Sandy MacDougall, CEO of Noram Lithium Corp. ("Noram" or the "Company") (TSXV: NRM | OTCQB: NRVTF | Frankfurt: N7R) reports the appointment of Bradley C. Peek, M.Sc., CPG as Vice President of Exploration. In addition, the Company has received final permits from Nevada's Bureau of Land Management for a 12-hole in-fill resource development program focused on upgrading a portion of an existing Inferred resource to the Indicated category at its high-grade Zeus Lithium Project. The current NI-43-101 resource contains a Measured and Indicated resource estimate* of 363 million tonnes grading 923 ppm lithium, and an Inferred resource of 827 million tonnes grading 884 ppm lithium utilizing a 400 ppm Li cut-off. Noram is aggressively moving forward with completing a pre-feasibility study ("PFS") by the end of 2022 after a Preliminary Economic Assessment indicates robust economics of NPV(8) US$2.67 billion and an IRR of 52% using a lithium carbonate price of US$ 14,250tonne

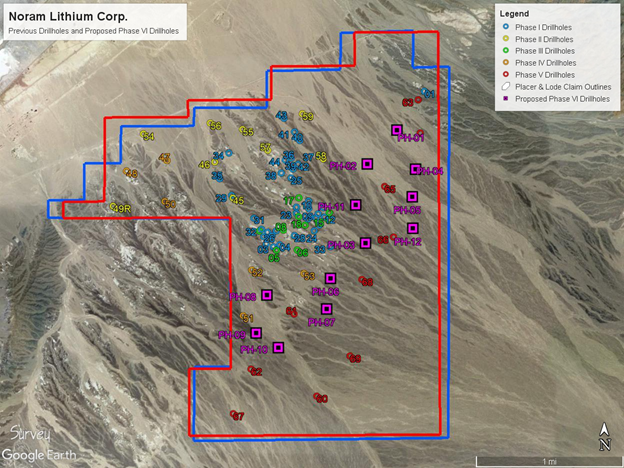

Figure 1 - Proposed drill sites for Phase VI Drill Program - Zeus Lithium Project

Zeus Lithium Project Drill Campaign and History

The Zeus project has undergone five previous drill campaigns (2016 - 2021), building one of the most significant lithium resources in Clayton Valley, Nevada. Noram is now proceeding with a Phase VI drill campaign, which is comprised of 12 "in-fill" holes to an approximate depth of 120m (393 ft). The program is expected to upgrade approximately 175 million tonnes of the current Inferred resource to the Indicated category which will have a significant impact on the PFS. Drilling will also provide fresh material for geotechnical and ongoing metallurgical testing and is an important data gathering exercise to be incorporated into the PFS, where the primary objectives are to upgrade and convert resources to reserves in developing the PFS mine plan and to obtain material for further metallurgical testing. Additional important objectives are to obtain additional information on lithology, mineralization, and clay speciation. Noram's team has commenced preparing the drill pads and mobilizing a drill rig. Drilling will be carried out 24 hours a day with 2 teams until completion.

The Phase VI drilling program has been specifically designed to upgrade a large portion of the current Inferred resource to the Indicated category using the least number of drillholes. Noram expects this updated NI 43-101 compliant resource model to be complete by Q3, 2022.

"I would like to officially welcome Brad as the newest member of our senior management team in the role of VP of Exploration. Brad has worked with the Noram team since its inception as an external geological consultant. He has been instrumental in building the significant lithium resource that we have today at our Zeus Lithium Project," stated Mr. Sandy MacDougall, CEO of Noram. "Brad has designed and overseen every drill program since 2016. Now as we push through to the completion of a pre-feasibility study in 2022, we are proud to have Brad join as an indispensable member of the team; elevating Noram as the Company accelerates exploration and development activities. With a robust treasury now exceeding CDN$18M, we are now fully financed to execute our goal of aggressively further de-risking the Zeus Project."

About Brad Peek, M.Sc., CPG

Brad brings more than 40 years' experience in global project management and mineral exploration. Mr. Peek received a Bachelor of Science degree in Geology from the University of Nebraska and a Master of Science degree in Geology from the University of Alaska. He also is a member of the Society of Economic Geologists, and the American Institute of Professional Geologists - Certified Professional Geologist, CPG11299.

The technical information contained in this news release has been reviewed and approved by Bradley C. Peek, MSc, CPG, Vice President Exploration for Noram, who is a Qualified Person as defined under National Instrument 43-101.

The Company has also reserved for grant 1,710,000 incentive stock option at a price of $0.80 for a period of ten years from the date of grant. This grant is an amendment to a previous option grant reservation disclosed in a news release dated February 28, 2022, whereby the price and terms remain the same but the options granted have increased from 1,400,000 to 1,710,000 incentive stock options. The Company will grant these incentive stock options to directors, officers, and consultants of the Company. These options are exercisable at $0.80 per share for a period of ten years from the date of grant.

All options will be granted in accordance with the Company's 10% Rolling Stock Option Plan.

About Noram Lithium Corp.

Noram Lithium Corp. (TSXV: NRM | OTCQB: NRVTF | Frankfurt: N7R) is a well-financed Canadian based advanced Lithium development stage company with less than 90 million shares issued and treasury exceeding US$18 million. Noram is aggressively advancing its Zeus Lithium Project in Nevada from the development-stage level through the completion of a Pre-Feasibility Study in 2022.

The Company's flagship asset is the Zeus Lithium Project ("Zeus"), located in Clayton Valley, Nevada. The Zeus Project contains a current 43-101 measured and indicated resource estimate* of 363 million tonnes grading 923 ppm lithium, and an inferred resource of 827 million tonnes grading 884 ppm lithium utilizing a 400 ppm Li cut-off. In December 2021, a robust PEA** indicated an After-Tax NPV(8) of US$1.3 Billion and IRR of 31% using US$9,500/tonne Lithium Carbonate Equivalent (LCE). Using the LCE long term forecast of US$14,000/tonne, the PEA indicates an NPV (8%) of approximately US$2.6 Billion and an IRR of 52% at US$14,250/tonne LCE.

Please visit our web site for further information: www.noramlithiumcorp.com.

ON BEHALF OF THE BOARD OF DIRECTORS

Sandy MacDougall

Chief Executive Officer and Director

C: 778.999.2159

For additional information please contact:

Peter A. Ball

President and Chief Operating Officer

peter@noramlithiumcorp.com

C: 778.344.4653

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements regarding, among other things, the completion transactions completed in the Agreement. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, regulatory approval processes. Although Noram believes that the assumptions used in preparing the forward-looking information in this news release are reasonable, including that all necessary regulatory approvals will be obtained in a timely manner, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Noram disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable securities laws. *Updated Lithium Mineral Resource Estimate, Zeus Project, Clayton Valley, Esmeralda County, Nevada, USA (August 2021) **Preliminary Economic Assessment Zeus Project, ABH Engineering (December 2021).

SOURCE: Noram Lithium Corp.

View source version on accesswire.com:

https://www.accesswire.com/694354/Noram-Appoints-VP-of-Exploration-Permits-Phase-VI-Drill-Campaign-At-Its-Zeus-Lithium-Project-And-Grants-Options