September 20, 2023

PARKD Ltd (“PARKD” or the “Company”) (ASX: PKD) is pleased to announce it is has entered an exclusivity agreement with Fielders Steel Roofing (Fielders) (a division of BlueScope Steel Limited (ASX: BSL)) (Exclusivity Agreement) in respect of the proposed licencing of PARKD’s Metal Deck Support System IP.

Highlights

- Exclusivity Agreement provides for a 120-day exclusivity period to finalise due diligence and a binding licencing agreement

- Exclusivity Agreement contains non-binding commercial licencing terms

- PARKD and Fielders have identified several opportunities to combine their individual Intellectual Property to develop a structural system that will greatly simplify construction methodology.

- The System will achieve improved structural performance, construction efficiency & productivity suitable for multi-level car parks, residential and commercial buildings.

As announced on 25 November 2022, PARKD and Fielders partnered to assess the potential to integrate Fielders’ high performing metal deck slab system, Slimdek, with PARKD’s Metal Deck Support System and its Patented CVBTM to create a superior low carbon solution for construction of Car Park and Commercial Developments. The Exclusivity Agreement follows joint R&D outcomes as outlined in the previous announcement of 2 May 2023.

Fielders has a 120 day exclusivity period (for nominal consideration) to complete technical and legal due diligence and for the parties to finalise binding terms of a Licensing Agreement.

The Exclusivity Agreement was agreed following an initial engineering technical assessment period where the companies undertook:

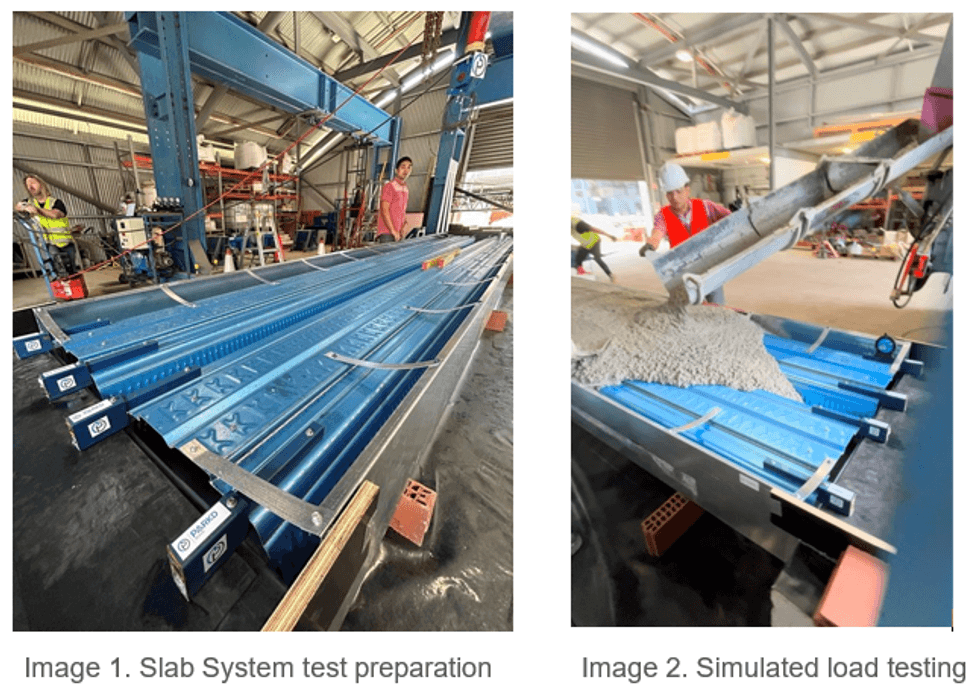

- Research and Development demonstrating the veracity of the IP performance through testing conducted by Curtin University’s School of Civil and Mechanical Engineering Structural Testing Laboratory (Refer Images 1 to 3);

- Manufacturing Supply Chain Assessment to determine unit costs and productivity scaling; and

- Engineering design review and compliance with the Australian National Construction Code.

Other than the 120 day exclusivity period (which is legally binding), the Exclusivity Agreement contemplates non-binding terms and conditions for PARKD to license its IP to Fielders for distribution, sale, market and manufacture under commercial Licensing Terms and Conditions to be agreed. The Exclusivity Agreement contemplates that the binding agreement will include the following considerations:

- License Rights

- Royalty

- Supply Cost

- Regional Territory

- Competition

- Performance

The MoU signed by the two companies (refer to the Company’s announcement dated 25 November 2022) was entered into after identifying the exciting potential for their respective IP technologies to offer the Australian construction market a system of building that could be “flat packed” and installed on projects without the need for specialised labour or subcontractors.

The Company considers that the signing of the Exclusivity Agreement represents a significant step forward towards a formal licencing agreement for national manufacturing and sale of IP owned by PARKD. The non-binding initial terms set-out percentage-based royalty payments that have the potential to scale the nature of PARKD’s current business and income streams.

There are no conditions precedent to the Exclusivity Agreement, however, investors should note that there is no guarantee that a formal binding agreement will be reached between the parties.

Click here for the full ASX Release

This article includes content from PARKD, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00