Pampa Metals Corp. ("Pampa Metals" or the "Company") (CSE:PM)(FSE:FIRA)(OTCQX®:PMMCF) is pleased to advise that diamond drill testing of the Buenavista target commenced on March 31, 2023. As previously advised, a ~2,100m diamond drill program of 3 deep holes designed to test coincident geological, geochemical, and geophysical anomalies at the Buenavista target and the Block 4 project more broadly is expected to be completed within 2 months, with assay results available during June

The first drill hole is centred on the dacite porphyry and phreatomagmatic breccia complex with quartz-veinlet stockworking at Buenavista, and is initially targeted to a depth of about 750m. The drill hole diameter will be HQ, with the option of reducing to NQ at depth, depending on drilling conditions.

Buenavista Target - Block 4 - Drill Rig on Site (light coloured area) for First Drill Hole

Block 4 Project & Buenavista Target - Summary Description of the New Porphyry Cu-Mo-Au Target

- Block 4 is the Company's priority project, with the Buenavista Target displaying characteristics indicative of a large, fertile, Tertiary aged, porphyry copper-molybdenum-gold system, located along the world's preeminent porphyry copper belt in northern Chile;

- Intense, sub-cropping, quartz-veinlet stockwork occurs at Buenavista within a dacite porphyry and phreatomagmatic breccia complex, flanked by a quartz-sulfide breccia to the west and skarn-type mineralization to the east, and is coincident with key geochemical and geophysical anomalies;

- Anomalous soil and trench geochemical values of copper, molybdenum, and gold (and other pathfinders), in a heavily supergene leached desert environment, coincide with mapped geology, hydrothermal alteration, magnetic and induced polarisation (IP) geophysical anomalies, and other complementary data including 3D modeling and age dating;

- The Buenavista Target footprint comprising geological, geochemical, and geophysical anomalies is approximately 1.5 km E-W by 1 km N-S along a significant geological structure;

- The presence of several other geophysical anomalies under post-mineral covered portions of the Block 4 property is suggestive of a potential "cluster" of porphyry copper-molybdenum-gold systems, a characteristic typical of some major porphyry copper districts in Chile and worldwide.

Buenavista Target - Block 4 - Drill Rig on Site for First Drill Hole

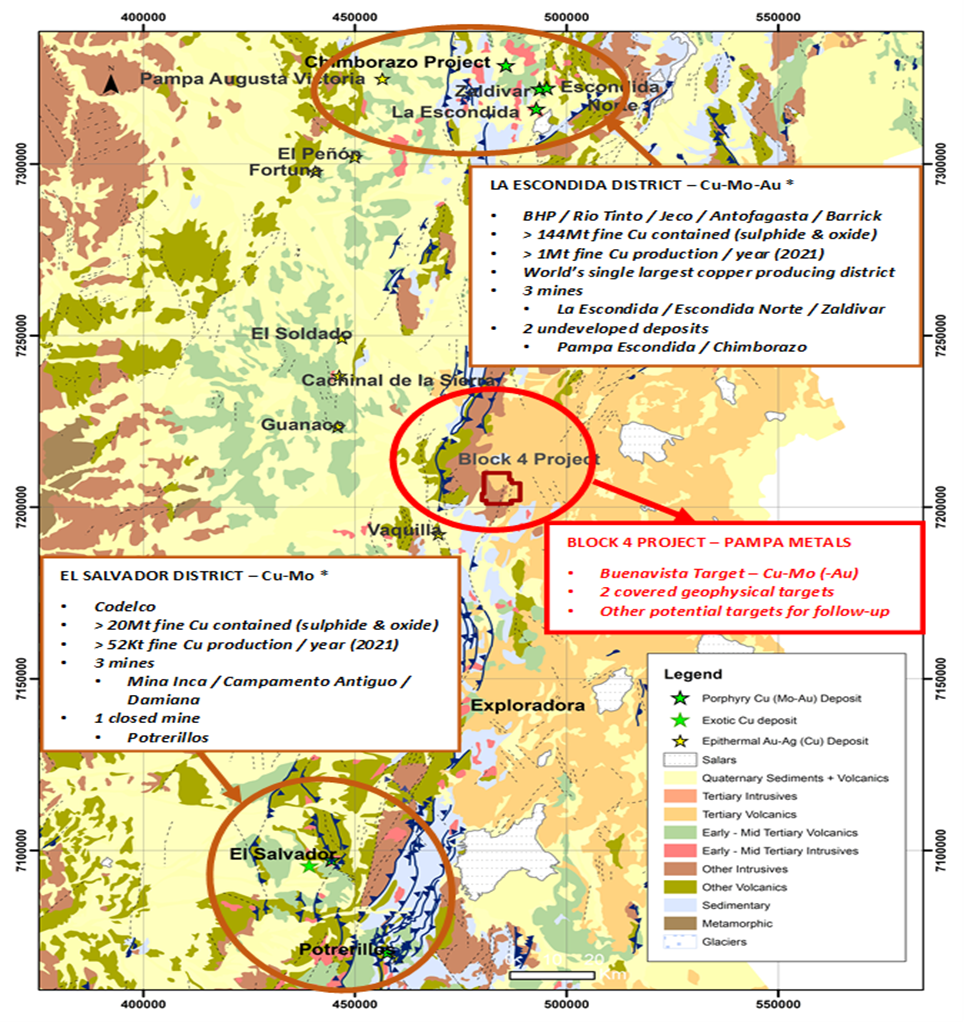

Block 4 - Regional Location Along the Domeyko Cordillera Porphyry Copper Belt

ABOUT Pampa Metals

Pampa Metals is a Canadian company listed on the Canadian Stock Exchange (CSE:PM), Frankfurt (FSE:FIRA) and OTC (OTCQB®:PMMCF) exchanges which wholly owns a 47,400 hectare portfolio of seven projects highly prospective for copper, molybdenum and gold located along proven and highly productive mineral belts in Chile, one of the world's top mining jurisdictions. The Company is actively advancing its projects through systematic exploration and drill testing of the highest priority targets, with a current focus on the Buenavista target and the Block 4 Project more broadly.

The Company's vision is to create significant value for shareholders and stakeholders through the application of its technical and commercial expertise towards exploring for a major copper discovery along the prime mineral belts of Chile. For more information, please visit Pampa Metals' website www.pampametals.com.

The latest Company Presentation can be accessed at https://pampametals.com/investor/.

Qualified Person

Technical information in this news release has been approved by Mario Orrego G, Geologist and a Registered Member of the Chilean Mining Commission and a Qualified Person as defined by National Instrument 43-101. Mr. Orrego is a consultant to the Company.

Note: The reader is cautioned that Pampa Metals' projects are early-stage exploration projects, and reference to existing mines and deposits, or mineralization hosted on adjacent or nearby properties, is not necessarily indicative of any mineralization on Pampa Metals' properties.

ON BEHALF OF THE BOARD

Joseph van den Elsen | President & CEO

INVESTORS CONTACT

Joseph van den Elsen | President & CEO

joseph@pampametals.com

Neither the CSE nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENT

This news release contains certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact, that address events or developments that Pampa Metals expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects" and similar expressions, or that events or conditions "will" or "may" occur. These statements are subject to various risks. Although Pampa Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guaranteeing of future performance and actual results may differ materially from those in forward-looking statements.

SOURCE: Pampa Metals Corp.

View source version on accesswire.com:

https://www.accesswire.com/747014/Pampa-Metals-Commences-Buenavista-Porphyry-Copper-Target-Drill-Testing