- GoldSpot Discoveries Corp.'s proprietary approach of Artificial Intelligence (AI) and geological interpretation highlight Lithium-Tantalum potential at the New Block 1-6 and 7 claims within the Nemiscau greenstone belt;

- A total of 19 high to moderate prospectivity Lithium-Tantalum targets were identified;

- Nickel-Copper and Gold potential was also revealed;

- Critical Elements boasts a unique and favorable land position proximal to the Whabouchi Lithium-Tantalum deposit, which opens up potential for new discoveries.

Critical Elements Lithium Corporation (the "Company" or "Critical Elements") (TSX-V:CRE) (OTCQX:CRECF) (FSE:F12) mandated GoldSpot Discoveries Corp. (TSX-V:SPOT) (OTCQX:SPOFF) ("GoldSpot") to conduct a remote targeting process for lithium and tantalum, and nickel-copper and gold, on the New Block 1-6 and 7 claims within the prolific Nemiscau belt (Figure 1). GoldSpot uses cutting edge technology and geoscientific expertise to mitigate exploration risks and make mineral discoveries

This study hinged on digital extraction from an exhaustive collection of compiled data, including assessment files, government data and academic studies. This dataset provided outcrop/sample description, bedrock geology, geochemical analyses, and geophysical surveys. Original data was cleaned and combined to create a comprehensive data set for geological interpretation and machine learning processes.

The compilation of discrete outcrop observations allowed a reliable update to existing geologic maps, resulting in a refined pegmatite map including metamorphic domains. A total of 42 pegmatite bodies were added to the current geological map, highlighting previously unknown potential for economic lithium-tantalum mineralization. An up to date structural interpretation was created based on a high-resolution aeromagnetic survey commissioned by Critical Elements. This survey revealed structurally complex patterns, including large-scale folds and major ENE-trending ductile fault zones.

GoldSpot generated lithium-tantalum, copper-nickel and gold focused targets. These target areas were generated using a knowledge based approach with Artificial Intelligence (AI) data-driven methods. The AI data analysis trains machine learning algorithms to predict the presence of lithium-tantalum (model 1), copper-nickel (model 2), and gold (model 3), using all variables (features), both numeric and interpreted on a 10 x 10 m grid cell datacube. Once the model performs to a satisfactory level, results produced include: 1) a series of zones with relatively high probability of containing lithium and tantalum (model 1; same process for models 2 and 3); 2) a ranking of feature importance for each input feature.

The best prediction model for the lithium-tantalum model was obtained using a Random Forest classifier for which performance metrics were above 80% precision. The updated lithology and structural interpretation were the dominant contributors to the targeting model.

Figure 1: Location of Critical Elements' projects, Eeyou Istchee, James Bay, Québec

