Differentiated banking experience enhanced with new features to deliver greater value, visibility and cash management capabilities to small businesses

INTUit (Nasdaq: INTU), the global technology platform that makes TurboTax, QuickBooks, Mint, Credit Karma, and Mailchimp, today introduced QuickBooks Checking . First launched in 2020 as QuickBooks Cash, QuickBooks Checking has transformed business banking into an active money-management hub that delivers greater cash flow predictability and financial control for small businesses.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211215005264/en/

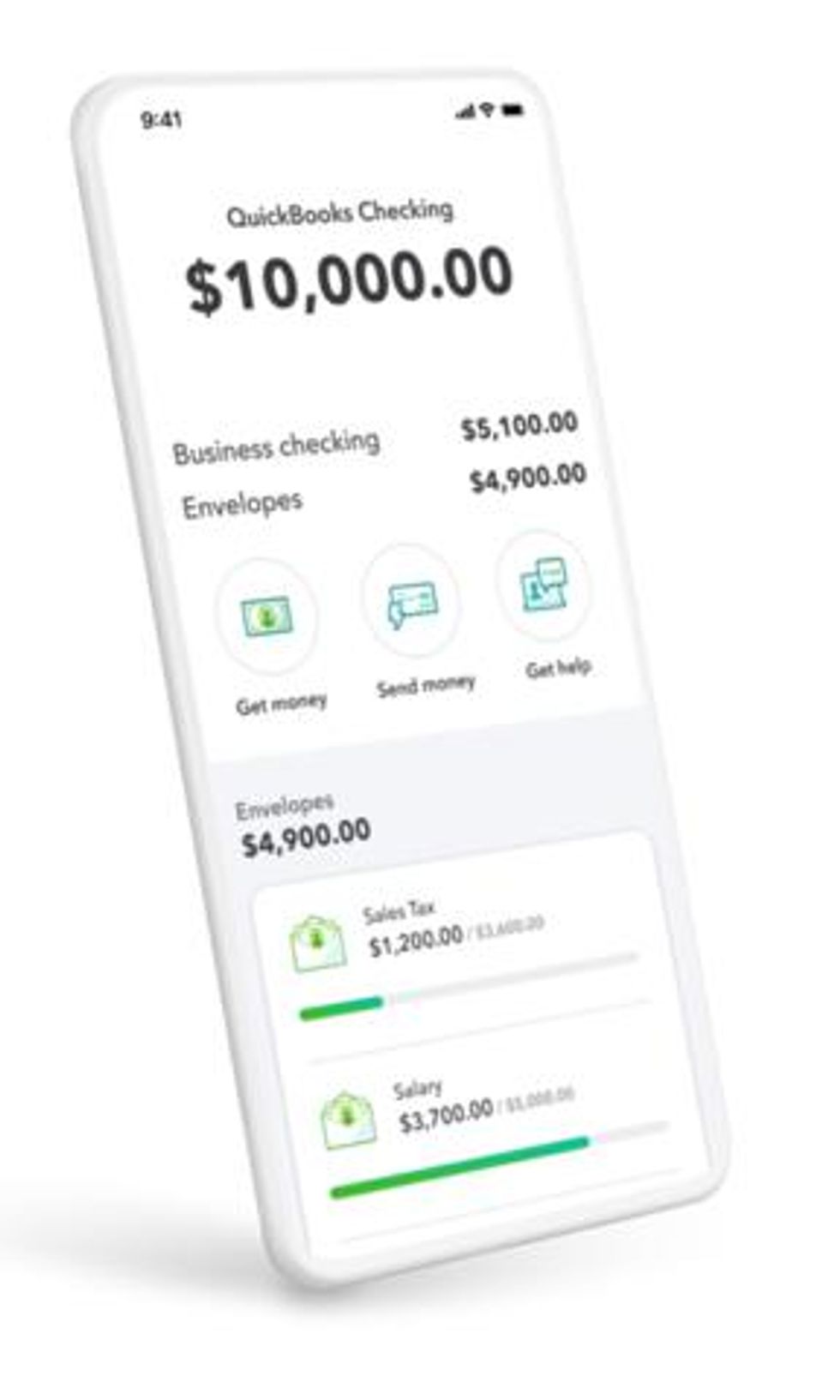

(Photo: Business Wire)

In less than two years, more than 150,000 small businesses have signed up for a QuickBooks Checking account which has zero opening fees, no minimum balance requirements and no monthly maintenance fees.* Since January 2021 alone, QuickBooks Checking's active customer base has grown 4x and more than one-third of those customers are new small businesses operating for a year or less.

