April 22, 2024

Oceana Lithium Limited (ASX: OCN, “Oceana” or “the Company”) is pleased to present its activities report for the March 2024 quarter.

Highlights

Solonópole Project, Ceará, Brazil

- Anomalous lithium values above 100 ppm (and up to 631 ppm) found in 383 soil samples within existing and new target areas.

- Integration and interpretation of these soil sample results with data from geophysics, geological mapping (138 line-km), trenching and RC drilling (~2,000m) further enhance prospectivity of existing and new targets.

- Combined datasets confirmed several swarms of pegmatite bodies striking in a NE-SW and E-W directions and identified new high priority areas.

- Nira interpreted to be the most prospective new target, with 180 soil samples of >100 ppm Li and as high as 524 ppm Li covering an area of at least 1km2.

- Nira also features 17 pegmatite outcrops with average widths of up to 30 meters and strike lengths from 200m to 600m.

- Planning for the next follow-up drilling campaign is underway.

Napperby Project, Northern Territory, Australia

- Oceana’s Napperby Project covers some of Arunta Province’s hottest granites plutons, the Wangala Granite (uranium) and Ennugan Mountains Granite (uranium/thorium).

- Both granite plutons show outstanding uranium/thorium ratios and are almost fully encapsulated within Napperby’s EL32836 and ELA32841.

- Follow-up exploration activities will target uranium and Rare Earth Elements (REEs) in parallel with Lithium-Caesium-Tantalum (LCT) pegmatites.

Corporate

- Experienced geologist and mining executive, Aidan Platel, appointed as non- executive director.

- Brazilian-based geologist, Mike Sousa, appointed as Exploration Manager and Competent Person.

- The Company remains well-funded with cash at 31 March of ~$2.67m.

OPERATIONS

Solonópole Project, Ceará State, Brazil

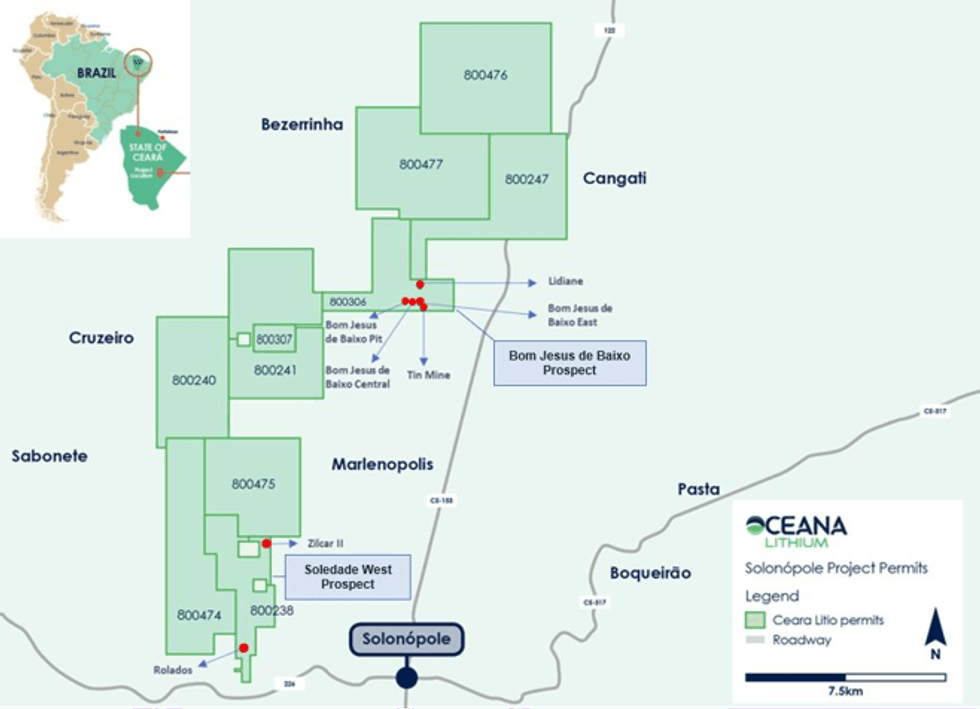

The Solonópole Project area is located in the state of Ceará, north-eastern Brazil and consists of ten (10) exploration permits covering approximately 124km2 (Figure 1), owned by Oceana’s subsidiary Ceará Litio. The project is approximately three to four hours by road from the state capital Fortaleza and deep-water port of Pecém, and is well serviced by sealed highways and high voltage electricity.

Large-Scale Soil Sampling and Geological Mapping at Solonópole Lithium Project

The large-scale infill soil sampling program that commenced in March 2023 continued over the project area (Figure 2). The optimized sampling grids are along 200m spaced lines with 25m sampling stations, aligned north south to cut across all typical pegmatite strike directions in this area.

As at 31 March 2024, over 10,300 soil samples had been collected from Solonópole and 8,741 soil samples had been analysed by X-Ray Fluorescence (XRF) for Lithium-Caesium-Tantalum (LCT) pathfinders, of which 1,908 soil samples have lab results validated by Oceana´s internal QA/QC. Anomalous lithium values above 100 ppm and up to 631 ppm were found in 383 soil samples within existing and new target areas.

Click here for the full ASX Release

This article includes content from Oceana Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

OCN:AU

The Conversation (0)

12 March 2024

Oceana Lithium

Large-scale, highly prospective, pre-discovery projects in Brazil and Australia

Large-scale, highly prospective, pre-discovery projects in Brazil and Australia Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00