March 19, 2024

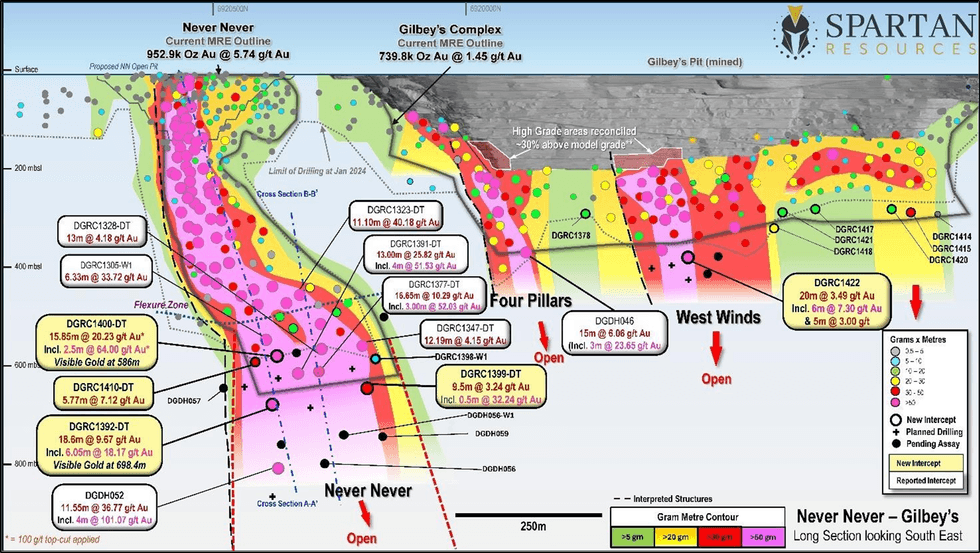

High-grade intercepts both inside and outside existing Resource’s points to expanding high-grade underground potential at Dalgaranga

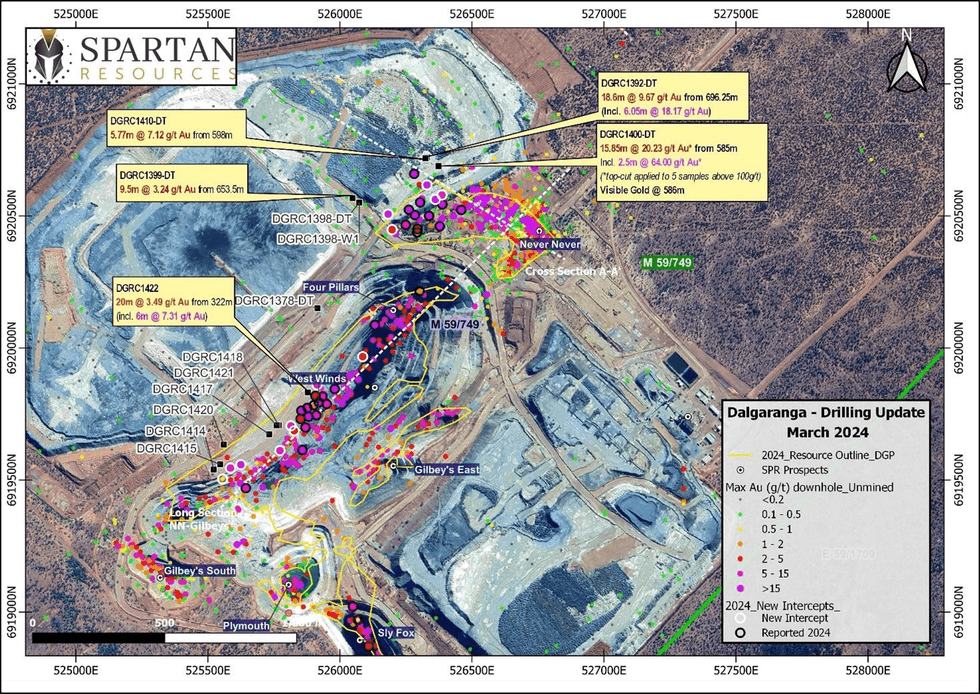

Spartan Resources Limited (ASX: SPR) (Spartan or the Company) is pleased to report updated drilling and assay information from recent drilling at its 100%-owned Dalgaranga Gold Project (“DGP”) in the Murchison region of Western Australia.

