes. Initial results were encouraging, identifying three correlated mineralized quartz veins; however, these have not demonstrated continuity on a larger scale due to structural complexity.

- Regional Program: VRIFY AI modelling has guided target generation for regional exploration work >30km south of Reefton at Bell Hill (refer to Figure 6). Initial surface rock-chip sampling of outcropping quartz veins returned grades of 14.2 g/t and 14.3g/t Au. September 8, 2025

Rua Gold Inc. (TSXV: RUA,OTC:NZAUF) (OTCQB: NZAUF) (WKN: A40QYC) ("Rua Gold" or the "Company") is pleased to provide an update on its ongoing drilling campaign at the Reefton Project, located on the South Island of New Zealand. The Company reports additional high-grade gold-antimony intersections, identified 270 meters north along strike of the current resource estimate.

Robert Eckford, CEO of Rua Gold, commented: "These drill results from Auld Creek have significantly expanded the scale and potential of the project, advancing us toward our goal of growing the resource base as outlined last month. Importantly, the mineralized system has now been extended both vertically and along strike, and remains open in all directions. With two rigs currently active on site and surface geochemistry confirming a 2.5-kilometre-long mineralized corridor, we are well positioned to build on this momentum.

At Cumberland, initial drilling identified well-mineralized quartz veins; however, the structural complexity has limited continuity on a broader scale. We will maintain a disciplined approach to prioritizing our targets and undertake further surface work before resuming drilling here.

Meanwhile, our regional exploration program is off to an encouraging start, with AI-assisted targeting and early rock-chip sampling returning grades of up to 14g/t gold more than 30km south of Reefton. These results highlight the scale of the opportunity as we work to unlock the full potential of the Reefton Goldfield."

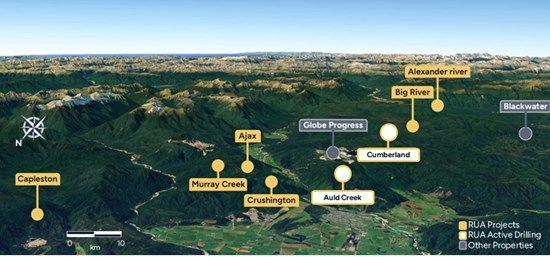

Figure 1: Overview of the Reefton Goldfield.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10755/265497_3b6e1d1e046aea24_007full.jpg

Figure 2: Core boxes from intercept ACDDH039 at Auld Creek

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10755/265497_ruagoldfig2.jpg

AULD CREEK

Rua Gold commenced drilling at Auld Creek in December 2024, with a targeted program designed to test four mineralised shoots identified through historical surface exploration and reinforced by this year's geochemical surveys and geological mapping.

Auld Creek is situated between two past-producing operations - the Globe Progress Mine and the Crushington Group of mines - which collectively produced 933,000oz at an average grade of 14.0g/t Au (Barry 1993). The current resource at Auld Creek is limited to two of the four known shoots, while soil geochemistry indicates strong potential for additional discoveries along a 2.5km strike length.

Since the Company's last update, seven holes (ACDDH033-039) have been completed, all of which intercepted the mineralized structure.

Assay results show:

- ACDDH033: 4.2m 1.27g/t Au from 264m depth

- ACDDH035: 2m 1.99g/t Au from 127m depth

- ACDDH036: 6m 0.88g/t Au from 84m depth

- ACDDH037: 8m 8.9g/t AuEq2 (6.2g/t Au & 0.6% Sb) from 158m depth

- ACDDH038: 3.5m 1.2g/t Au from 109m depth

- ACDDH039: 17m 9.8 AuEq2 (3.6g/t Au & 1.5% Sb) from 155m depth

ACDDH034 incepted the Bonanza shoot but there was no significant mineralization.

Drilling from the current campaign has extended the Fraternal shoot to more than 300m in vertical depth and 620m along strike, providing strong evidence of resource expansion potential ahead of the planned NI 43-101 resource update at year-end.

A second drill rig was mobilized in September. One rig is focused on testing the northern extent of Bonanza and infilling drill spacing along strike at Fraternal, while the second rig targets the southern extent of Fraternal.

