November 05, 2024

With a market capitalization of approximately C$10 million and no debt, Riverside Resources (TSXV:RRI) has successfully advanced over 80 exploration projects and has completed seven successful spinouts and royalty transactions over its 17-year history. Founded in 2007, the company focuses on precious and base metals, with a unique business model designed to minimize financial risk while maximizing exploration opportunities.

Riverside's diversified portfolio spans different geographies and commodities, including gold, silver, copper and rare earth elements (REE) in Ontario and British Columbia in Canada, and across Mexico. Riverside is well-capitalized, with over $5 million in cash on hand, no debt, and a well-established royalty portfolio. This strong financial position allows the company to continue exploring new opportunities while reducing operational risks.

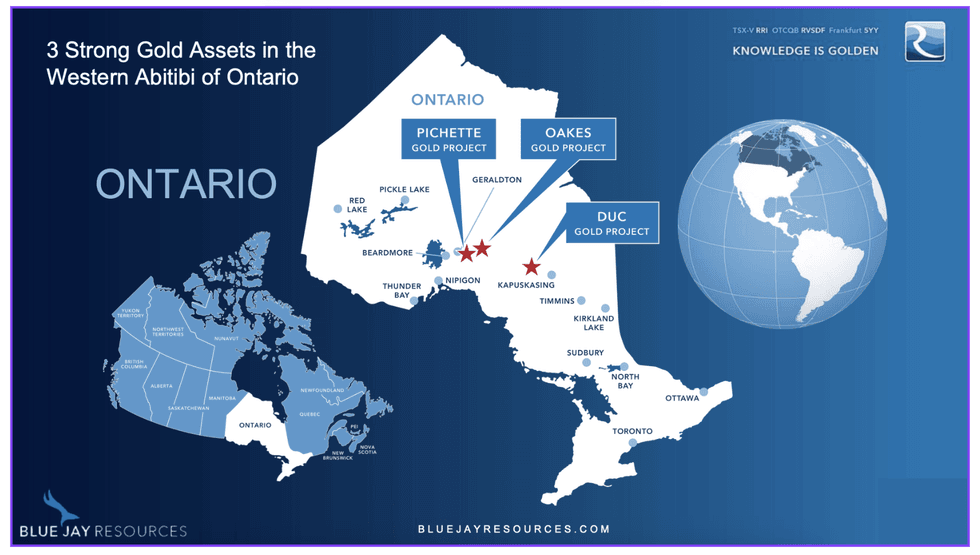

Riverside Resources' Ontario-based gold projects are located in the Western Abitibi region, one of Canada's most prolific gold-producing areas. The company's assets are near Equinox Gold's Greenstone gold mine, which provides significant potential for future development or acquisition. The Greenstone mine is expected to produce more than 390,000 ounces of gold annually for the first five years of its over 15 years of mine life. As this mine nears the end of its life, Riverside's nearby properties could provide valuable ore, potentially making them attractive targets for acquisition by Equinox or other major players in the region.

Company Highlights

- Riverside Resources has successfully advanced over 80 exploration projects using more than $85 million in partner-funded exploration.

- Riverside’s Ontario gold projects are strategically located near Equinox Gold’s Greenstone Mine, offering significant potential for future development or acquisition.

- The Cecilia gold-silver project in Sonora, Mexico, is advancing through a partner-funded drilling program with Fortuna Silver Mines, offering significant discovery potential.

- With over C$5 million in cash and no debt, Riverside Resources is financially strong, ensuring sustained exploration activity.

- The company has completed seven successful spinouts and royalty transactions over its 17 year history, creating substantial value for shareholders.

- The company’s business model minimizes financial risk by partnering with larger companies, enabling multiple simultaneous exploration projects.

This Riverside Resources profile is part of a paid investor education campaign.*

Click here to connect with Riverside Resources (TSXV:RRI) to receive an Investor Presentation

RRI:CC

The Conversation (0)

03 November 2024

Riverside Resources

Project generator with a diversified portfolio of gold, silver, copper and REE assets in Canada and Mexico

Project generator with a diversified portfolio of gold, silver, copper and REE assets in Canada and Mexico Keep Reading...

9h

As Gold Investment Surges, Fake Platforms and AI Drive New Fraud Wave

As gold prices continue to soar past record highs, investors are pouring billions into bars, coins, and digital tokens. However, regulators and analysts warn that the same rally is fueling a surge in scams that are quietly draining retirement accounts and life savings.Gold has long been marketed... Keep Reading...

11h

Peruvian Metals Announces the 10-Year Renewal of the Use of Surface Rights at the Aguila Norte Processing Plant

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that the Company has renewed the lease on the use of the surface rights at its 80-per-cent-owned Aguila Norte processing plant ("Aguila Norte" or the "Plant") located in... Keep Reading...

27 February

American Eagle Announces $23 Million Strategic Investment Backed by Eric Sprott

Highlights:The investment adds a third strategic investor, when combined with investments by mining companies South32 Group Operations PTY Ltd. and Teck Resources LimitedThe Offering funds significantly expanded drill programs for 2026 and 2027 at the Company's NAK copper-gold porphyry project... Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00