- WORLD EDITIONAustraliaNorth AmericaWorld

October 19, 2021

Auroch Minerals Limited (ASX:AOU) (Auroch or the Company) is pleased to announce that down-hole geophysical surveys have been successfully completed on the first drill-hole NPDD008 in the maiden diamond drill programme into the Nepean Deeps target. The drill programme was designed to test for down-plunge extensions to the high-grade nickel sulphide mineralisation below the historic Nepean mine at the Nepean Nickel Project in Western Australia (Auroch Minerals 80%).

Highlights

- Down-hole electromagnetics (DHEM) survey completed on the first Nepean Deeps drill-hole NPDD008 has identified three off-hole conductors centred at 540m, 1,025m and 1,230m down-hole

- Down-hole magnetometric resistivity (DHMMR) survey completed on drill-hole NPDD008 also identified one clear off-hole anomaly at 1,230m down-hole

- The DHEM and DHMMR conductors together with the 78m of prospective komatiitic ultramafics intersected over four intervals in NPDD008 provide high priority drill targets with the next drill-hole commencing this week

- Assay and DHEM results from regional RC drilling at Nepean have identified multiple targets for follow-up drill testing

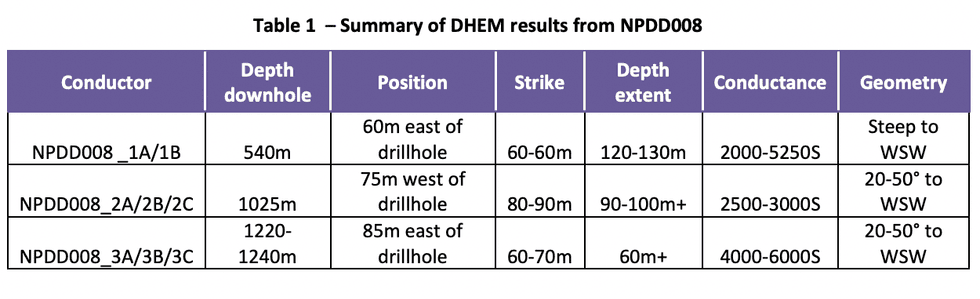

The DHEM survey successfully identified three off-hole conductors within a radius of approximately 100–150m from drill-hole NPDD008 that are potentially indicative of well-developed nickel sulphide mineralisation (Figure 1, Table 1).

The uppermost DHEM conductor is centred at 540m down-hole, proximal to the upper ultramafic intersected in NPDD008. This highly prospective drill target is also proximal to the historic Nepean mine workings, and will be the first of the DHEM conductors to be drill tested with the next diamond hole commencing this week.

The central off-hole DHEM conductor is approximately 1,025m down-hole and is located where the original footwall contact of the Nepean mine nickel sulphide mineralisation was projected down-dip, coincident with an area of stronger seismic reflectors, making it a very strong drill target.

Read the full article here.

AOU:AU

The Conversation (0)

23 September 2021

Auroch Minerals

Exploring High-Grade Nickel Sulfides in Western Australia

Exploring High-Grade Nickel Sulfides in Western Australia Keep Reading...

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00