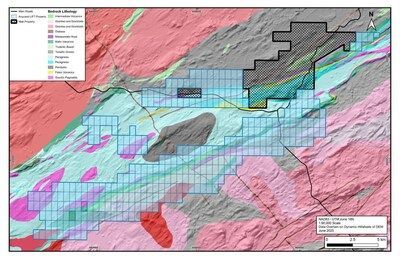

Power Metallic Mines Inc . (the "Company" or "Power Metallic") (TSXV: PNPN) (OTCBB: PNPNF) (Frankfurt: IVV) is pleased to announce it has executed a definitive agreement dated June 9, 2025 to acquire a 100 % interest in 313 mineral claims totalling 167 km² from Li-FT Power Ltd. ("Li-FT") (TSXV: LIFT) (OTCQX: LIFFF) (FRA: WS0). The claims adjoin the Company's 45.86 km² Nisk property, where exploration is expanding the high–grade Lion Cu–PGE discovery and the Nisk Ni–Cu–Co deposit. On closing, Power Metallic's land position will grow more than 300% to ~212.86 km², securing approximately 20 km of strike on the northern basin margin and 30 km on the southern margin that envelope the Nisk, Lion, and Tiger discoveries.

Nisk Project Area

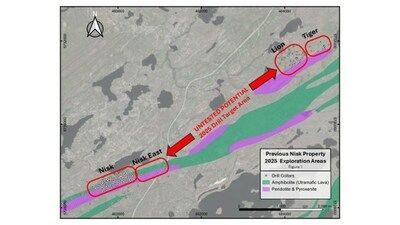

The Nisk-Lion-Tiger discoveries have established a new polymetallic district with considerable potential for additional deposits. These deposit types are globally rare but form clusters at district and camp scale (Noril'sk and Talnakh, Kevitsa and Sakatti, as relevant examples). Currently discovered polymetallic mineralization on the Nisk property has been confined to a major translithospheric structure along the sedimentary basin margin defining the locations of the Nisk, Lion, and Tiger discoveries (Figure 1 map of original Nisk targets overlain on geology).

Work by Power Metallic and Li-FT has identified a larger region proximal to the Nisk property that has additional potential for polymetallic deposits. Significantly Power Metallic sees potential in the wider basin where exploration to date suggest conditions similar to those at the Nisk-Lion-Tiger discoveries. The land purchased from Li-FT covers a further 20 km of strike length along the northern margin of the basin that contains Nisk-Lion-Tiger, and the most prospective 30 km of strike length along the southern basin margin, which has been identified by Power Metallic through regional geophysics as prospective, and corroborated by extension soil and till elemental anomalies from surveys carried out by Li-FT (Figure 2 map of regional play with New property, showing relative size with original Nisk property). The control of the most readily accessible prospective geology proximal to the known mineralizing system (Nisk-Lion-Tiger) gives Power Metallic the opportunity to control the discovery of multiple polymetallic deposits within the identified regional system across both its 80% owned properties and its 100% owned properties.

Steve Beresford , Director and Special Advisor, stated:

"Polymetallic deposits have unique primary and secondary geochemical footprints (that contrast with Nickel dominant sulfide deposits like Voisey's Bay) that enable us to recognize early the tip of the iceberg i.e. extensions of Lion or mimics that represent new camp to district scale opportunities. We know a lot about how these deposits spatially cluster that's different to lode Au or VMS, and now is the time to own the whole opportunity".

Purchase Agreement Terms

The purchase of the 100% interest in the claims (exclusive exploration rights) requires a $700,000 cash payment to Li-FT and the issuance of 6,000,000 common shares of the Company (the " Shares "). All the Shares will have a statutory hold period of four months and a day from issuance in accordance with Canadian securities laws. 3,000,000 of the 6,000,000 Shares will also bear a 12 month hold and restriction from transfer. Additionally, Li-FT will retain a 0.5% NSR on all acquired claims. The share–weighted consideration preserves cash for drilling while giving both Power Metallic and Li–FT exposure to the exploration upside in the basin. The issuance of the Shares is subject to the Company's receipt of approval from the TSX Venture Exchange.

