(TheNewswire)

HIGHLIGHTS

-

Updated assumptions from the NI 43-101 Feasibility Study have increased the Project's Pre-tax NPV to C$383.1m (previously - C$175.8m) and Post-tax NPV to C$287m (previously - $126.3m)

-

The average EBITDA over the mine life increased to C$102m per annum (previously $67.6m); peaking at C$168m during the fourth year of production

-

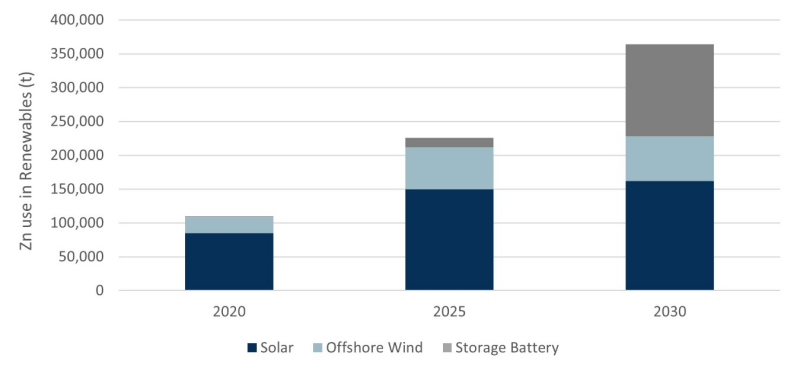

The Zinc price has increased substantially since the October 2021 Feasibility Study . The fundamentals for sustained higher prices continue to strengthen due to multiple factors, including zinc's importance in the renewable energy industry

-

The Company is fully funded until a Final Investment Decision (FID) following the recent C$5.2m capital raising

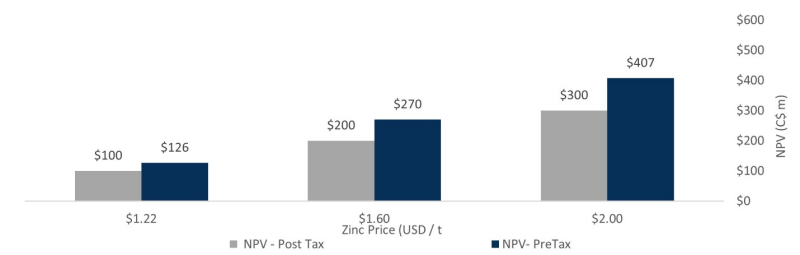

May 17, 2022 – TheNewswire - Metallum Resources Inc. (TSXV:MZN) ( "Metallum" or the "Company") is pleased to announce updated economics for its Superior Lake Zinc and Copper Project ("Project") in Ontario, Canada. Based on updated assumptions 1 , the Project's NPV 8 Pre-tax has increased to C$383m (previously - C$175.8m) whilst the average EBITDA 3 has increased to C$102m per annum (previously C$67.6m). Image 1 illustrates the Project's Pre and Post tax NPV 8% returns based on a number of zinc price scenarios.

Image 1: NPV 8 under a range of different zinc price assumptions 1,2,4

The significant improvement in prices for the suite of commodities produced at the Project (zinc, copper, silver and gold), has driven the Project's improved returns compared to the Feasibility Study (Table 1 below). Whilst zinc, the major commodity produced at the Project, price has slightly fallen from its recent a 15-year high (US$2.05 / lb) achieved during April 2022, the fundamentals for the sector are extremely positive due to limited new supply, whilst a significant increase in demand, largely driven by the importance of zinc in multiple renewable energy industry (EV (electric vehicles), solar power generation and wind energy).

1 - Updated commodity prices: Zn: US$1.65/lb, Cu: US$4.22/lb, Au: US$ 1,845/oz, Ag: US$21.6/oz ; 2 - 8% discounted NPV pre-tax; 3 - Life of mine average EBITDA. Total project EBITDA is $870m; 4 The Feasibility Study was conducted using a Zinc price of US$1.22/lb (US$2,700/t), Copper Price of US$3.31/lb (US$7,300/t), Silver Price of US$21.00/oz, and Gold price of US$1,635/oz.

Image 2: Forecasted zinc demand used on renewables industry 5

5 - Source: CRU, IRENA, Teck

Given the strengthening market fundamentals for the Project, the Company is advancing the Project through a number of critical steps prior to making a Final Investment Decision (FID) in the future. Updates on these initiatives will be released as work is advanced.

The Company is in an excellent financial position following the recent C$5.2m capital raising that sees the Company fully funded until an FID is made. A summary of the key inputs and outputs in the Feasibility Study and updated returns are highlighted below.