Highlights:

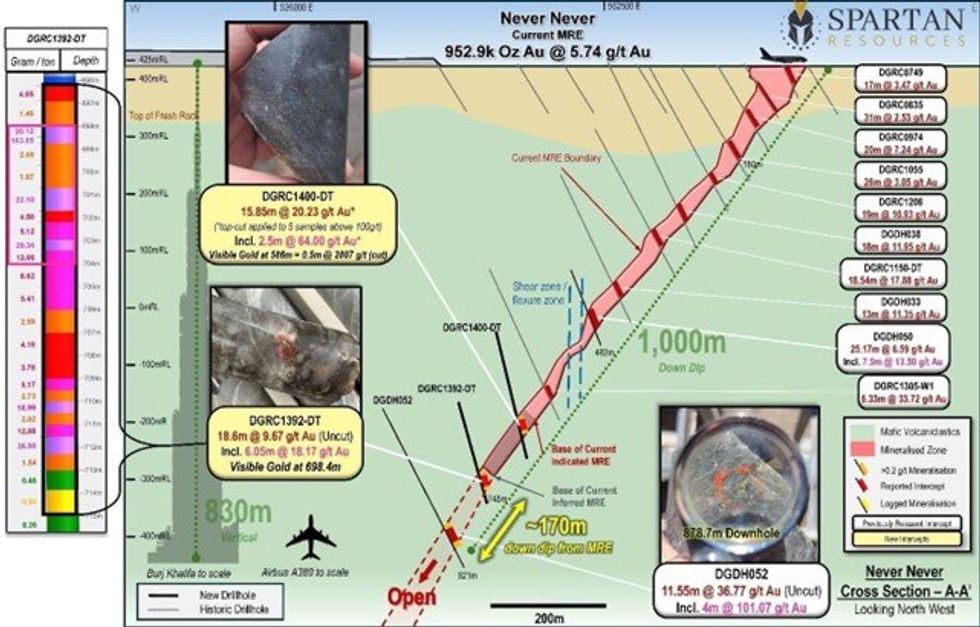

Never Never Gold Deposit:

- 15.85m @ 20.23/t gold (100g/t top-cut) from 585.0m, incl. 2.50m @ 64.00g/t (DGRC1400-DT)

- 9th best Never Never gram x metre intercept (320.65gxm) in-fills Inferred area of the current 0.95Moz Never Never Mineral Resource Estimate.

- Uncut intercept – 15.85m @ 136.80g/t gold, incl. 2.50m @ 697.00g/t

- 18.60m @ 9.67g/t gold (uncut) from 696.25m, incl. 6.05m @ 18.17g/t (DGRC1392-DT)

- Intercept located ~20m below and outside current 0.95Moz Mineral Resource Estimate.

West Winds Gold Prospect:

- 20.00m @ 3.49g/t gold from 322.0m, incl. 6.00m @ 7.30g/t (DGRC1422)

The assays in this release include significant intercepts from resource in-fill and exploration drilling at the high-grade Never Never Gold Deposit, as well as a new broad intercept of significant gold mineralisation beneath the Gilbey’s Complex Mineral Resource, which is part of the developing higher grade West Winds Gold Prospect.

Management Comment

Spartan Managing Director and Chief Executive Officer, Simon Lawson, said: “These latest drill-holes continue to demonstrate the untapped high-grade gold potential at Dalgaranga. Our drilling at the expanding Never Never Gold Deposit is consistently delivering high-grade gold drill intercepts, week after week, month after month.

“When you combine this with the high-grade intercepts that we’re also seeing from the nearby Four Pillars and West Winds gold prospects – such as 15m @ 6g/t gold including 3.0m @ 23g/t and 20m @ 3.5g/t gold including 6m @ 7g/t respectively, outside existing resources – you can see why we’re so excited about the potential ahead of us!

“We understand better than most just how difficult it is to exist as a gold producer with low grade ore feed and the consequential risk to cash margins. That is why as an exploration business we are focused and committed to finding high-grade ounces, delivering consistent high-grade resource growth and eventually solid high-grade reserves aimed at underpinning long-term, lower-risk re-start of gold production at Dalgaranga.

“These high-grade drill results continue to give us the confidence that we will succeed in our task to deliver value to all of our shareholders, rather than just talk about doing it.”

Click here for the full ASX Release

This article includes content from Spartan Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SPR:AU

The Conversation (0)

03 April 2024

Spartan Resources

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia

Focused on Growing High-grade Gold Ounces in front of established infrastructure in Prolific Western Australia Keep Reading...

4h

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

5h

Silver Hammer Closes CDN$3,913,617 Non-Brokered Private Placement Pursuant to Listed Issuer Exemption

Silver Hammer Mining Corp. (CSE: HAMR,OTC:HAMRF) (the "Company" or "Silver Hammer") is pleased to announce that further to its news release dated February 2, 2026, it has closed its previously announced non-brokered private placement pursuant to the Listed Issuer Exemption ("LIFE") (the... Keep Reading...

21h

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

21h

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

23h

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

23h

High-Grade Gold in Initial White Dam Drilling Results

Pacgold (PGO:AU) has announced High-Grade Gold in Initial White Dam Drilling ResultsDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00