Figure 3: Location of Auld Creek Drilling

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10755/265497_3b6e1d1e046aea24_011full.jpg

Figure 4: Fraternal ore shoots at Auld Creek.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10755/265497_3b6e1d1e046aea24_012full.jpg

CUMBERLAND

The Cumberland Mine Belt is 2.2 kilometer-long target, defined by strong arsenic soil geochemistry, located south of the Globe-Progress Mine. Drilling commenced in April 2025, focusing on the northern section, the Gallant Lode. The first two holes (CUDDH001 and CUDDH002) intersected 25m of mineralization, marking a strong start to the exploration of this historic mine camp. However, in subsequent holes the mineralization pinched out around 100m depth. In total, 16 holes have now been drilled at Cumberland this year, for a total of 2,370m (refer to Figure 5 below).

Drilling on this target has been paused while the team undertakes additional surface exploration work on the southern section of the Cumberland Gold Belt.

Figure 5: Initial drilling completed across the Cumberland Gallant target

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10755/265497_3b6e1d1e046aea24_013full.jpg

REGIONAL

Rua Gold has utilized VRIFY AI modelling to guide target generation in its southern regional exploration program. At the Bell Hill permit, located 34km south of Reefton, follow-up work identified two outcropping quartz veins.

Rock-chip samples from these outcrops returned assays of 14.3g/t Au (see Figure 6). Channel sampling of the outcrops has been completed, with assays pending.

Figure 6: Regional view showing location of rock chip samples from Bell Hill

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10755/265497_3b6e1d1e046aea24_014full.jpg

ABOUT Rua Gold

Rua Gold is an exploration company, strategically focused on New Zealand. With decades of expertise, our team has successfully taken major discoveries into producing world-class mines across multiple continents. The team is now focused on maximizing the asset potential of Rua Gold's two highly prospective high-grade gold projects.

The Company controls the Reefton Gold District as the dominant landholder in the Reefton Goldfield on New Zealand's South Island with over 120,000 hectares of tenements, in a district that historically produced over 2Moz of gold grading between 9 and 50g/t.

The Company's Glamorgan Project solidifies Rua Gold's position as a leading high-grade gold explorer on New Zealand's North Island. This highly prospective project is located within the North Islands' Hauraki district, a region that has produced an impressive 15Moz of gold and 60Moz of silver. Glamorgan is adjacent to OceanaGold Corporation's biggest gold mining project, Wharekirauponga.

For further information, please refer to the Company's disclosure record on SEDAR+ at www.sedarplus.ca.

TECHNICAL INFORMATION

Simon Henderson CP, AUSIMM, a qualified person under National Instrument 43-101 Standards of Disclosure for Mineral Projects and Chief Operating Officer and a director of Rua Gold, has reviewed and approved the technical disclosure contained herein. Mr. Henderson has participated in the geochemical sampling, and mapping programs to verify that they have been conducted in accordance with standard operating procedures. Mr. Henderson has verified the data disclosed by running checks on the location, analytical, and test data underlying the information in the technical disclosure herein.

QA/QC Drill Core

Core samples were sent to SGS Laboratories, Westport for sample preparation. SGS is independent of the Company. Samples were crushed and pulverized to 85% passing 75 µm. The pulverized rock-chips were split into two samples: a ~50 g sent for laboratory analysis, and the reject returned to RGL for pXRF analysis and storage. Pulverized rock-chip samples were analyzed for gold (Au) by 50-g fire assay with AAS finish at SGS Waihi (SGS Code FAA505); and for antimony (Sb) by Sodium Peroxide Fusion Analysis by ICP-MS at SGS Waihi.

QA/QC Rock Samples

Samples were crushed to 75% passing 2 mm (SGS code CRU75) and pulverised to 85% passing 75 µm (SGS code PUL85_CR). The pulverised rock-chips were split into two samples: a ~50 g sent for laboratory analysis, and the reject returned to Rua Gold for pXRF analysis and storage. Rock chip samples are selective by their nature, and not necessarily indicative of mineralization throughout the project.