Table 1: Updated Feasibility Assumptions and Outputs

| Units | Feasibility Study (Nov 2021) 2 | Updated Assumptions 1 | Change C$ | Change % | |

| Average Zinc Production (concentrate) | Tonnes pa | 33,401 | 33,401 | - | - |

| Average Copper Production (concentrate) | Tonnes pa | 1,270 | 1,270 | - | - |

| Mine Life | years | 8.5 | 8.5 | - | - |

| Initial Capex 1 | C$ Million | 145.1 | 145.1 | - | - |

| C 1 - Operating Costs | C$ / lb | 0.44 | 0.44 | - | - |

| AISC – operating costs | C$ / lb | 0.55 | 0.51 | -0.04 | 7% |

| Pre-Tax NPV 8% | C$ Million | 175 | 383 | 207.3 | 118% |

| Pre-Tax IRR | % | 26 | 42 | 16 | 62% |

| Post-Tax NPV 8% | C$ Million | 126 | 287 | 160.7 | 127% |

| Post-Tax IRR | % | 23 | 38 | 15 | 65% |

| Payback | years | 2.5 | 2.25 | 0.25 | 11% |

| Zn Price | USD/lb | 1.22 | 1.65 | 0.43 | 35% |

| Cu Price | USD/lb | 3.31 | 4.22 | 0.91 | 27% |

| Au Price | USD/oz | 1,635 | 1,845 | 210 | 13% |

| Ag Price | USD/oz | 21.00 | 21.60 | 0.6 | 3% |

1 - Updated commodity prices: Zn: US$1.65/lb, Cu: US$4.22/lb, Au: US$ 1,845/oz, Ag: US$21.6/oz ;

2 - The Feasibility Study was conducted using a Zinc price of US$1.22/lb (US$2,700/t), Copper Price of US$3.31/lb (US$7,300/t), Silver Price of US$21.00/oz, and Gold price of US$1,635/oz.

The Feasibility Study dated effective October 13, 2021 was prepared by DRA Global Limited, along with contributions from other prominent engineering companies. The detailed technical report is available on SEDAR under the Company's profile. The technical report is also available on Metallum's website at metallumzinc.com.

Qualified Person

The news release has been reviewed and approved by Andrew Tims, P.Geo., Exploration Manager of the Company, and a Qualified Person as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects .

ON BEHALF OF THE BOARD

For further information, contact:

Kerem Usenmez, President & CEO

Tel: 604-688-5288; Fax: 604-682-1514

Email: info@metallumzinc.com

Website: metallumzinc.com

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this news release constitute forward-looking statements within the meaning of Canadian securities legislation. All statements included herein, other than statements of historical fact, are forward-looking statements and include, without limitation, statements about the Feasibility Study, the updated economics of the Project, and the Company's development plans for the Project. Often, but not always, these forward looking statements can be identified by the use of words such as "estimate", "estimates", "estimated", "potential", "open", "future", "assumed", "projected", "used", "detailed", "has been", "gain", "upgraded", "offset", "limited", "contained", "reflecting", "containing", "remaining", "to be", "periodically", or statements that events, "could" or "should" occur or be achieved and similar expressions, including negative variations.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any results, performance or achievements expressed or implied by forward-looking statements. Such uncertainties and factors include, among others, the uncertainties inherent in the Feasibility Study and the updated economics of the Project; whether exploration and development of the Company's properties will proceed as planned; changes in general economic conditions and financial markets; the Company or any joint venture partner not having the financial ability to meet its exploration and development goals; risks associated with the results of exploration and development activities, estimation of mineral resources and the geology, grade and continuity of mineral deposits; unanticipated costs and expenses; risks associated with COVID-19 including adverse impacts on the world economy, exploration and development efforts and the availability of personnel; and such other risks detailed from time to time in the Company's quarterly and annual filings with securities regulators and available under the Company's profile on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking statements contained herein are based on the assumptions, beliefs, expectations and opinions of management, including but not limited to: the accuracy of the Feasibility Study and the updated economics of the Project; that the Company's stated goals and planned exploration and development activities will be achieved; that there will be no material adverse change affecting the Company or its properties; and such other assumptions as set out herein. Forward-looking statements are made as of the date hereof and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on forward-looking statements.

ABOUT Metallum Resources

Metallum Resources (MZN.TSXV) owns 100% of the Superior Lake Zinc and Copper Project in Ontario, Canada. The Project ranks as the highest grade zinc project in North America with a resource of 2.35 Mt at 17.9% Zn, 0.9% Cu, 0.4 g/t Au and 34 g/t Ag.

The Company completed a positive Feasibility Study that highlights the Project will rank in the lowest quartile of operating costs (C1 costs – C$0.44 / lb; AISC C$0.51 / lb). These low costs driven by the high grade of the Project drive robust economic returns. The majority of permits and licenses are in place allowing for a quick re-development following a Final investment Decision.

For further details about the Company and the Superior Project, please visit the Company's website at metallumzinc.com .

Copyright (c) 2022 TheNewswire - All rights reserved.