- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

September 18, 2023

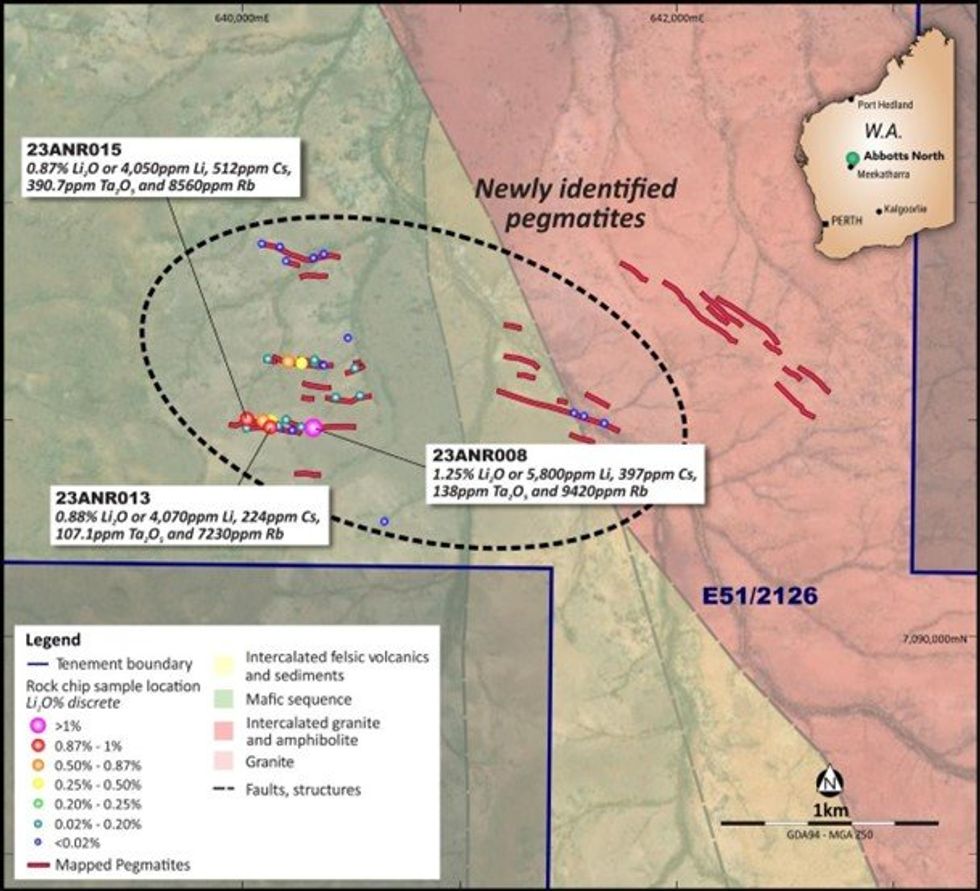

SensOre Ltd (ASX: S3N) is pleased to report that its subsidiary Exploration Ventures AI Pty Ltd (EXAI, 70% Deutsche Rohstoff AG: 30% S3N) has confirmed the presence of lithium bearing pegmatites at the recently discovered Buttamiah Prospect on the Abbotts North project leases. EXAI secured the option to acquire 100% of the project from a private company in August for a $75,000 option fee, exercisable for $275,000 by 2025.

Highlights

- The application of SensOre’s proprietary AI/ML, complemented through reconnaissance mapping and sampling, has identified a new pegmatite field within the Abbotts Greenstone Belt sequence.

- Lithium mineralisation within the Buttamiah Prospect confirmed with rock chip samples reporting encouraging assays up to 1.25% Li2O:

- 23ANR008 1.25% Li2O or 5,800ppm Li, 397ppm Cs, 138ppm Ta2O5

- 23ANR013 0.88% Li2O or 4,070ppm Li, 224ppm Cs, 107ppm Ta2O5

- 23ANR015 0.87% Li2O or 4,050ppm Li, 512ppm Cs, 390ppm Ta2O5

- At least three separate pegmatite dykes identified with Potassium / Rubidium ratios less than 10 indicating a highly fractionated, fertile field.

- The pegmatites in the vicinity of the anomalous (>0.1% Li2O) samples at surface are 2-3metres wide and up to 350m long. Several areas have multiple sub parallel units. Overall, the pegmatite field remains open to the north and under cover.

SensOre CEO Richard Taylor said: "SensOre and Deutsche Rohstoff are excited by EXAI’s success at Buttamiah. We are encouraged to see a new lithium discovery in a district with no previous lithium identified. In a market where prospective lithium projects attract a significant premium, EXAI has moved on an area where conventional targeting has overlooked the prospectivity, despite the presence of previously mapped pegmatites. On the back of success on this and other projects, SensOre and Deutsche Rohstoff are exploring options for the EXAI portfolio using SensOre’s proprietary artificial intelligence driven targeting tools.”

The Buttamiah Prospect is within EXAI’s Abbotts North Project, approximately 35km to the North of Meekatharra in the Murchison region of Western Australia. Geologically the prospect is situated within a largely basaltic sequence of the Abbots Greenstone belt. The Abbotts Greenstone belt consists of a succession of mafic and ultramafic units as well as felsic volcanics and sediments. The sequence has been intruded by porphyries, pegmatites and granites. The margins of the belt are structurally complex and the belt is bounded by granites and monzogranites to the East, West and North.

Locally, several pegmatite dyke swarms can be found sub-cropping mainly within a metabasalt unit and some of the structurally complex zones consisting of intercalated granite, greenstones and pegmatites. The extent of some of the pegmatites is difficult to ascertain due the presence of colluvial cover. The most fractionated pegmatite dykes are located within the mafic units furthest from the granite contact.

Initial indications show pegmatite swarms appear to increase in width to the East, adjacent to the granite contact. The sub-cropping pegmatites in the vicinity of the anomalous (>0.1% Li2O) samples are two to three metres wide at surface and have up to three sub parallel units between 0.2m and 3m in width. These units thin towards the West and are obscured by colluvium to the East but have a mapped length of over 350m.

Click here for the full ASX Release

This article includes content from SensOre, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

S3N:AU

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00