Rua Gold Contact

Robert Eckford

Chief Executive Officer

Email: reckford@RUAGOLD.com

Website: www.RUAGOLD.com

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this new release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur and specifically include statements regarding: the Company's strategies, expectations, planned operations or future actions, including but not limited to exploration programs at its Reefton and Glamorgan projects and the results thereof. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements.

Investors are cautioned that any such forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. A variety of inherent risks, uncertainties and factors, many of which are beyond the Company's control, affect the operations, performance and results of the Company and its business, and could cause actual events or results to differ materially from estimated or anticipated events or results expressed or implied by forward looking statements. Some of these risks, uncertainties and factors include: general business, economic, competitive, political and social uncertainties; risks related to the effects of the Russia-Ukraine war; risks related to climate change; operational risks in exploration, delays or changes in plans with respect to exploration projects or capital expenditures; the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; changes in labour costs and other costs and expenses or equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, including but not limited to environmental hazards, flooding or unfavorable operating conditions and losses, insurrection or war, delays in obtaining governmental approvals or financing, and commodity prices. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements and reference should also be made to the Company's short form base shelf prospectus dated July 11, 2024, and the documents incorporated by reference therein, filed under its SEDAR+ profile at www.sedarplus.ca for a description of additional risk factors.

Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Table 1: Location of Auld Creek drill holes from RUA 2024-2025 program

| Hole ID | Easting | Northing | rL | Total Depth | Site _ID | Dip | Azimuth (true) | Year |

| ACDDH022 | 1507213 | 5333198 | 511.11 | 108.5 | Pad 10 | -54 | 193 | 2024 |

| ACDDH023 | 1507213 | 5333200 | 510.87 | 51.5 | Pad 10 | -60 | 85 | 2024 |

| ACDDH024 | 1507290 | 5333150 | 538.41 | 156.3 | Old Pad 13 | -37 | 220 | 2025 |

| ACDDH025 | 1507290 | 5333151 | 538.03 | 180.9 | Old Pad 13 | -54 | 248 | 2025 |

| ACDDH026 | 1507291 | 5333151 | 537.77 | 200 | Old Pad 13 | -59 | 231 | 2025 |

| ACDDH027 | 1507291 | 5333150 | 538.15 | 193.4 | Old Pad 13 | -45 | 212 | 2025 |

| ACDDH028 | 1507078 | 5332957 | 605.4 | 243.5 | Pad 18 | -50 | 104 | 2025 |

| ACDDH029 | 1507079 | 5332956 | 605.43 | 256 | Pad 18 | -50 | 120 | 2025 |

| ACDDH030 | 1507074 | 5332955 | 606.38 | 268.5 | Pad 18 | -53 | 85 | 2025 |

| ACDDH031 | 1507074 | 5332955 | 606.24 | 336 | Pad 18 | -65 | 74 | 2025 |

| ACDDH032 | 1507075 | 5332956 | 606.15 | 351.6 | Pad 18 | -70 | 108 | 2025 |

| ACDDH033 | 1507076 | 5332956 | 606.13 | 291.1 | Pad 18 | -64 | 92 | 2025 |

| ACDDH034 | 1507213 | 5333197 | 511.61 | 200 | Pad 10 | -72 | 267 | 2025 |

| ACDDH035 | 1507209 | 5333371 | 511.61 | 194.3 | Pad 02 | -53 | 85 | 2025 |

| ACDDH036 | 1507209 | 5333371 | 511.61 | 200.8 | Pad 02 | -60 | 125 | 2025 |

| ACDDH037 | 1507209 | 5333371 | 511.61 | 189.3 | Pad 02 | -62 | 49 | 2025 |

| ACDDH038 | 1507209 | 5333371 | 511.61 | 154.3 | Pad 02 | -67 | 72 | 2025 |

| ACDDH039 | 1507209 | 5333371 | 511.61 | 188 | Pad 02 | -75 | 60 | 2025 |

| ACDDH040 | 1507209 | 5333371 | 511.61 | 238.7 | Pad 02 | -67 | 39 | 2025 |

Table 2: Significant drilling intercepts at Auld Creek, full mineralized zone composites.

