May 22, 2022

Anson Resources Limited (Anson or the Company) is pleased to announce that its resource expansion drilling program has reached the target depth for the commencement of drilling into the priority Mississippian Units at the Long Canyon No. 2 well, at the Company’s Paradox Lithium Project (“the Project”) in Utah, USA.

Highlights:

- Drilling at Long Canyon No. 2 Well has reached the target depth of 2,334m (7,670ft) at the top of the Mississippian units

- Drilling of Mississippian units at Long Canyon No. 2 is a key part of Anson’s resource expansion program at the Paradox Lithium Project in Utah

- The Mississippian brine aquifer hosts a substantial lithium-rich zone of approximately 100m-250m thickness

- Drilling is designed to convert existing Exploration Target into Indicated and Inferred JORC Resources

- Drill chips through the entire units will be collected for analysis

- Brine samples to be assayed for lithium, bromine and other minerals and diamond core drilling to be conducted for porosity, specific yield and permeability

- All results to be incorporated in a JORC Resource upgrade

Drilling has reached the target depth of 2,334 metres (7,670 feet) at Long Canyon No.2 well. This represents a key milestone in the current phase of Anson’s resource expansion program at the Paradox Lithium Project.

Drilling at Long Canyon No. 2 well is designed to target the large Mississippian supersaturated brine aquifer in this unit, with the aim of converting the previously identified Exploration Target into an Indicated and Inferred Resource (see ASX Announcement 17 January 2022). The planned JORC Resource upgrade will support the Detailed Feasibility Study and the development of the Paradox Lithium Project into a substantial lithium (and bromine) producing operation. Leading global engineering solutions firm Worley is undertaking the DFS (see ASX announcement 24 November 2021).

The previously sampled Clastic Zone 31 horizon has been sealed and the cast iron plugs of the abandoned well have now been drilled out. This will enable access to the Mississippian units to collect brine samples for testing for lithium and other minerals. The drilling of the Mississippian Units is expected to be completed next month and results will be released when available. Drilling will also include the collection of diamond core to be used to estimate porosity, specific yield and permeability which are required for the JORC Resource upgrade.

Paradox Lithium Project Resource Expansion Strategy

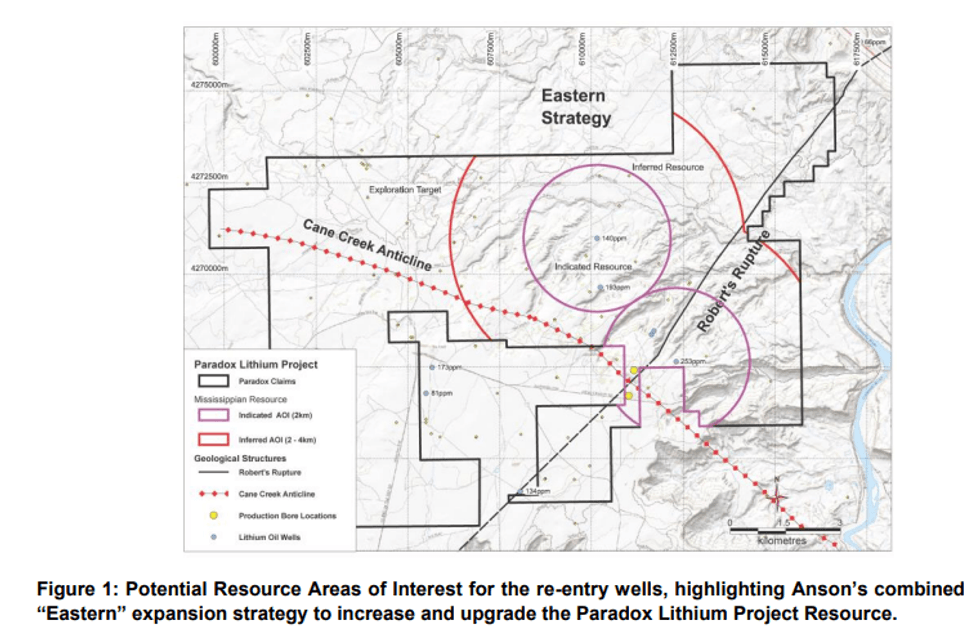

Anson’s resource expansion drilling program is focused on delivering a significant resource upgrade at the Paradox Lithium Project and is comprised of a combined “Eastern” and “Western” expansion strategy.

The Company’s resource expansion strategy is focused on:

- Increasing the existing JORC 2012 estimates both vertically and horizontally at existing targets across the Paradox Lithium Project area; and

- Defining resources at new claims to be added adjacent to the Paradox Lithium Project.

The current drilling at Long Canyon No.2 well along with planned upcoming drilling at Cane Creek 32-1 well allows Anson to execute the “Eastern” component of the Paradox Lithium Resource expansion strategy in full (see ASX Announcement 24 February 2022) see Figure 1.

Click here for the full ASX Release

This article includes content from Anson Resources Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ASN:AU

The Conversation (0)

08 June 2022

Anson Resources

Developing a Near-Term Clean Energy Project in Utah

Developing a Near-Term Clean Energy Project in Utah Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00