3.10 gt Au, 25.52 gt Ag, 4.09% Cu, 12.06 gt Pd, 2.00 gt Pt Cu EqRec 1 10.99% over 12.54 m in PML-25-012a

1.32 g/t Ag, 0.60% Cu, 0.24g/t Pd, and 0.26 Ni – Cu EqRec 1 1.22% over 11.25 m in PMN-25-004

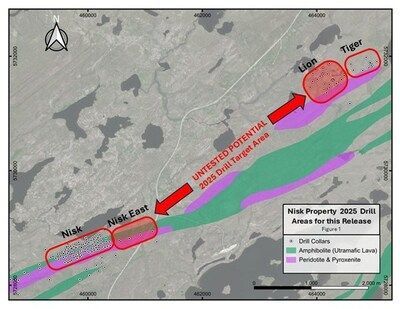

TORONTO , June 4, 2025 /CNW/ - Power Metallic Mines Inc . (the "Company" or "Power Metallic" ) (TSXV: PNPN) (OTCBB: PNPNF) (Frankfurt: IVV) is pleased to announce the return of the final 11 holes from the winter 2025 drilling campaign focused on the Lion Zone (9 holes) and Nisk East (2 holes). The nine holes at lion (PML-25-005 to 013) were testing multiple areas of the Lion Zone, including the down plunge extent, shallow sub-crop projections, in-fill drilling of the Lion Zone, and testing of off-hole EM (BHEM) anomalies west of Lion (Table 1). The general location of the drilling in this news release for the Lion Zone and Nisk East Zone is shown in Figure 1.

LION ZONE DRILL RESULTS

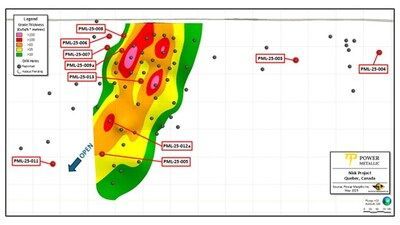

The nine holes reported in this release were testing the deeper plunge extent on the western side of the Lion Zone; shallow sub-cropping interpreted locations of the Lion Zone, and internal in-fill drilling to better define the heterogenous width and grade of the Lion Zone in preparation for a future mineral resource estimate.

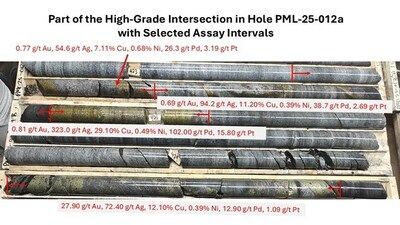

Holes PML-25-005 and 012a were testing the down plunge extent of the western side of the Lion Zone. Both holes intersected substantial polymetallic zones ( 3.10 g/t Au, 25.52 g/t Ag, 4.09% Cu, 12.06 g/t Pd, 2.00 g/t Pt – Cu EqRec 1 10.99% over 12.54 m in PML-25-012a – Figure 2) indicating a potential shift to the west for the plunge of the high grade portion of the Lion zone. This plunge direction will be followed up by early drill holes in the spring/summer drill campaign starting in early June.

"Well apologies that took a lot longer than I thought. We try and provide as much visibility as possible but there were some unforeseen delays. That being said we think they have been worth the wait. The team is very keen to get that suite of holes between Nisk and Lion and let's just see how connected these mineralized areas are!" commented Power Metallic CEO Terry Lynch .

Holes PML-25-006 through 009a tested interpreted shallow sub-crop locations for the Lion Zone. The shallow areas of Lion were gaps in our knowledge of the deposit. All holes hit low grade hanging-wall style mineralization but failed to intersect the high-grade zones encountered in deeper drill holes.

Hole PML-25-13 was specifically targeted on a wide gap in drill spacing that was interpreted as a relatively low grade portion of the Lion Zone. This hole intersected better than expected mineralization including 0.15 g/t Au, 3.73 g/t Ag, 1.48% Cu, 1.49 g/t Pd and 0.44 g/t Pt over 5.83 meters, effectively filling a hole in the projection of the Lion Zone.

Figure 3 below shows a revised long-section with pierce points of the drill holes with assays reported in this news release. Significantly, the southwestern plunge direction remains open for additional increases to the size of Lion, and this will be our first target tested in the spring/summer drill campaign.

NISK EAST DRILL RESULTS

Two holes were targeted on areas east of the Nisk Deposit (MRE 2023), termed Nisk East in previous press releases. Historical drilling in the area had given indications of possible Lion, or Lion-Nisk hybrid style mineralization through indicator minerals located in stratigraphic positions conducive for Lion style zones. Hole PMN-25-003 failed to intersect any significant mineralization, but hole PMN-25-004 hit Lion style mineralization on the stratigraphic footwall to the ultra-mafic sill, like Lion's location. Additional mineralization extended into the ultra-mafic with Ni-Cu Nisk style sulphide mineralization. This discovery will be followed up by drilling in the spring/summer drill campaign and this success provides proof of exploration concepts along the untested target strike length between the Nisk and Lion zones.

