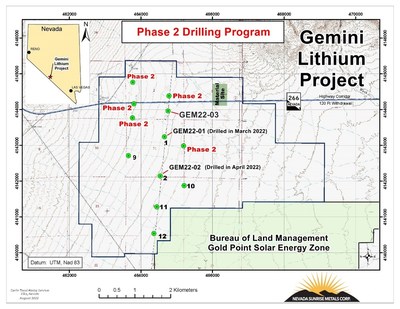

Nevada Sunrise Metals Corp. ("Nevada Sunrise", or the "Company", formerly Nevada Sunrise Gold Corp.) (TSXV: NEV) (OTC: NVSGF) announced today that the Phase 2 drilling program is underway at the Company's 100%-owned Gemini Lithium Project ("Gemini"). Gemini is located in the Lida Valley basin in Esmeralda County, Nevada approximately 23 miles (35 kilometres) southeast of North America's only operating lithium mine at Silver Peak, Nevada .

The first drill hole of the program is GEM22-03, which is planned to reach a minimum depth of 1,500 feet (457 metres). Up to six boreholes are planned in Phase 2 for an estimated total of 8,000 feet (2,439 metres) of drilling. The exploration goals for the Phase 2 program are: (1) test lithium-bearing brine and sediments at greater depths than previous boreholes GEM22-01 and GEM22-02, and (2) determine the lateral extent of lithium-mineralized brine and sediments identified in the previous Gemini drill holes. Drill hole locations may be amended or revised during the Phase 2 program as results warrant.

For further information on Gemini, including location maps and photos click here

About Gemini

Gemini consists of 582 unpatented placer and lode claims located in the western Lida Valley, Esmeralda County , approximately 6 miles (10 kilometres) east of the town of Lida, Nevada . In the spring of 2022, Nevada Sunrise expanded the size of the Project to a land position covering approximately 5,700 acres (2,300 hectares). Gemini is situated adjacent to the Gold Point Solar Energy Zone, a BLM land reserve set aside for solar and wind power generation projects until 2033.

The Lida Valley is a flat, arid basin with a similar geological setting to the better-known Clayton Valley basin where Albermarle Corporation operates the Silver Peak lithium brine mine, which has operated continuously since 1966. Exploration at Gemini is complemented by the Company's 80.09 acre/feet/year water right, a pre-requisite for the exploration and development of lithium brine projects in Nevada . Under State of Nevada law, water cannot be pumped from a subterranean source without a valid water permit.

Nevada Sunrise drilled two reverse circulation ("RC") boreholes for a total of 2,020 feet (615.85 metres) in its maiden drilling program at Gemini in March and April 2022 . The initial results represent a new discovery of lithium-bearing sediments and lithium-in-water in the western Lida Valley, which has not been historically drill tested for lithium mineralization. The analytical results from boreholes GEM22-01 and GEM22-02, located 0.69 miles (1.1 kilometres) apart suggest that the extent of lithium-bearing clay layers and waters at Gemini may be widespread:

- Borehole GEM22-01 : weighted-average of 1,203.41 parts per million ("ppm") lithium over 580 feet (176.83 metres) from 320 to 900 feet (97.56 to 274.39 metres), including 1,578.19 ppm lithium over 300 feet (91.46 metres);

- Borehole GEM22-02 : weighted-average of 1,101.73 ppm lithium over 730 feet (222.56 metres) from 390 to 1,120 feet (118.90 to 341.46 metres), including 2,217.69 ppm lithium over 130 feet (39.63 metres) and 3,304.34 ppm lithium over 50 feet (15.24 metres).

Water samples from borehole GEM-22-01 averaged 327.7 milligrams per litre ("mg/L") lithium over 220 feet (67.07 metres) from 600 to 820 feet (182.93 to 250 metres) with a peak value of 519 mg/L lithium . Water samples from borehole GEM22-02 returned an average of 116.28 mg/L lithium over 460 feet (140.24 metres) from 660 to 1,120 feet (201.22 to 341.46 metres) with a peak value of 286.0 mg/L lithium.

Sampling and Analytical QA/QC and Statement of Qualified Person

The results of geochemical analysis on sediment samples described in this news release were shipped in March and April 2022 to American Assay Laboratories and ALS Group USA ("ALS") and were analyzed utilizing a multi-element ICP-MS method. Specifically, the analytical method involves aqua regia digestion of the sample followed by the inductively coupled plasma (ICP) technique to ionize the sample, and spectrometry to determine elemental concentrations. Duplicates, field blanks, and certified reference standards were inserted at regular intervals in the sample stream to ensure accuracy of the analytical method.