As an online and mobile-optimized banking solution, small businesses can apply for a QuickBooks Checking account in minutes and access a range of services and features, including a debit card (physical and virtual)*, a competitive 1.00% APY* on all balances, and bill pay* (checks and ACH) at no additional fee. Integrated with QuickBooks Online, QuickBooks Checking also works seamlessly with QuickBooks Payments, which processes $91 billion in annual volume, instantly depositing funds from processed transactions for same-day use at no extra cost for eligible customers.*

"Thousands of small businesses are turning to QuickBooks Checking to manage their cash flow and we're laser focused on continuing to refine and design an even more robust banking experience with their specific needs in mind," said Rania Succar, Senior Vice President of QuickBooks Money Offerings. "A banking solution that's seamlessly integrated with the QuickBooks platform accelerates our ability to deliver tremendous benefits to small businesses and support them with complete visibility of and fast access to their money, all with total reliability."

QuickBooks Checking will continue to offer industry-leading banking services small business customers have come to love including two key features that help customers better manage their overall cash flow. The Cash Flow Planner* delivers powerful insights to help plan for the future by predicting cash flow 90 days out leveraging machine learning and data analysis. The planner proactively alerts business owners when cash flow might become a concern and provides recommendations on how to navigate potential challenges.

Another QuickBooks Checking feature small businesses will continue to enjoy is Envelopes* , which allows them to partition money for planned or unexpected expenditures and avoid spending funds before their intended use. Small businesses commonly use the Envelopes feature to set aside funds for expenses like taxes and payroll. Sales tax in particular is something businesses need to plan for and trying to manage this manually can take significant time and energy. By applying advanced machine learning, QuickBooks Checking will also be streamlining this process for small businesses with the introduction of Sales Tax Automation*. Coming soon, this feature will automatically set aside sales tax for payments in a sales tax envelope.

QuickBooks Checking is also introducing new features to create an even more powerful one-stop business banking solution. New features include:

- Mobile Check Deposit* , giving small businesses the ability to accept checks from customers or vendors and deposit those funds into their account seamlessly from anywhere. Mobile check deposit will begin rolling out to eligible QuickBooks Checking customers in the coming weeks.

- A Virtual Debit Card* made available immediately upon account approval, giving customers greater flexibility to start spending their balance even before their physical debit card arrives.

- Apple Pay/Google Pay* , delivering even more convenience, flexibility and speed in making purchases with your debit card in-store and online.

QuickBooks Checking, a business checking account provided by our partner, GreenDot Bank, is integrated with QuickBooks' suite of money products that encompass payments, capital and banking services and are designed specifically to help small business customers have faster access to their money and better manage their cash flow. QuickBooks' business banking offering and its cash planning feature have been recognized for their leadership in fintech innovation, garnering Fast Company Innovation by Design Awards in 2020 and 2021 . Through offerings like QuickBooks Checking and Money by QuickBooks , Intuit continues to transform business banking, easing money management and delivering greater predictability of cash flow for small businesses at every stage of their journey.

More information on QuickBooks Checking is available here .

About Intuit:

Intuit is the global technology platform that helps consumers and small businesses overcome their most important financial challenges. Serving more than 100 million customers worldwide with TurboTax , QuickBooks , Mint , Credit Karma , and Mailchimp , we believe that everyone should have the opportunity to prosper. We never stop working to find new, innovative ways to make that possible. Please visit us for the latest information about Intuit, our products and services, and find us on social .

QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank.

QuickBooks Checking Account opening is subject to identity verification and approval by Green Dot Bank.

QuickBooks Payments and QuickBooks Checking accounts: Users must apply for both QuickBooks Payments and QuickBooks Checking accounts when bundled. QuickBooks Payments' Merchant Agreement and QuickBooks Checking account's Deposit Account Agreement apply.

QuickBooks Checking account: Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Green Dot Bank operates under the following registered trade names: GoBank, GO2bank and Bonneville Bank. Registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits. Green Dot is a registered trademark of Green Dot Corporation. ©2021 Green Dot Corporation. All rights reserved. QuickBooks products and services, including Instant Deposit, QuickBooks Payments, Cash flow planning / forecasting are not provided by Green Dot Bank.

Mobile Check Deposit: Limited availability. Offering coming soon.

* Important offers, pricing details and disclaimers

View source version on businesswire.com: https://www.businesswire.com/news/home/20211215005264/en/

Intuit QuickBooks:

Dan Mahoney

Dan_Mahoney@intuit.com

Jen Garcia

Jeng@accesstheagency.com