| Hole ID | From | To | Interval | Au (g/t) | Sb (%) |

| ACDDH026 | 175 | 175.9 | 0.9 | 0.96 | |

| ACDDH026 | 175.9 | 177.1 | 1.2 | 1.55 | |

| ACDDH027 | 152 | 153 | 1 | 2.52 | |

| ACDDH027 | 153 | 154 | 1 | 1.88 | |

| ACDDH027 | 154 | 155 | 1 | 3.44 | |

| ACDDH027 | 155 | 156 | 1 | 2.25 | |

| ACDDH027 | 156 | 157 | 1 | 1.84 | |

| ACDDH027 | 157 | 158 | 1 | 0.37 | |

| ACDDH027 | 158 | 159 | 1 | 0.15 | |

| ACDDH027 | 159 | 160 | 1 | 2.38 | 0.013% |

| ACDDH027 | 160 | 161 | 1 | 2.39 | 0.802% |

| ACDDH027 | 161 | 162 | 1 | 4.75 | 0.008% |

| ACDDH027 | 162 | 163 | 1 | 2.84 | 0.016% |

| ACDDH027 | 163 | 164 | 1 | 8.42 | 0.010% |

| ACDDH027 | 164 | 165 | 1 | 4.7 | 0.010% |

| ACDDH027 | 165 | 166 | 1 | 3.77 | 0.009% |

| ACDDH027 | 166 | 167 | 1 | 15 | 0.178% |

| ACDDH027 | 167 | 168 | 1 | 3.11 | 0.428% |

| ACDDH028 | 209.5 | 210.15 | 0.65 | 0.92 | |

| ACDDH028 | 210.15 | 210.6 | 0.45 | 18.4 | 11.600% |

| ACDDH028 | 210.6 | 211.4 | 0.8 | 8.28 | 4.680% |

| ACDDH028 | 211.4 | 212 | 0.6 | 1.68 | |

| ACDDH031 | 310.4 | 312.5 | 2.1 | 5.4 | 13.06% |

| ACDDH032 | 296 | 305 | 9.0 | 0.6 | |

| ACDDH033 | 263.8 | 265 | 1.2 | 2.09 | 0.30% |

| ACDDH033 | 265 | 266 | 1 | 0.54 | 0.02% |

| ACDDH033 | 266 | 267 | 1 | 1.58 | |

| ACDDH033 | 267 | 268 | 1 | 0.71 | |

| ACDDH035 | 127 | 128 | 1 | 2.48 | |

| ACDDH035 | 128 | 129 | 1 | 1.5 | |

| ACDDH036 | 84 | 85 | 1 | 1.63 | |

| ACDDH036 | 85 | 86 | 1 | 0.18 | |

| ACDDH036 | 86 | 87 | 1 | 0.21 | |

| ACDDH036 | 87 | 88 | 1 | 0.5 | |

| ACDDH036 | 88 | 89 | 1 | 0.68 | |

| ACDDH036 | 89 | 90 | 1 | 2.08 | 0.06% |

| ACDDH037 | 147 | 148 | 1 | 1.98 | 0.02% |

| ACDDH037 | 148 | 149 | 1 | 0.44 | |

| ACDDH037 | 149 | 150 | 1 | 1.55 | |

| ACDDH037 | 150 | 151 | 1 | 0.26 | |

| ACDDH037 | 151 | 152 | 1 | 0.05 | |