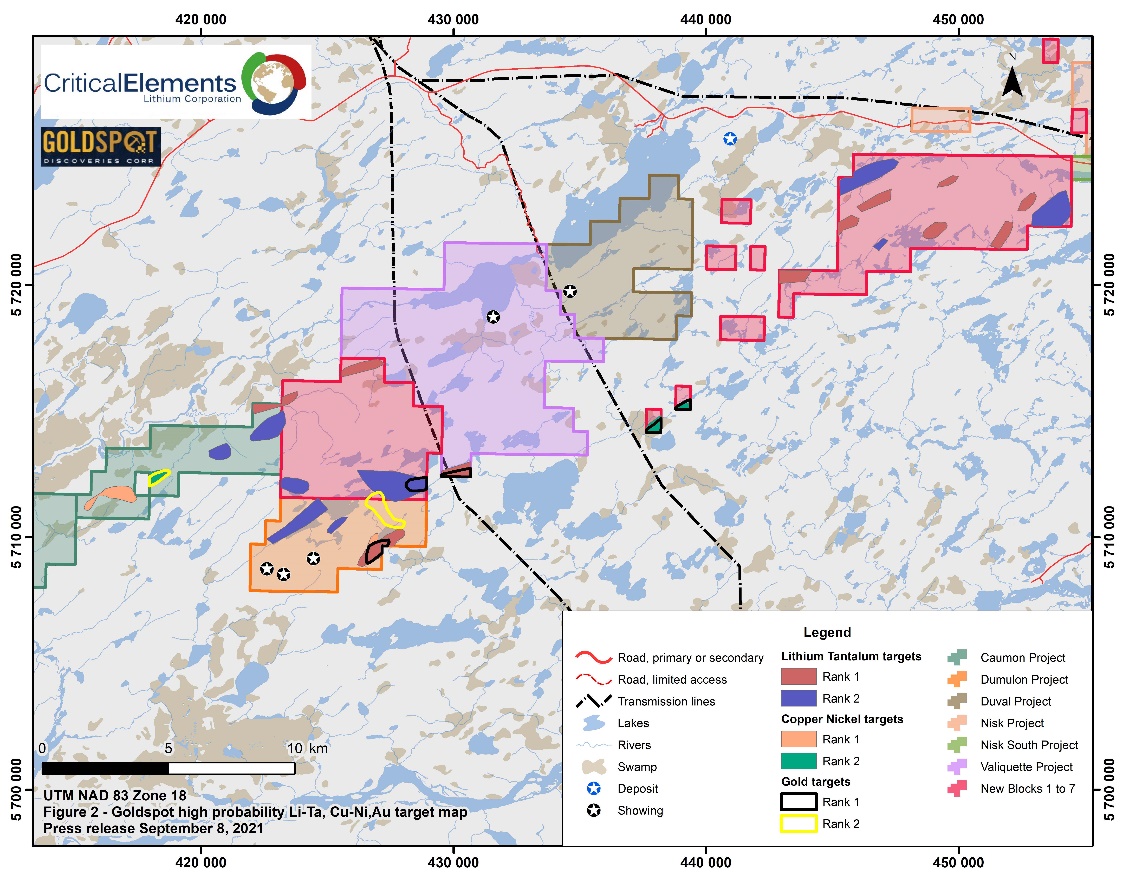

A total of 19 lithium-tantalum exploration targets were identified (Figure 2), reducing the area of investigation to approximately 16% of the total claim holding. These targets highlight the outer zones of felsic batholiths as the most prospective areas of the claims, including ENE trends at both northern and southern margins of the pertained claims.

A total of 5 copper-nickel and 7 gold targets were also identified (Figure 2). These targets commonly occur in similar geological settings: areas of intense structural complexity where a diversity of rock units occurs, including mafic units, felsic intrusions and paragneiss.

In addition to the targeting, GoldSpot provided a map of probable outcrop zones to support future field programs. More than 75% of the existing outcrops were found by the machine learning model, highlighting the predictive accuracy of this approach. The machine learning-assisted outcrop detection allows for time- and cost-efficient field exploration.

The area of interest occurs in the southeastern part of the Nemiscau Subprovince. The northern Nemiscau Subprovince is marked by the volcano-sedimentary rocks of the Lac des Montagnes Group which consists of mafic to felsic volcanic units and iron formations. These Archean volcanic-sedimentary packages are affected by major NE-trending ductile shear-zones (Pedreira et al., 2020) during the Kenoran orogeny (2720 - 2680 Ma). Local geology exposures include metamorphosed sediments units (i.e., paragneiss from the Rupert Complex and Voirdye Formation), syn-tectonic intrusives (i.e., De la Hutte Complex and The Canard Suite) and post-tectonic pegmatites (i.e., Mezière Suite and Spodumène Suite).

"Although Critical Elements' primary focus is on advancement of the Rose project through detailed engineering for Phase I and delivery of advanced technical studies for Phase II, the Company is making plans to follow up the prioritized Smart targets generated. Ground-truthing followed by surface-sampling and drill-testing are contemplated. This is consistent with our aspiration to be a large, responsible supplier of lithium, enjoying the inherent advantages of our host jurisdiction of Quebec," said Jean-Sébastien Lavallée, Chief Executive Officer of the Company.

Qualified Person

The technical information in this press release has been prepared in accordance with the Canadian regulatory requirements set out in NI 43-101 -- Standards of Disclosure for Mineral Projects, and reviewed and approved by Ludovic Bigot, professional geologist (OGQ - P.GEO No. 01655), a qualified person as defined by NI 43-101 guidelines.

