April 22, 2024

West Cobar Metals Limited (ASX:WC1) (“West Cobar”, “the Company”) is pleased to provide an update on activities at its Salazar critical minerals project in Western Australia.

Highlights

- Titanium industry expert TZMI completes titanium benchmarking study on the Salazar Critical Minerals Project

- Study identifies Newmont as a standout from its peers in terms of Ti and TREO in-situ grade

- Benchmarking study is highly encouraging and supports validating flowsheet for production of titanium minerals from Salazar

Salazar Critical Minerals Project Ti Benchmarking Study

Following successful characterisation testwork of Ti mineralisation at the Newmont Deposit area1, West Cobar Metals engaged international titanium expert TZ Minerals International Pty Ltd (TZMI) to complete a benchmarking study of the Newmont resource.

TZMI is a global, independent consulting and publishing company which specialises in all aspects of the mineral sands, titanium dioxide and coatings industries2.

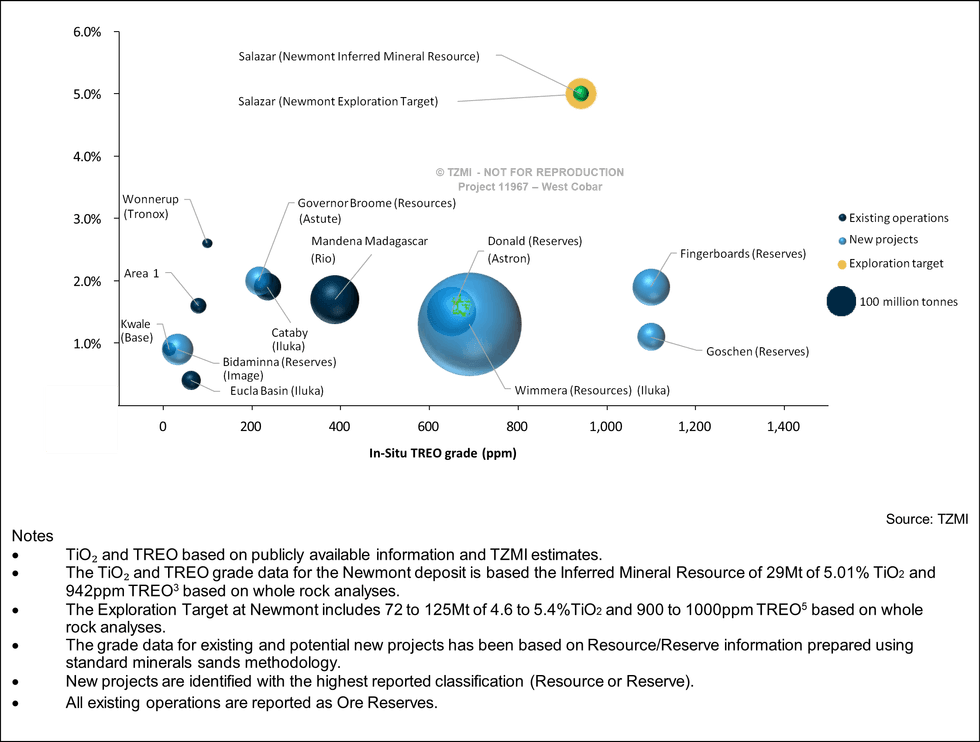

The Newmont resource3 and characterisation data was used by TZMI to benchmark the Salazar project deposit against several existing operations and potential new projects under development using publicly available information and TZMI estimates. The outcomes of the benchmarking are shown in Figure 1.

The benchmarking study shows that the Ti contained within the Newmont deposit has promising potential for economic extraction and that the Newmont resource is positioned favourably amongst peer resources in respect of both Ti and rare earth element content.

The relative positioning of the Newmont Inferred Ti and rare earth element resource is very positive for West Cobar, with relatively high insitu TiO2 grades and TREO grades compared to its peers. The Ti levels of the resource (on a whole rock basis) compare very favourably to both developing and operating projects.

TZMI concluded that “In terms of final ilmenite product quality, the composition of the magnetic fraction (comprising predominantly ilmenite) shows some promise with TiO₂ levels as high as 48.5%. This suggests the ilmenite is likely present as primary ilmenite … the CaO, MgO, V₂O₅, Cr₂O₃ in the magnetic fraction all seem relatively low which is positive and likely to be within the accepted levels for ilmenite used in sulfate pigment production.”

Click here for the full ASX Release

This article includes content from West Cobar Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00