| ACDDH037 | 152 | 153 | 1 | 0.07 | |

| ACDDH037 | 153 | 154 | 1 | ||

| ACDDH037 | 154 | 155 | 1 | ||

| ACDDH037 | 155 | 156 | 1 | 0.07 | |

| ACDDH037 | 156 | 157 | 1 | 0.59 | 0.02% |

| ACDDH037 | 157 | 158 | 1 | 0.01% | |

| ACDDH037 | 158 | 159 | 1 | 10.8 | 0.04% |

| ACDDH037 | 159 | 160 | 1 | 10.8 | 0.79% |

| ACDDH037 | 160 | 161 | 1 | 8.46 | 0.02% |

| ACDDH037 | 161 | 162 | 1 | 6 | 1.70% |

| ACDDH037 | 162 | 163 | 1 | 7.49 | 2.31% |

| ACDDH037 | 163 | 164 | 1 | 2.15 | |

| ACDDH037 | 164 | 165 | 1 | 2.24 | |

| ACDDH037 | 165 | 166 | 1 | 1.93 | |

| ACDDH037 | 166 | 167 | 1 | 0.99 | |

| ACDDH037 | 167 | 168 | 1 | 1.05 | |

| ACDDH037 | 168 | 169 | 1 | 1.7 | 0.02% |

| ACDDH038 | 109.5 | 110.5 | 1 | 2.43 | |

| ACDDH038 | 110.5 | 111.3 | 0.8 | 0.59 | |

| ACDDH038 | 111.3 | 112 | 0.7 | 0.73 | |

| ACDDH038 | 112 | 113 | 1 | 0.43 | |

| ACDDH039 | 150 | 151 | 1 | 1.48 | 0.01% |

| ACDDH039 | 151 | 152 | 1 | 0.9 | 0.03% |

| ACDDH039 | 152 | 153 | 1 | 1.22 | 0.06% |

| ACDDH039 | 153 | 154 | 1 | 0.27 | 0.01% |

| ACDDH039 | 154 | 155 | 1 | 2.73 | 0.53% |

| ACDDH039 | 155 | 156 | 1 | 6.87 | 0.04% |

| ACDDH039 | 156 | 157 | 1 | 3 | 1.67% |

| ACDDH039 | 157 | 158 | 1 | 8.06 | 4.83% |

| ACDDH039 | 158 | 159 | 1 | 4.47 | 3.05% |

| ACDDH039 | 159 | 160 | 1 | 2.52 | 0.08% |

| ACDDH039 | 160 | 161 | 1 | 8.01 | 5.22% |

| ACDDH039 | 161 | 162 | 1 | 3.35 | 0.21% |

| ACDDH039 | 162 | 163 | 1 | 5.62 | 0.16% |

| ACDDH039 | 163 | 164 | 1 | 0.71 | 0.01% |

| ACDDH039 | 164 | 165 | 1 | 7.63 | 8.75% |

| ACDDH039 | 165 | 166 | 1 | 1.8 | 0.01% |

| ACDDH039 | 166 | 167 | 1 | 1.84 | 0.02% |

No significant mineralization noted in ACDDH034

Table 3: Location of Cumberland drill holes from RUA 2025 program

| Hole ID | Easting | Northing | rL | Total Depth | Site _ID | Dip | Azimuth (true) | Year |

