(TheNewswire)

Vancouver, British Columbia TheNewswire - August 20, 2025, Rockland Resources Ltd. (the "Company" or "Rockland") (CSE: RKL,OTC:BERLF) (OTCQB: BERLF) (FSE: GB2) congratulates Kairos Power and Google on their groundbreaking collaboration with the Tennessee Valley Authority (TVA). This landmark agreement will see power supplied from Kairos's Hermes 2 Generation IV small modular reactor (SMR) to offset Google's data center electricity demand beginning in 2030.

A Milestone for Advanced Nuclear Energy

This agreement underscores several industry firsts:

-

First Commercial Gen-IV PPA – TVA becomes the first U.S. utility to contract power from a fluoride salt-cooled high-temperature reactor.

-

Scaling Clean Energy for AI – Google will secure clean energy attributes for up to 50 MWe of firm, carbon-free baseload power to support its data centers.

-

Accelerating Deployment – Hermes 2 is designed to deliver 50 MWe from a single unit, supported through the DOE's Advanced Reactor Demonstration Program.

-

Path to 500 MWe – This project is a step toward Google and Kairos's broader commitment to bring 500 MWe of advanced nuclear online by 2035.

Critical Minerals: The Beryllium Connection

-

As new reactor designs move closer to deployment, demand for critical minerals like beryllium is set to grow.

-

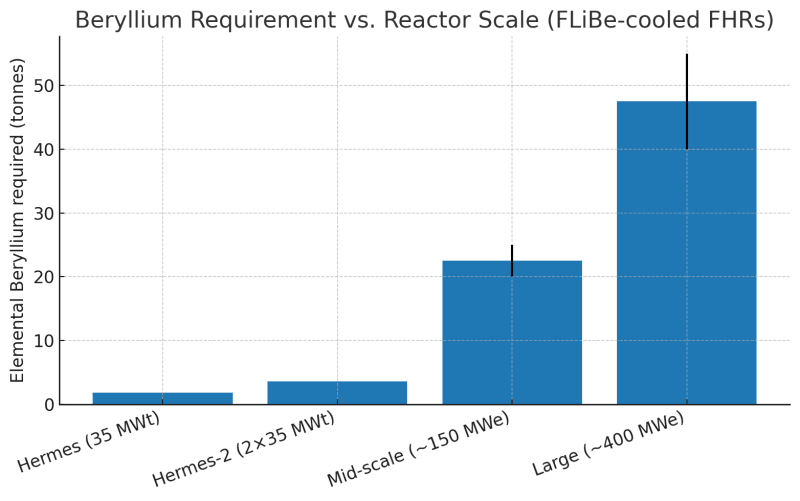

This breakdown illustrates the beryllium requirement per reactor when using FLiBe (LiF-BeF ) salt as a coolant (1) (2):

⚡ Test Reactor (35 MWt): ~1.8 t Be

⚡ Hermes-2 (2×35 MWt): ~3.6 t Be

⚡ Mid-scale FHR (~150 MWe): ~20–25 t Be

⚡ Large-scale FHR (~400 MWe): ~40–55 t Be

-

With global production hovering at ~330–400 tonnes per year, a single fleet of advanced reactors could represent a significant new source of demand.

For those of us in mining, energy, and critical minerals, the message is clear: beryllium supply security will be essential to enabling next-generation clean energy.

"At Rockland, we view this agreement as a pivotal moment for advanced nuclear energy and critical minerals alike," said Will Rascan, President of Rockland Resources. "Just as Kairos and Google are charting a path to decarbonize power for AI data centers, Rockland is working on its portfolio of beryllium projects located in the premium world production Spor Mountain district of Utah."

About Beryllium

Beryllium is a high-value, essential, light metal with wide applications in the aerospace, computer, telecommunications, electronics, medical, satellite, clean energy, and defense sectors. Anticipated future needs for beryllium, as well the limitation of having only a single source for US domestic use, places beryllium as both a critical and a strategic mineral according to US government sources.

About Rockland Resources Ltd. - Exploring For Tomorrow's Technology

Rockland Resources Ltd. (CSE: RKL,OTC:BERLF) (OTCQB: BERLF) (FSE: GB2) is specializing in beryllium discovery and development at its strategically located Meteor, Beryllium Butte and Claybank projects in the Spor Mountain region of Utah, USA. Spor Mountain is home to Materion's (NYSE: MTRN) Spor Mountain Mine, the largest beryllium producer in the world and continuously mined since 1969. In 2024 the Fraser Institute ranked Utah as the prime jurisdiction in the world for mining investment. Rockland has a unique position in its jurisdiction, properties in Spor Mountain, and a recently assembled team with a great depth in the exploration, recovery and marketing of beryllium.

The Company also holds a 100%-interest in the Cole Gold Mine, located in the western portion of the prolific Red Lake gold district of Ontario.

References:

(1) https://www.nrc.gov/docs/ML2127/ML21272A383.pdf

(2) https://www.energy.gov/ne/articles/kairos-power-wraps-molten-salt-testing-project

On Behalf of the Board of Directors

Michael England, CEO & Director

For further information, please contact:

Mike England

Email: mike@engcom.ca

N ei t h e r t he Canadian Securities Exchange nor i t s R e gu l a t i on Ser v ice s P r o v i d e r a c c e p t s re s pon s i b ili t y f or t he ad e qua c y or a cc u r a c y of t h i s rele a s e .

Copyright (c) 2025 TheNewswire - All rights reserved.