April 19, 2023

Battery and critical metals explorer and developer Pan Asia Metals Limited (ASX: PAM) (‘PAM’ or ‘the Company’) is pleased to report that it has received the results from sulphate roast and lithium extraction on samples of lepidolite concentrates from the Reung Kiet Lithium Prospect.

HIGHLIGHTS

- Lepidolite concentrates derived from fresh and weathered mineralisation subjected to sulphate roasting and water leaching testwork results received.

- Excellent recoveries achieved, ranging up to 88% lithium (Li) extraction.

- Ten tests undertaken on concentrates derived from fresh mineralisation (5) and oxidised mineralisation (5).

- Fresh concentrate tests yielded slightly better lithium extraction compared to oxidized concentrates.

- Further optimisation testwork is underway.

- Further work to also test concentrates derived from optically sorted ore to be undertaken.

Pan Asia Metals Managing Director Paul Lock said: “We are very pleased with these results, particularly so as we achieved lithium recoveries of up to 88% in the first round of our roasting and leaching testwork, and greater than 80% with lower reagent use. With additional testwork we are confident of achieving better results, we are aiming for recoveries in the mid to high ‘80s and plan to achieve this through further work on roast reagent ratios, roast time and temperature and the effect of agglomerating the roast feed, as well as using a concentrate derived from sorted ore.”

Two samples of lepidolite concentrate, weighing approximately 1kg each, were delivered to ALS Metallurgy in Perth in late December, 2022. These two concentrate samples were generated from the testwork program performed by BGRIMM Technology Group (BGRIMM) during 2022.

Testwork method

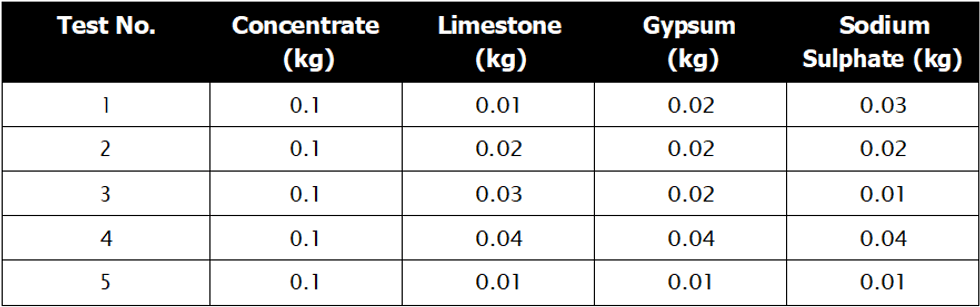

The fresh (Fr) and oxide (Ox) samples were milled to 80% passing 125 microns (0.125mm). These samples were then split into 5 x 100 gram samples. Each 100g sample was mixed with three roast reagents (limestone, gypsum and sodium sulphate) at quantities shown in Table 1. Water was added to achieve a moisture content of 20%.

The roast feed samples were then roasted in a kiln at 900°C for 1hr with small sub- samples then taken for XRD analysis. The remaining roast product samples were leached in de-ionised (DI) water (20% solids) at 60°C for 1 hour. At the end of the leach period, the slurry was filtered. The filtrate was assayed. The residue was re-pulped with DI water (20% solids) and washed (re-leached) at 60°C for 1 hour and the filtration step repeated. The re-pulp procedure was repeated. The final residue was assayed.

Click here for the full ASX Release

This article includes content from Pan Asia Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PAM:AU

The Conversation (0)

09 July 2023

Pan Asia Metals

First-mover Advantage in Critical Metals for Southeast Asia Market

First-mover Advantage in Critical Metals for Southeast Asia Market Keep Reading...

17h

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00