Fully Funded 100,000–Metre Drill Program Through 2026

The drilling rig has been collared on the first hole of the summer program. We are resuming work along the Nisk–Lion–Tiger trend while integrating its newly acquired LIFT claims—an expansion that increases the Company's land position more than 300%. Field crews will mobilize in successive waves beginning the last week of May, with camp upgrades—including grid–power wiring for new core–logging facilities—well underway. Drilling will initially recommence in the Nisk-Lion-Tiger area to expand current zones. It is anticipated that by early fall of 2025 the core facility capacity will be ramped up to six drills enabling quicker exploration target turnaround and flexibility to follow exploration successes on the expanded Nisk Project Area.

Key elements of the work program

- District–scale data integration. Historical technical data from the LIFT claims are being compiled alongside existing datasets to refine regional targeting.

- Airborne & ground geophysics. A large–scale airborne EM survey—followed by targeted ground EM—will seek near–surface conductors.

- Systematic mapping and prospecting. Field teams will focus on areas highlighted by Li–FT's previous geochemical anomalies, moving from regional reconnaissance to detailed mapping and sampling as anomalies are confirmed.

- Follow–up drilling. Once preliminary geophysics and mapping results are interpreted, priority targets, primarily confirmed by EM, will be drilled through late 2025 and into the 2026 winter season.

Terry Lynch, CEO, stated:

"Consolidating the LIFT ground lets us apply the geological insights from Nisk across a district–scale footprint. With over 100,000 metres of fully funded drilling in front of us, we can systematically approach new sulphide occurrences while continuing to grow our established resources."

JC Evensen, Strategic Advisor, added:

"The opportunity to consolidate control of this emerging polymetallic mineral district will allow Power Metallic to fully explore and understand its potential before determining the value maximizing development pathway for all stakeholders involved. The discovery of Lion transformed how this area was understood geologically, and now, with the counsel of Steve Beresford on the board, Joe Campbell , Adam Findlay and the entire exploration team have an opportunity to see if there is something better than Lion to be discovered."

A more detailed summer exploration plan—updated to reflect the expanded acreage—will be released within the next 2–4 weeks .

Qualified Person

Joseph Campbell , P.Geo, VP Exploration at Power Metallic, is the qualified person who has reviewed and approved the technical disclosure contained in this news release.

About Power Metallic Mines Inc.

Power Metallic is a Canadian exploration company focused on advancing the Nisk Project Area (Nisk–Lion–Tiger)—a high–grade nickel–copper–PGE, gold and silver system—toward Canada's next polymetallic mine.

On 1 February 2021, Power Metallic (then Chilean Metals) secured an option to earn up to 80% of the Nisk project from Critical Elements Lithium Corp. (TSX–V: CRE). Following the June 2025 purchase of 313 adjoining claims (~167 km²) from Li–FT Power, the Company now controls ~212.86 km² and roughly 50 km of prospective basin margins.

Power Metallic is expanding mineralization at the Nisk and Lion discovery zones, evaluating the Tiger target, and exploring the enlarged land package through successive drill programs.

Beyond the Nisk Project Area, Power Metallic indirectly has an interest in significant land packages in British Columbia and Chile , by its 50% share ownership position in Chilean Metals Inc., which were spun out from Power Metallic via a plan of arrangement on February 3, 2025 .

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This message contains certain statements that may be deemed "forward-looking statements" concerning the Company within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential," "indicates," "opportunity," "possible" and similar expressions, or that events or conditions "will," "would," "may," "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward-looking statements. Such material risks and uncertainties include, but are not limited to, among others; the timing for various drilling plans; the ability to raise sufficient capital to fund its obligations under its property agreements going forward and conduct drilling and exploration; to maintain its mineral tenures and concessions in good standing; to explore and develop its projects; changes in economic conditions or financial markets; the inherent hazards associates with mineral exploration and mining operations; future prices of nickel and other metals; changes in general economic conditions; accuracy of mineral resource and reserve estimates; the potential for new discoveries; the ability of the Company to obtain the necessary permits and consents required to explore, drill and develop the projects and if accepted, to obtain such licenses and approvals in a timely fashion relative to the Company's plans and business objectives for the applicable project; the general ability of the Company to monetize its mineral resources; and changes in environmental and other laws or regulations that could have an impact on the Company's operations, compliance with environmental laws and regulations, dependence on key management personnel and general competition in the mining industry.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/power-metallic-acquires-167km-from-li-ft-power-expanding-nisk--lion-polymetallic-project-area-by-over-300-302476218.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/power-metallic-acquires-167km-from-li-ft-power-expanding-nisk--lion-polymetallic-project-area-by-over-300-302476218.html

SOURCE Power Metallic Mines Inc.