Water parameters including TDS, conductivity, temperature, and pH values were obtained in the field by direct measurement with a handheld Hanna Model 98194 Multiparameter Meter, which meets Good Laboratory Practice (as proscribed by the Organization for Economic Cooperation and Development) for calibration and measurement. All depth measurements reported, including sample and interval widths are down-hole. As holes are oriented vertical and geologic stratigraphy is primarily horizontal to sub-horizontal, downhole measurements are assumed to be close to true thickness.

Groundwater samples were collected at 20-foot (6.1-metre) intervals and sent to Western Environmental Testing Laboratory in Reno , Nevada under project chain-of-custody protocols for analysis. Industry standard methods for examination of water were employed by the laboratory. General chemistry testing included analysis for specific gravity, total hardness, total alkalinity, bicarbonate, carbonate, hydroxide, total dissolved solids (TDS) and electrical conductivity. Anions (chloride, sulfate) were analyzed by ion chromatography. Trace metals (lithium, magnesium, boron, calcium, potassium, strontium, and sodium) were analyzed by inductively coupled plasma-optical emission spectroscopy (ICP-OES) methods.

The scientific and technical information contained in this news release has been reviewed and approved by Robert M. Allender, Jr. , CPG, RG, SME, a Qualified Person for Nevada Sunrise as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects .

About Nevada Sunrise

Nevada Sunrise is a junior mineral exploration company with a strong technical team based in Vancouver, BC , Canada , that holds interests in lithium, gold, copper and cobalt exploration projects located in the State of Nevada, USA .

Nevada Sunrise owns 100% interests in the Gemini and Jackson Wash lithium projects, both of which are located in Esmeralda County, NV. The Company owns Nevada water right Permit 86863, located in the Lida Valley basin, near Lida, NV.

The Company's key gold asset is a 20.01% interest at the Kinsley Mountain Gold Project ("Kinsley Mountain") near Wendover, NV. Kinsley Mountain is a joint venture with Copaur Minerals Inc. ("Copaur"), following the completion of a plan of arrangement between Copaur and the Company's former joint venture partner, New Placer Dome Gold Corp. Kinsley Mountain is a Carlin-style gold project hosting a National Instrument 43-101 compliant gold resource consisting of 418,000 indicated ounces of gold grading 2.63 g/t Au (4.95 million tonnes), and 117,000 inferred ounces of gold averaging 1.51 g/t Au (2.44 million tonnes), at cut-off grades ranging from 0.2 to 2.0 g/t Au 1 .

1 Technical Report on the Kinsley Project, Elko County, Nevada , U.S.A., dated June 21, 2021 with an effective date of May 5, 2021 and prepared by Michael M. Gustin , Ph.D., and Gary L. Simmons , MMSA and filed under New Placer Dome Gold Corp.'s Issuer Profile on SEDAR ( www.sedar.com ).

Nevada Sunrise has the right to earn a 100% interest in the Coronado VMS Project, located approximately 48 kilometers (30 miles) southeast of Winnemucca, NV. The Company owns a 15% interest in the historic Lovelock Cobalt Mine and the Treasure Box copper properties, each located approximately 150 kilometers (100 miles) east of Reno, NV , with Global Energy Metals Corp. holding an 85% participating interest.

FORWARD LOOKING STATEMENTS

This news release may contain forward – looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur and include disclosure of anticipated exploration activities. Although the Company believes the expectations expressed in such forward – looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward looking statements. Forward – looking statements are based on the beliefs, estimates and opinions of the Company's management on the date such statements were made. The Company expressly disclaims any intention or obligation to update or revise any forward – looking statements whether as a result of new information, future events or otherwise.

Such factors include, among others, risks related to the Company's 2022 exploration plans at the Gemini Lithium Project; reliance on technical information provided by third parties on any of our exploration properties; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; labor disputes and other risks of the mining industry; delays due to pandemic; delays in obtaining governmental approvals, financing, or in the completion of exploration, as well as those factors discussed in the section entitled "Risk Factors" in the Company's Management Discussion and Analysis for the Nine Months Ended June 30, 2022 , which is available under Company's SEDAR profile at www.sedar.com .

Although Nevada Sunrise has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Nevada Sunrise disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise. Accordingly, readers should not place undue reliance on forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. The securities of Nevada Sunrise Gold Corporation have not been registered under the United States Securities Act of 1933, as amended, and may not be offered or sold within the United States or to the account or benefit of any U.S. person.

SOURCE Nevada Sunrise Metals Corporation

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/October2022/19/c0749.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/October2022/19/c0749.html