Table 1: Significant assay results from this news release - Lion and Nisk East Zones

| Lion Zone - Significant assay from holes PML-25-005, 006 | Comment | |||||||||||

| Hole | From | To | Length | Au | Ag | Cu | Ni | Pd | Pt | Co | CuEq | |

| (m) | (m) | (m) | (g/t) | (g/t ) | ( %) | ( %) | (g/t ) | (g/t ) | ( %) | ( %) | | |

| PML-25-005 | 526.00 | 548.50 | 22.50 | 0.20 | 8.83 | 1.03 | 0.05 | 2.74 | 0.47 | 0.00 | 2.24 | Deep |

| Including | 543.30 | 548.50 | 5.20 | 0.56 | 25.38 | 4.00 | 0.19 | 11.84 | 2.01 | 0.01 | 8.99 | |

| Including | 543.30 | 545.30 | 2.00 | 1.09 | 60.75 | 8.67 | 0.25 | 25.65 | 4.86 | 0.01 | 19.22 | |

| PML-25-006 | 77.40 | 80.15 | 2.75 | 0.12 | 5.84 | 1.69 | 0.14 | 1.07 | 0.03 | 0.01 | 2.18 | Shallow holes |

| PML-25-007 | 114.05 | 121.05 | 7.00 | 0.12 | 2.57 | 0.59 | 0.08 | 0.45 | 1.74 | 0.01 | 1.42 | |

| Including | 115.05 | 117.05 | 2.00 | 0.21 | 3.90 | 1.20 | 0.13 | 1.16 | 5.57 | 0.00 | 3.44 | |

| PML-25-008 | 74.77 | 76.77 | 2.00 | 0.15 | 265.00 | 2.10 | 0.07 | 1.87 | 1.38 | 0.00 | 3.21 | |

| PML-25-009a | From 30-130 meters scattered Cu-Au-Ag with 0.30-0.70% CuEq (35m mineralized) | |||||||||||

| and | 139.32 | 140.32 | 1.00 | 0.32 | 9.80 | 1.33 | 0.14 | 1.59 | 0.01 | 0.01 | 2.24 | |

| PML-25-010 | No significant assays | Testing BHEM | ||||||||||

| PML-25-011 | 422.70 | 424.70 | 2.00 | 0.01 | 1.40 | 0.20 | 0.27 | 0.54 | 0.08 | 0.01 | 0.99 | |

| PML-25-012a | 418.21 | 430.75 | 12.54 | 3.10 | 35.52 | 4.09 | 0.20 | 12.06 | 2.00 | 0.01 | 10.99 | 100m up |

| Including | 423.42 | 425.93 | 2.51 | 0.75 | 124.91 | 13.21 | 0.53 | 46.62 | 5.55 | 0.03 | 31.40 | |

| PML-25-013 | 263.50 | 276.00 | 12.50 | 0.13 | 2.56 | 0.77 | 0.02 | 0.73 | 0.22 | 0.00 | 1.10 | In-fill drilling |

| Including | 267.23 | 273.06 | 5.83 | 0.15 | 3.73 | 1.48 | 0.03 | 1.49 | 0.44 | 0.00 | 2.05 | |

| Including | 267.23 | 269.23 | 2.00 | 0.28 | 7.15 | 4.09 | 0.08 | 3.09 | 0.57 | 0.00 | 4.95 | |

| | | | | | | | | | | | | |

| Nisk East Zone - Significant assay from holes PMN-25-003, 004 | | |||||||||||

| Hole | From | To | Length | Au | Ag | Cu | Ni | Pd | Pt | Co | CuEq | |

| (m) | (m) | (m) | (g/t) | (g/t ) | ( %) | ( %) | (g/t ) | (g/t ) | ( %) | ( %) | | |

| PMN-25-003 | No significant assays | | ||||||||||

| PMN-25-004 | 247.00 | 258.25 | 11.25 | 0.02 | 1.32 | 0.60 | 0.26 | 0.24 | 0.08 | 0.02 | 1.22 | Nisk East |

| Including | 247.00 | 251.00 | 4.00 | 0.01 | 2.86 | 1.49 | 0.29 | 0.44 | 0.19 | 0.02 | 2.10 | |

| Including | 247.00 | 249.00 | 2.00 | 0.01 | 5.40 | 2.93 | 0.33 | 0.60 | 0.25 | 0.02 | 3.44 | |

| Note: Reported length is downhole distance; true width based on model projections is estimated as 85% of downhole length |

1 Copper Equivalent Rec Calculation (CUEqRec 1 )

CuEqRec represents CuEq calculated based on the following metal prices (USD) : 2,360.15 $/oz Au, 27.98 $/oz Ag, 1,215.00 $/oz Pd, 1000.00 $/oz Pt, 4.00 $/lb Cu, 10.00 $/lb Ni and 22.50 $/lb Co., and a recovery grade of 80% for all commodities, consistent with comparable peers.