| CUDDH001 | 1508688 | 5327986 | 619.24 | 89.9 | Pad 01 | -46 | 92 | 2025 |

| CUDDH002 | 1508688 | 5327986 | 619.22 | 104.8 | Pad 01 | -69 | 92 | 2025 |

| CUDDH003 | 1508687 | 5327987 | 619.06 | 157.8 | Pad 01 | -57 | 40 | 2025 |

| CUDDH004 | 1508688 | 5327986 | 619.08 | 194.5 | Pad 01 | -78 | 92 | 2025 |

| CUDDH005 | 1508689 | 5327987 | 619.11 | 133.7 | Pad 01 | -45 | 135 | 2025 |

| CUDDH006 | 1508685 | 5327989 | 618 | 47.6 | Pad 01 | -60 | 140 | 2025 |

| CUDDH007 | 1508689 | 5327987 | 619.21 | 149.6 | Pad 01 | -63 | 136 | 2025 |

| CUDDH008 | 1508699 | 5327857 | 647.53 | 246 | Pad 07 | -45 | 140 | 2025 |

| CUDDH009 | 1508699 | 5327857 | 647.58 | 146 | Pad 07 | -45 | 124 | 2025 |

| CUDDH010 | 1508699 | 5327857 | 647.58 | 146.2 | Pad 07 | -59 | 88 | 2025 |

| CUDDH011 | 1508699 | 5327857 | 647.58 | 209 | Pad 07 | -62 | 134 | 2025 |

| CUDDH012 | 1508699 | 5327857 | 647.58 | 177.7 | Pad 07 | -45 | 245 | 2025 |

| CUDDH013 | 1508750 | 5328017 | 604.49 | 163.2 | Pad 06 | -54 | 226 | 2025 |

| CUDDH014 | 1508750 | 5328017 | 604.49 | 94.5 | Pad 06 | -59 | 253 | 2025 |

| CUDDH015 | 1508750 | 5328017 | 604.49 | 169.2 | Pad 06 | -65 | 250 | 2025 |

| CUDDH016 | 1508750 | 5328017 | 604.49 | 200 | Pad 06 | -45 | 90 | 2025 |

Table 4: Table of Au intercepts from Cumberland drilling program.

| Hole ID | From | To | Interval | Au (g/t) |

| CUDDH001 | 44 | 45 | 1 | 16.17 |

| CUDDH001 | 45 | 46 | 1 | 1.12 |

| CUDDH001 | 46 | 47 | 1 | 1.61 |

| CUDDH002 | 64 | 65 | 1 | 1.03 |

| CUDDH002 | 65 | 66 | 1 | |

| CUDDH002 | 66 | 67 | 1 | 2.85 |

| CUDDH002 | 67 | 68 | 1 | 0.42 |

| CUDDH002 | 68 | 69 | 1 | 0.31 |

| CUDDH002 | 69 | 70 | 1 | 1.55 |

| CUDDH002 | 70 | 71 | 1 | 3.59 |

| CUDDH002 | 71 | 72 | 1 | 26.9 |

| CUDDH002 | 72 | 73 | 1 | 1.31 |

| CUDDH002 | 73 | 74 | 1 | 0.03 |

| CUDDH002 | 74 | 75 | 1 | 0.58 |

| CUDDH002 | 75 | 76 | 1 | 0.72 |

| CUDDH002 | 76 | 77 | 1 | 3.88 |

| CUDDH002 | 77 | 78 | 1 | 0.88 |

| CUDDH003 | 38 | 39 | 1 | 0.24 |

| CUDDH003 | 39 | 40 | 1 | 0.2 |

| CUDDH003 | 40 | 41 | 1 | 0.49 |

| CUDDH005 | 54.2 | 55.9 | 1.7 | 0.13 |

| CUDDH005 | 59.3 | 60.1 | 0.8 | 0.14 |

| CUDDH005 | 60.1 | 60.8 | 0.7 | 0.62 |

| CUDDH008 | 154 | 155 | 1 | 0.12 |

| CUDDH008 | 155 | 156 | 1 | 0.52 |

| CUDDH008 | 156 | 157 | 1 | 0.77 |

| CUDDH008 | 157 | 158 | 1 | 0.12 |

| CUDDH008 | 167 | 168 | 1 | 0.97 |

| CUDDH008 | 168 | 169 | 1 | 0.5 |

| CUDDH008 | 175 | 176 | 1 | 2.61 |

| CUDDH008 | 176 | 177 | 1 | 0.98 |

| CUDDH008 | 177 | 178 | 1 | 0.09 |

| CUDDH008 | 178 | 179 | 1 | 0.44 |

| CUDDH012 | 118 | 119 | 1 | 1.04 |

| CUDDH012 | 119 | 120 | 1 | 2.64 |

| CUDDH012 | 120 | 121 | 1 | 0.87 |

| CUDDH012 | 121 | 122 | 1 | 0.44 |

No significant mineralization noted in CUDDH004, CUDDH006, CUDDH007, CUDDH009, CUDDH010, CUDDH011, CUDDH013, CUDDH014, CUDDH015 and CUDDH016

Table 5: Location of Bell Hill rock samples

| Sample ID | Easting | Northing | rL | Au (g/t) | Year |

| GERS0895 | 1484012 | 5286738 | 243 | 14.3 | 2025 |

| GERS0896 | 1490781 | 5293290 | 378 | 14.2 | 2025 |

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/265497