- WORLD EDITIONAustraliaNorth AmericaWorld

Investing in Graphene Companies

10 Biggest EV Stocks to Watch in 2026

Top 3 ASX Cobalt Stocks (Updated January 2026)

Top 5 Canadian Cobalt Stocks (Updated January 2026)

Top 9 Global Lithium Stocks (Updated January 2026)

Top 5 US Lithium Stocks (Updated January 2026)

Overview

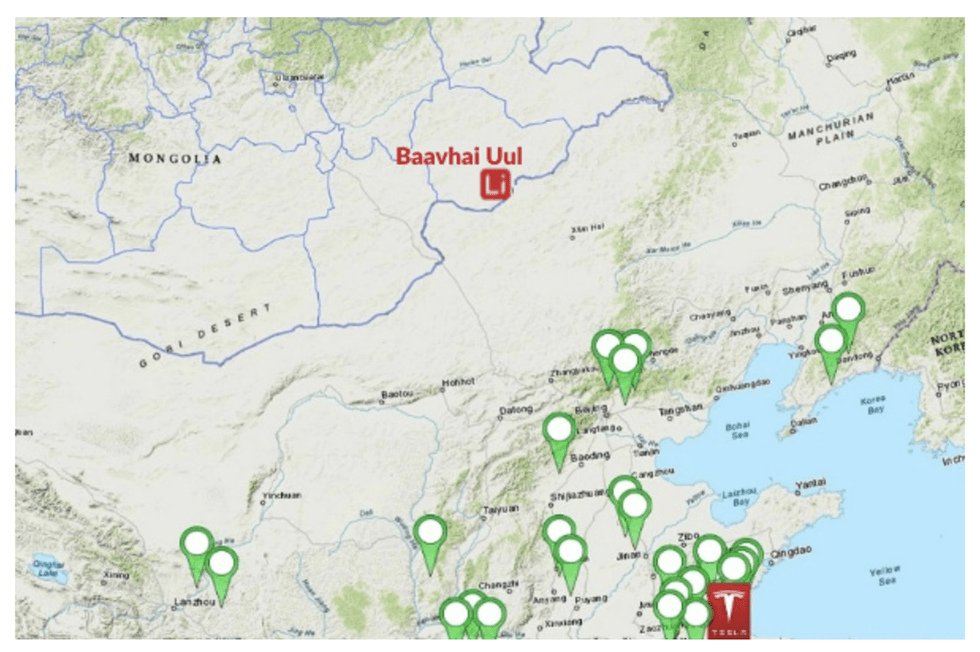

Lithium ION Energy Ltd. (TSXV:ION, OTC:IONGF, FSE:5YB) is a battery metal exploration company focusing on lithium exploration in southeast Mongolia. The company holds one of the largest mining licenses in Mongolia and is leveraging its first-mover advantage to explore an area of more than 80,000 hectares containing lithium brine targets.

The global lithium market is projected to grow to US$6.62 billion by the end of 2028 driven by demand from the green energy and electric vehicle markets. Rising concern over global carbon emissions is leading to the increasing adoption of green technologies, including electric vehicles and large-scale energy storage solutions, all of which require massive amounts of battery metals like lithium, cobalt and nickel. Governments around the world, including the United States and China, are working to secure a steady supply of battery metals to prepare for a green energy future.

The Mongolian government has granted Lithium ION Energy one of the largest exploration licenses in the country for the company’s Baavhai-Uul project in the Sukhbaatar province. The 81,758-hectare asset contains high-grade, near-surface lithium brines of up to 810 parts per million (ppm) with low potassium and magnesium ratios, which makes for better crystallization of the lithium hydroxide. ION Energy is the first company to be granted a license for this asset, which has never been mined before. Previous exploration work has been conducted on the project by the Technical University of Mongolia and the Mongolian government.

The potential for significant deposits is driven by the geology of Southeast Mongolia, which mirrors the famed Lithium Triangle of South America. Like the Lithium Triangle, the region is an endorheic basin contained within a low precipitation zone.

Lithium ION Energy’s management team has extensive experience working with the Mongolian government, which has been largely supportive of mining exploration within the country. The Mongolian economy is largely commodity-based and is considered by the World Bank to be stable and growing. Mongolia’s Foreign Investment Promotion and Protection Agreement (FIPA) with Canada, signed in 2017, established a legal framework under which Canadian investors working in Mongolia are offered greater predictability and certainty for their investments.

Outside of Mongolia, Lithium ION Energy is exploring opportunities in Canada. It has signed a definitive agreement to acquire the Bliss Lake Lithium Pegmatite project in the Northwest Territories. The project is 5,798 hectares in area and totals five contiguous licenses. It is located less than 15 kilometers from Li-FT Power Ltd's "Road Access Group," where numerous lithium-bearing pegmatites have been identified and sampled with over 1 percent lithium oxide. Numerous pegmatite occurrences have been identified from landsat images on the Bliss Lake Project, the largest of which is interpreted to be more than 300 meters in strike length.

Get access to more exclusive Lithium Investing Stock profiles here