PROGRESS ON SPRING/SUMMER DRILL CAMPAIGN START-UP

As previously disclosed (news release April 30, 2025 ), Power Metallic is expanding its core facility to accommodate up to six drills turning. Currently the area of the old core facility has been moved or dismantled and useable structures from that facility have been co-opted into office, storage, safety, core cutting and medical units. New core buildings are beginning to arrive (converted containers – Figure 4, 5), with the first two units in place, and electrical hook-ups being prepared.

Drilling is scheduled to start on June 6 with two drills. By the end of June, with the delivery of the next two core logging units, production will be increased to four drills. Initial drilling will be focused on expanding the Lion zone, with follow-up drilling beginning to explore the strike extensions of the favorable stratigraphy from the Lion and Nisk zones, including exploration along the Tiger trend.

Drilling during the spring/summer will be a combination of overland and helicopter supported drilling. As we move into the fall freeze up and acquire the final two core logging containers, exploration will expand to six drills.

As previously advised, the summer period will include extensive mapping and prospecting carried out in parallel with airborne EM surveying over prospective target areas. Power Metallic has planned the logistics and support for carrying out this largest exploration effort on the project to date.

Previously released drill results are available in a public database accessible as a download on Power Metallic's website. Currently this database contains hole assay and collar information up to hole PML-25-002 and will be updated as soon as possible with all remaining publicly released holes.

Qualified Person

Joseph Campbell , P.Geo, VP Exploration at Power Metallic, is the qualified person who has reviewed and approved the technical disclosure contained in this news release.

About Power Metallic Inc.

Power Metallic is a Canadian exploration company focusing on developing the High-Grade Nickel Copper PGM, Gold and Silver Nisk project into Canada's next polymetallic mine.

On February 1, 2021 , Power Metallic (then called Chilean Metals) completed the acquisition of its option to acquire up to 80% of the Nisk project from Critical Elements Lithium Corp. (CRE: TSXV).

The NISK property comprises a large land position (20 kilometres of strike length) with numerous high-grade intercepts. Power Metallic is focused on expanding the high-grade nickel-copper PGM, Gold and Silver mineralization with a series of drill programs designed to evaluate the initial Nisk discovery zone, the Lion discovery zone and to explore the land package for adjacent potential poly metallic deposits.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

QAQC and Sampling

GeoVector Management Inc ("GeoVector") is the Consulting company retained to perform the actual drilling program, which includes core logging and sampling of the NQ size drill core.

All samples were submitted to and analyzed at Activation Laboratories Ltd ("Actlabs"), an independent commercial laboratory for both the sample preparation and assaying. Actlabs is a commercial laboratory independent of Power Metallic with no interest in the Project. Actlabs is an ISO 9001 and 17025 certified and accredited laboratories. Samples submitted through Actlabs are run through standard preparation methods and analysed using RX-1 (Dry, crush (

GeoVector's QAQC program includes regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results. QAQC and data validation was performed, and no material errors were observed.

Cautionary Note Regarding Forward-Looking Statements

This message contains certain statements that may be deemed "forward-looking statements" concerning the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential," "indicates," "opportunity," "possible" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, among others; the timing for various drilling plans; the ability to raise sufficient capital to fund its obligations under its property agreements going forward and conduct drilling and exploration; to maintain its mineral tenures and concessions in good standing; to explore and develop its projects; changes in economic conditions or financial markets; the inherent hazards associates with mineral exploration and mining operations; future prices of nickel and other metals; changes in general economic conditions; accuracy of mineral resource and reserve estimates; the potential for new discoveries; the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the projects and if accepted, to obtain such licenses and approvals in a timely fashion relative to the Company's plans and business objectives for the applicable project; the general ability of the Company to monetize its mineral resources; and changes in environmental and other laws or regulations that could have an impact on the Company's operations, compliance with environmental laws and regulations, dependence on key management personnel and general competition in the mining industry.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/power-metallic-intercepts-12-54-meters-of-10-99-cueq-at-the-lion-zone-and-11-25m-of-1-22-cueq-at-nisk-east---first-lion-like-mineralization-intercepted-near-the-nisk-zone-302473285.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/power-metallic-intercepts-12-54-meters-of-10-99-cueq-at-the-lion-zone-and-11-25m-of-1-22-cueq-at-nisk-east---first-lion-like-mineralization-intercepted-near-the-nisk-zone-302473285.html

SOURCE Power Metallic Mines Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/June2025/04/c5649.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/June2025/04/c5649.html