About Critical Elements Lithium Corporation

Critical Elements Lithium Corporation aspires to become a large, responsible supplier of lithium to the flourishing electric vehicle and energy storage system industries. To this end, Critical Elements Lithium is advancing the wholly owned, high purity Rose lithium project in Quebec. Rose is the Company's first lithium project to be advanced within a highly prospective land portfolio of over 700 square kilometers. In 2017, the Company completed a robust feasibility study on Rose Phase 1 for the production of high quality spodumene concentrate. The internal rate of return for the Project is estimated at 34.9% after tax, with a net present value estimated at C$726 million at an 8% discount rate. Capital cost parameters were confirmed in 2019 by Primero Group in the context of a Guaranteed Maximum Price under an Early Contractor Involvement agreement, as a prelude to an Engineering, Procurement and Construction process. Detailed engineering for Phase I is expected to conclude this year as the Company plans to deliver technical studies for Phase II; the conversion of spodumene concentrate to high quality lithium hydroxide. In the Company's view, Quebec is strategically well-positioned for US and EU markets and boasts exceptional infrastructure including a low-cost, low-carbon power grid featuring 93% hydroelectricity. The project has received approval from the Federal Minister of Environment and Climate Change on the recommendation of the Joint Assessment Committee, comprised of representatives from the Impact Assessment Agency of Canada and the Cree Nation Government; we await similar approval under the Quebec environmental assessment process near-term. The Company also has a strong, formalized relationship with the Cree Nation.

About GoldSpot Discoveries Corp.

GoldSpot Discoveries Corp. (TSXV: SPOT) (OTCQX: SPOFF) is a technology services company in mineral exploration. GoldSpot is a leading team of expert scientists who merge geoscience and data science to deliver bespoke solutions that transform the mineral discovery process. In the race to make discoveries, GoldSpot produces Smart Targets and advanced geological modelling that saves times, reduces costs and provides accurate results.

For further information, please contact:

Jean-Sébastien Lavallée, P.Geo.

Chief Executive Officer

819-354-5146

jslavallee@cecorp.ca

www.cecorp.ca

Cautionary statement concerning forward-looking statements

This news release contains "forward-looking information" within the meaning of Canadian Securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "scheduled", "anticipates", "expects" or "does not expect", "is expected", "scheduled", "targeted", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information contained herein include, without limitation, statements relating to the completion of the Project's approval, the completion of the provincial permitting process, mineral reserve estimates, mineral resource estimates, realization of mineral reserve and resource estimates, capital and operating costs estimates, the timing and amount of future production, costs of production, success of mining operations, the ranking of the project in terms of cash cost and production, permitting, economic return estimates, power and storage facilities, life of mine, social, community and environmental impacts, lithium and tantalum markets and sales prices, off-take agreements and purchasers for the Company's products, environmental assessment and permitting, securing sufficient financing on acceptable terms, opportunities for short and long term optimization of the Project, and continued positive discussions and relationships with local communities and stakeholders. Forward-looking information is based on assumptions management believes to be reasonable at the time such statements are made. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Although Critical Elements has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Factors that may cause actual results to differ materially from expected results described in forward-looking information include, but are not limited to: the completion of the Project's approval, the completion of the provincial permitting process, Critical Elements' ability to secure sufficient financing to advance and complete the Project, uncertainties associated with the Company's resource and reserve estimates, uncertainties regarding global supply and demand for lithium and tantalum and market and sales prices, uncertainties associated with securing off-take agreements and customer contracts, uncertainties with respect to social, community and environmental impacts, uncertainties with respect to optimization opportunities for the Project, as well as those risk factors set out in the Company's year-end Management Discussion and Analysis dated August 31, 2020, the Company's Annual Information Form dated August 3, 2021, and other disclosure documents available under the Company's SEDAR profile. Forward-looking information contained herein is made as of the date of this news release and Critical Elements disclaims any obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is described in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Critical Elements Lithium Corporation

View source version on accesswire.com:

https://www.accesswire.com/662952/Critical-Elements-and-GoldSpot-Discoveries-Identify-Lithium-Tantalum-Targets-at-the-Critical-Elements-Claims-in-the-Nemiscau-Belt-Using-Artificial-Intelligence