- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

April 26, 2023

Pivotal Metals Limited (ASX:PVT) (‘Pivotal’ or the ‘Company’) is pleased to provide its Appendix 5B cash flow statement for the quarter ended 31 March 2023, along with the following operational summary.

Investment Highlights

HORDEN LAKE COPPER-NICKEL-PGM

- Drilling permits received for the Horden Lake drilling and metallurgical test work programme planned for 2023.

SAN FINX TIN-TUNGSTEN

- Water permit approved, critical to unlocking development of project.

SANTA COMBA TIN-TUNGSTEN

- At the end of quarter, the Department of Mines in Galicia announced a decision to cancel the mining concessions at Santa Comba. These mining concessions were otherwise due to expire in 2068. The Company is currently reviewing its options on this matter.

CORPORATE

- Extensive investor roadshow undertaken to introduce the new Canadian focus for Company.

- Discussions advancing regarding securing of third-party investment for advancement of the Spanish asset portfolio.

- Pivotal’s cash position at 31 March 2023 was $2.394m

Managing Director Steven Turner said: “The previous quarter saw the completion of an extensive refocus for the Company, having in a very short period of time built an impressive portfolio of high quality copper-nickel and PGM assets in Quebec, Canada, including a name change to reflect this strategic shift. This last quarter has seen the Company marketing this change, meeting existing and new investors ahead of an exciting and busy programme for 2023.”

CANADA

Horden Lake

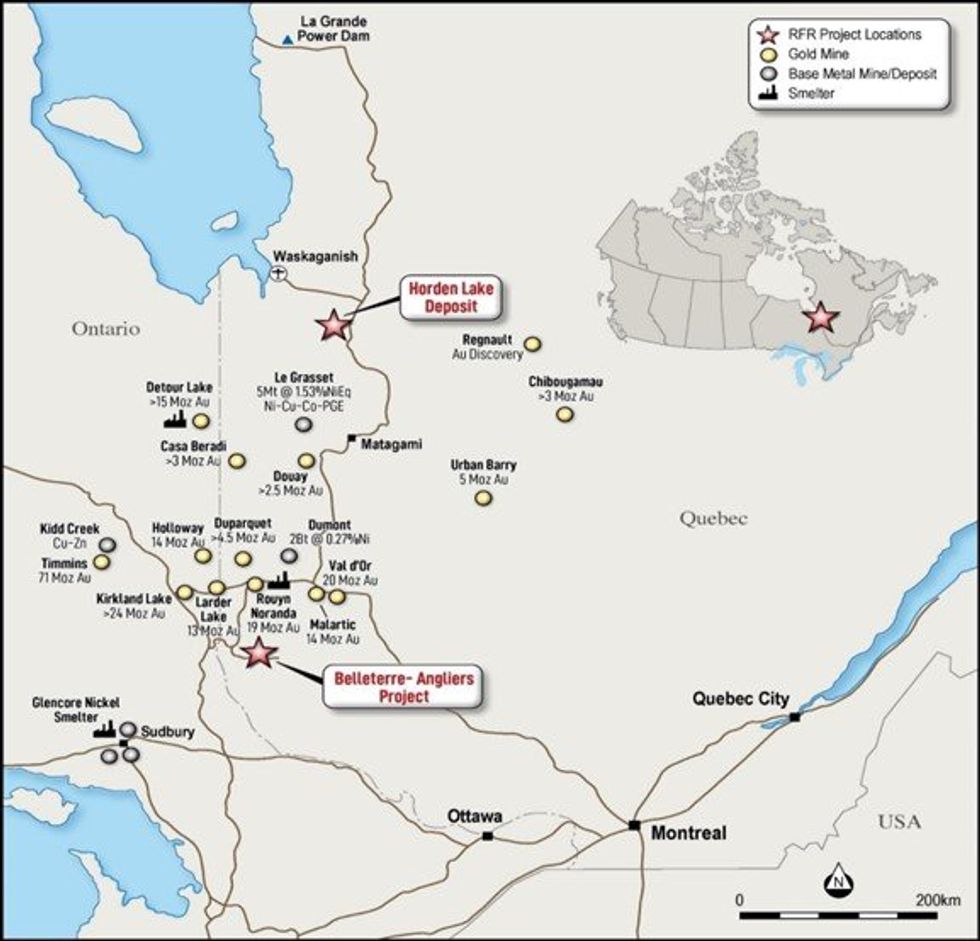

Horden Lake has become the Company’s flagship investment. The project is located 140km north of Matagami in northwest Quebec, close to the recently upgraded James Bay Highway, linking Matagami to the La Grande Hydroelectric Dam, benefiting from HV power lines and fibre optic cable. The road runs within 10km of the property.

The deposit was discovered in the 1960s by INCO, when infrastructure in the region was non-existent, and benefits from 52,000m of drilling, with the most recent being in 2012. On November 14th the Company released the pit constrained JORC compliant mineral resource estimate of 27.8 Mt of 1.49% CuEq (0.3% CuEq Open Pit cut-off and 1.12% CuEq Underground cut-off applied), with 55% currently classified in the Indicated Resource category and 45% in the Inferred Category. *

Click here for the full ASX Release

This article includes content from Pivotal Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PVT:AU

The Conversation (0)

18 January 2024

Pivotal Metals

Investing in metals for a sustainable energy transition.

Investing in metals for a sustainable energy transition. Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00