August 13, 2024

Robotic technology company FBR Limited (ASX: FBR; OTCQB: FBRKF) (‘FBR’ or ‘the Company’) is pleased to announce that it has received confirmation from CRH Ventures that the first next-generation Hadrian X® has successfully met their requirements and has completed Site Acceptance Testing at the Fort Myers facility in Florida, United States.

Highlights

- FBR receives confirmation from CRH Ventures that first next-generation Hadrian X® successfully completes Site Acceptance Testing at Fort Myers facility in Florida

- Confirmation received from an independent structural engineer that the structure is consistent with design requirements and meets applicable building standards

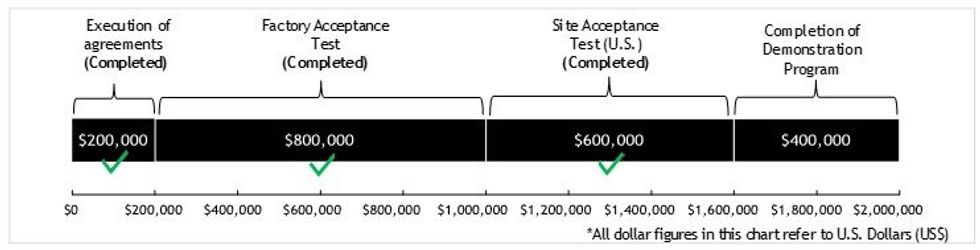

- FBR to receive next tranche of non-refundable payment from CRH Ventures of US$600,000 under Demonstration Program agreement

- Construction of the first house in the Demonstration Program to commence shortly

An independent structural engineer provided confirmation that the walls of the test build were consistent with the design and met applicable building standards.

Completion of Site Acceptance Testing triggered a US$600,000 payment by CRH Ventures to FBR and the commencement of the Demonstration Program. The Demonstration Program requires FBR to construct the external walls of five to ten single-storey houses utilising the next-generation Hadrian X®. The Demonstration Program will commence shortly.

The Demonstration Program will be deemed complete when FBR completes construction of its five houses plus up to five houses added to the program by CRH Ventures, with all houses to be certified by an independent structural engineer. Upon completion of the Demonstration Program, FBR will receive a payment of US$400,000 from CRH Ventures under the Demonstration Program agreement. The completion of the Demonstration Program also marks the commencement of a 45-day period for CRH Ventures to exercise the option to form a joint venture for the delivery of Wall as a Service® in the United States.

This announcement has been authorised for release to the ASX by the FBR Board of Directors.

Click here for the full ASX Release

This article includes content from FBR Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

27 September 2023

Firebird Metals

Building Western Australia’s Next Major Manganese Mine for the EV Battery Market

Building Western Australia’s Next Major Manganese Mine for the EV Battery Market Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00